Story. Value. Breakthrough.

Step 1. Set up your scene

We need the whole team to be on the same page to kick off successfully. Here we explore the WHY behind your product─what do you want to create, what is your mission and goals and the market you want to match. This kind of deep-dive allows us to fully empathize with your challenge as our own. This is the only way to communicate a unique product story through design.

Threats we need to handle:

- Disagreements among stakeholders

- Unclear goals and expectations

- Ineffective action plan

Steps toward an amazing product:

- Stakeholders’ interview

- Product audit and strategy

- Competitors’ research

Step 2. Find the heroes of your story

Every story has a hero, and yours is no exception. If we treat your product as an integral part of the story your brand conveys, we can make it much more meaningful and valuable to your hero─the customer. But, first, it's important to see who your hero is, what he/she is fighting for, what their dreams and experiences are throughout the process and what role your product plays in this journey.

Threats we need to handle:

- Customer disappointment

- Bad reviews

- Low product ratings

- Losing customers to competitors

Steps toward an amazing product:

- Definition of key user personas

- Creation of an empathy map

- Definition of Jobs-To-Be-Done (JTBD)

- Conducting a Red Route analysis

Step 3. Lead your heroes through the journey

Let's discover the journey of your hero and define a story that would delight him/her. This will demonstrate how exactly your product can help the hero to reach his/her goals and what the experience should be like in the process. Your product is the hero's ally. If its guidance is easy and delightful, the hero will be keen to invite others to your story.

Threats we need to handle:

- Complexity of the product, which causes struggles

- Difficulties that cause users extra time and effort

- Ignored or sabotaged business goals

Steps toward an amazing product:

- Mapping a user journey with a BUP holistic frame

- Engineering information architecture

- Creation of the Value Storyboard

- Creation of user flows

Step 4. Bring your brand’s uniqueness to life

What will your hero feel when he/she embarks on the story you tell through your product? Will it feel like they’ve been teleported 30 years back in time, in the middle of a “desert” of confusion and complexity? OR will it feel like they’ve entered a place of joy and delight? The Key Design concept unlocks the door to your unique story. It becomes the cornerstone of the design language, forming an immediate emotional bond between the product and the hero.

Threats we need to handle:

- Being outdated and boring

- Not differing from competitors

- A product that doesn’t match brand values

Steps toward an amazing product:

- Wireframing and user testing

- Analyse branding and artefacts

- Generation of the Mood Board

- Creation of the Key Concept

Step 5. Create a full visual prototype

Are you ready to feel the power of your product even before its launch? To make it happen, we will carefully put all the pieces of the puzzle together by delivering omnichannel clickable screens and motion interactions. In this way, your product story will be ready for testing in the hands of real users.

Threats we need to handle:

- Developmental struggles

- Faulty estimations

- Bad usability and lack of demand

Steps toward an amazing product:

- Crafting an omni-channel UI design

- Providing a click-through UI prototype

- Delivering a cutting-edge motion design

Step 6. Build your story with confidence

To guide the hero, your team needs to know the right way. Tailor-made UX design guide and documentation for your digital product ensures a quick and effective handover of the UX and UI deliverables to your team. All deliverables and elements compiled in a design system serve as a map that confirms that the team is on the same page and going in the right direction to provide the hero with the best experience on all channels within a digital ecosystem.

Threats we need to handle:

- Slowed developmental process

- Inconsistency of flows, modules and channels

- Miscommunication among the team

Steps toward an amazing product:

- Creation of the UX/UI design system

- Formation of a motion design system

- Preparation of the design documentation

Step 7. Develop the story with UXDA's guidance

The story doesn't end when last design screen is created. We provide UX guidance, even in the development phase. Design support, development supervision and launch support allows your team to go full speed in delivering a top-notch financial brand experience for your heroes─the customers.

Threats we need to handle:

- Mistakes in design implementation

- User frustration caused by the end product

- Lack of user-centricity in the team

- Mitigating risks of product launch

Steps toward an amazing product:

- UX consulting

- UX design support of development

- Product launch support

- UX improvements based on user feedback

Step 1. Set up your scene

We need the whole team to be on the same page to kick off successfully. Here we explore the WHY behind your product─what do you want to create, what is your mission and goals and the market you want to match. This kind of deep-dive allows us to fully empathize with your challenge as our own. This is the only way to communicate a unique product story through design.

Threats we need to handle:

- Disagreements among stakeholders

- Unclear goals and expectations

- Ineffective action plan

Steps toward an amazing product:

- Stakeholders’ interview

- Product audit and strategy

- Competitors’ research

Step 2. Find the heroes of your story

Every story has a hero, and yours is no exception. If we treat your product as an integral part of the story your brand conveys, we can make it much more meaningful and valuable to your hero─the customer. But, first, it's important to see who your hero is, what he/she is fighting for, what their dreams and experiences are throughout the process and what role your product plays in this journey.

Threats we need to handle:

- Customer disappointment

- Bad reviews

- Low product ratings

- Losing customers to competitors

Steps toward an amazing product:

- Definition of key user personas

- Creation of an empathy map

- Definition of Jobs-To-Be-Done (JTBD)

- Conducting a Red Route analysis

Step 3. Lead your heroes through the journey

Let's discover the journey of your hero and define a story that would delight him/her. This will demonstrate how exactly your product can help the hero to reach his/her goals and what the experience should be like in the process. Your product is the hero's ally. If its guidance is easy and delightful, the hero will be keen to invite others to your story.

Threats we need to handle:

- Complexity of the product, which causes struggles

- Difficulties that cause users extra time and effort

- Ignored or sabotaged business goals

Steps toward an amazing product:

- Mapping a user journey with a BUP holistic frame

- Engineering information architecture

- Creation of the Value Storyboard

- Creation of user flows

Step 4. Bring your brand’s uniqueness to life

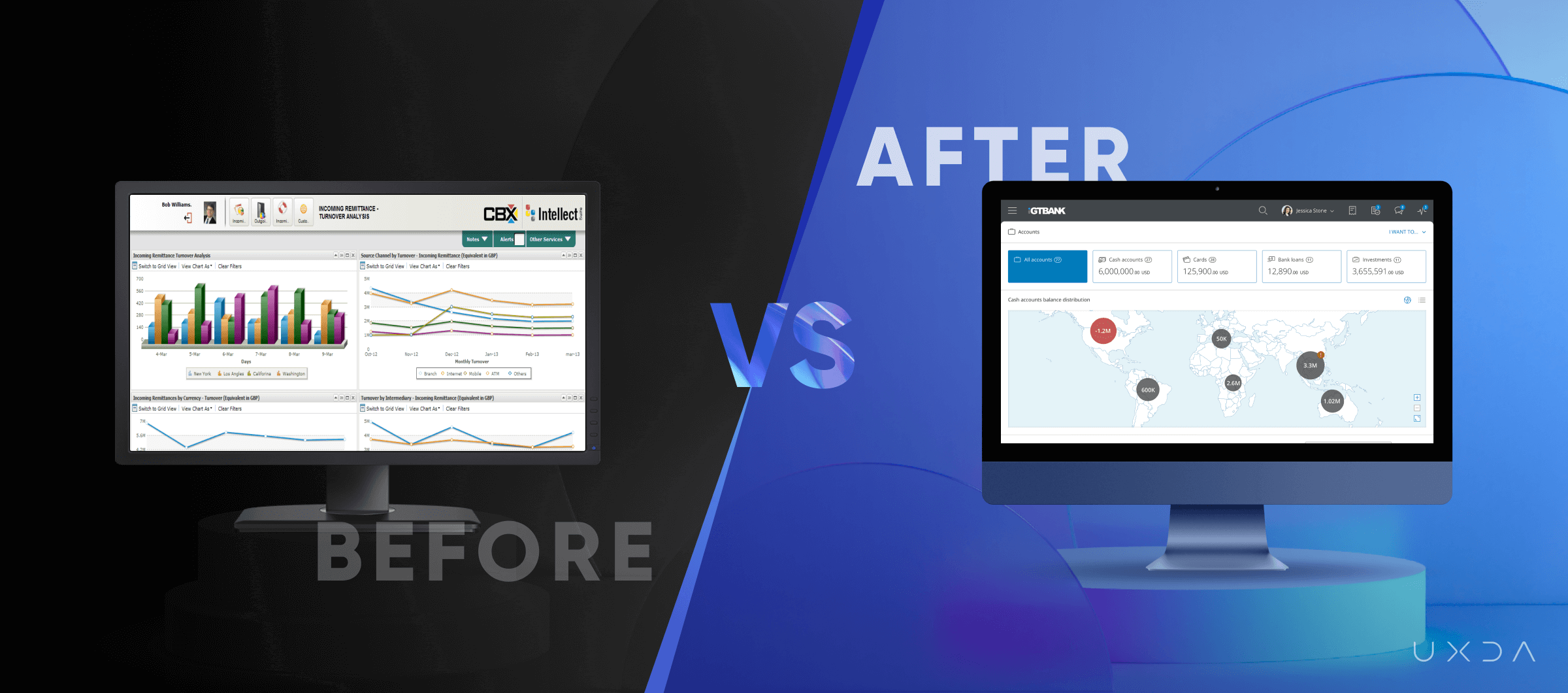

What will your hero feel when he/she embarks on the story you tell through your product? Will it feel like they’ve been teleported 30 years back in time, in the middle of a “desert” of confusion and complexity? OR will it feel like they’ve entered a place of joy and delight? The Key Design concept unlocks the door to your unique story. It becomes the cornerstone of the design language, forming an immediate emotional bond between the product and the hero.

Threats we need to handle:

- Being outdated and boring

- Not differing from competitors

- A product that doesn’t match brand values

Steps toward an amazing product:

- Wireframing and user testing

- Analyse branding and artefacts

- Generation of the Mood Board

- Creation of the Key Concept

Step 5. Create a full visual prototype

Are you ready to feel the power of your product even before its launch? To make it happen, we will carefully put all the pieces of the puzzle together by delivering omnichannel clickable screens and motion interactions. In this way, your product story will be ready for testing in the hands of real users.

Threats we need to handle:

- Developmental struggles

- Faulty estimations

- Bad usability and lack of demand

Steps toward an amazing product:

- Crafting an omni-channel UI design

- Providing a click-through UI prototype

- Delivering a cutting-edge motion design

Step 6. Build your story with confidence

To guide the hero, your team needs to know the right way. Tailor-made UX design guide and documentation for your digital product ensures a quick and effective handover of the UX and UI deliverables to your team. All deliverables and elements compiled in a design system serve as a map that confirms that the team is on the same page and going in the right direction to provide the hero with the best experience on all channels within a digital ecosystem.

Threats we need to handle:

- Slowed developmental process

- Inconsistency of flows, modules and channels

- Miscommunication among the team

Steps toward an amazing product:

- Creation of the UX/UI design system

- Formation of a motion design system

- Preparation of the design documentation

Step 7. Develop the story with UXDA's guidance

The story doesn't end when last design screen is created. We provide UX guidance, even in the development phase. Design support, development supervision and launch support allows your team to go full speed in delivering a top-notch financial brand experience for your heroes─the customers.

Threats we need to handle:

- Mistakes in design implementation

- User frustration caused by the end product

- Lack of user-centricity in the team

- Mitigating risks of product launch

Steps toward an amazing product:

- UX consulting

- UX design support of development

- Product launch support

- UX improvements based on user feedback

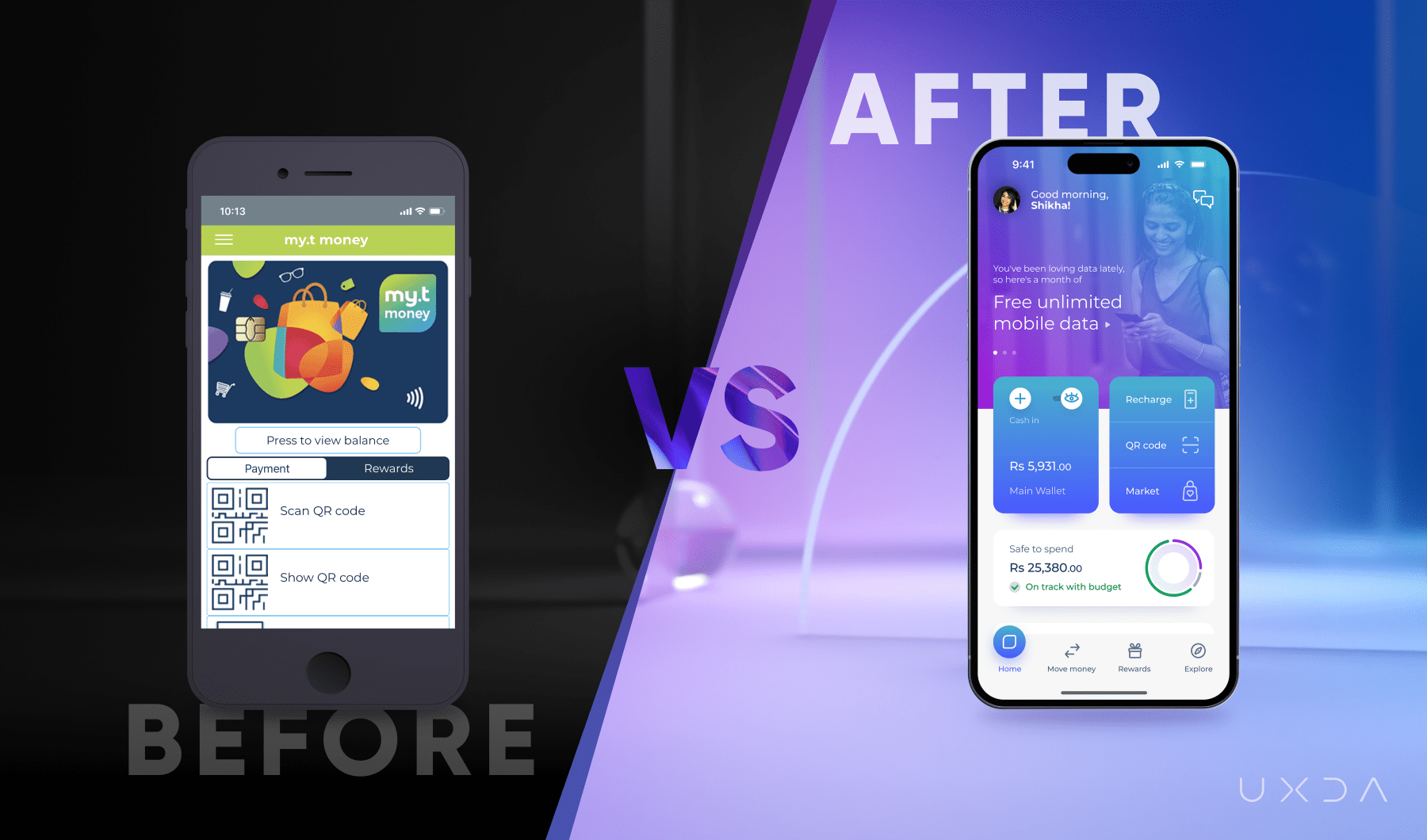

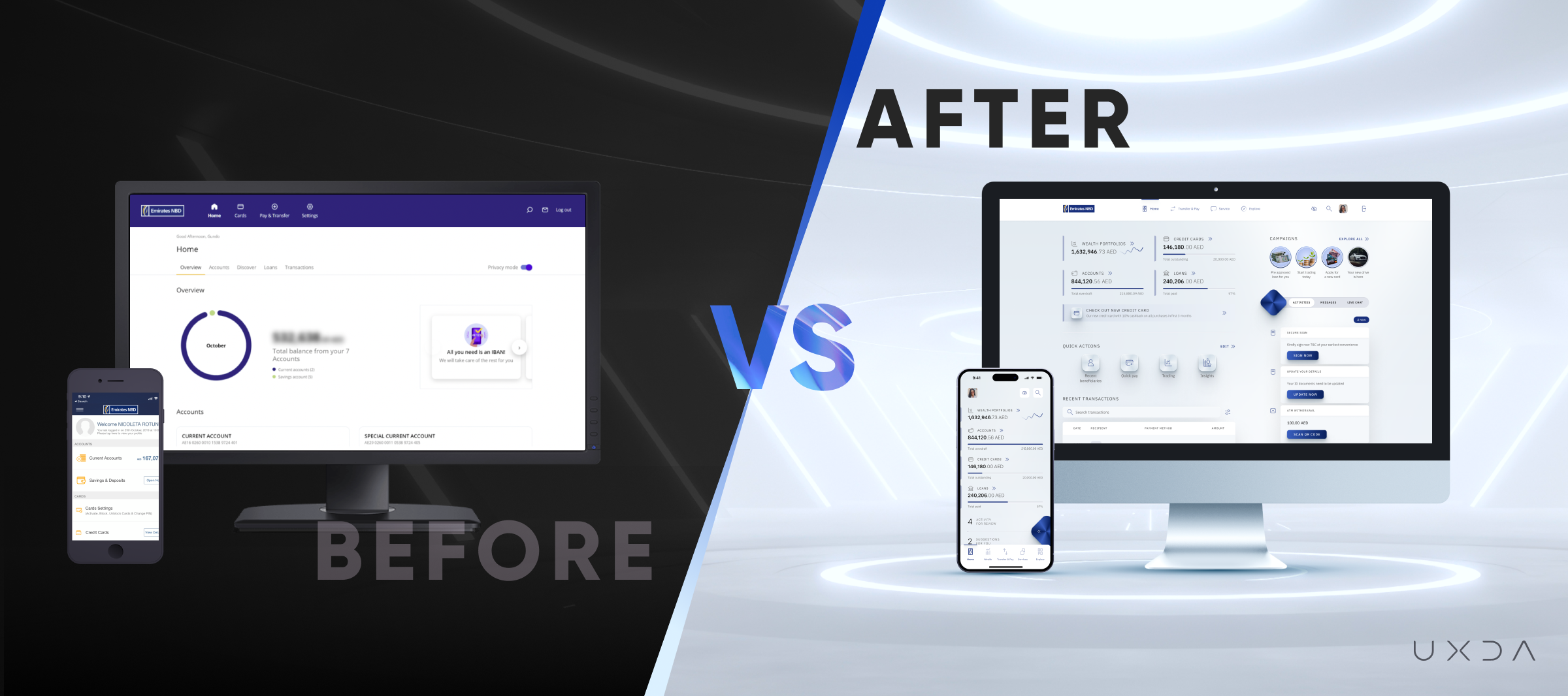

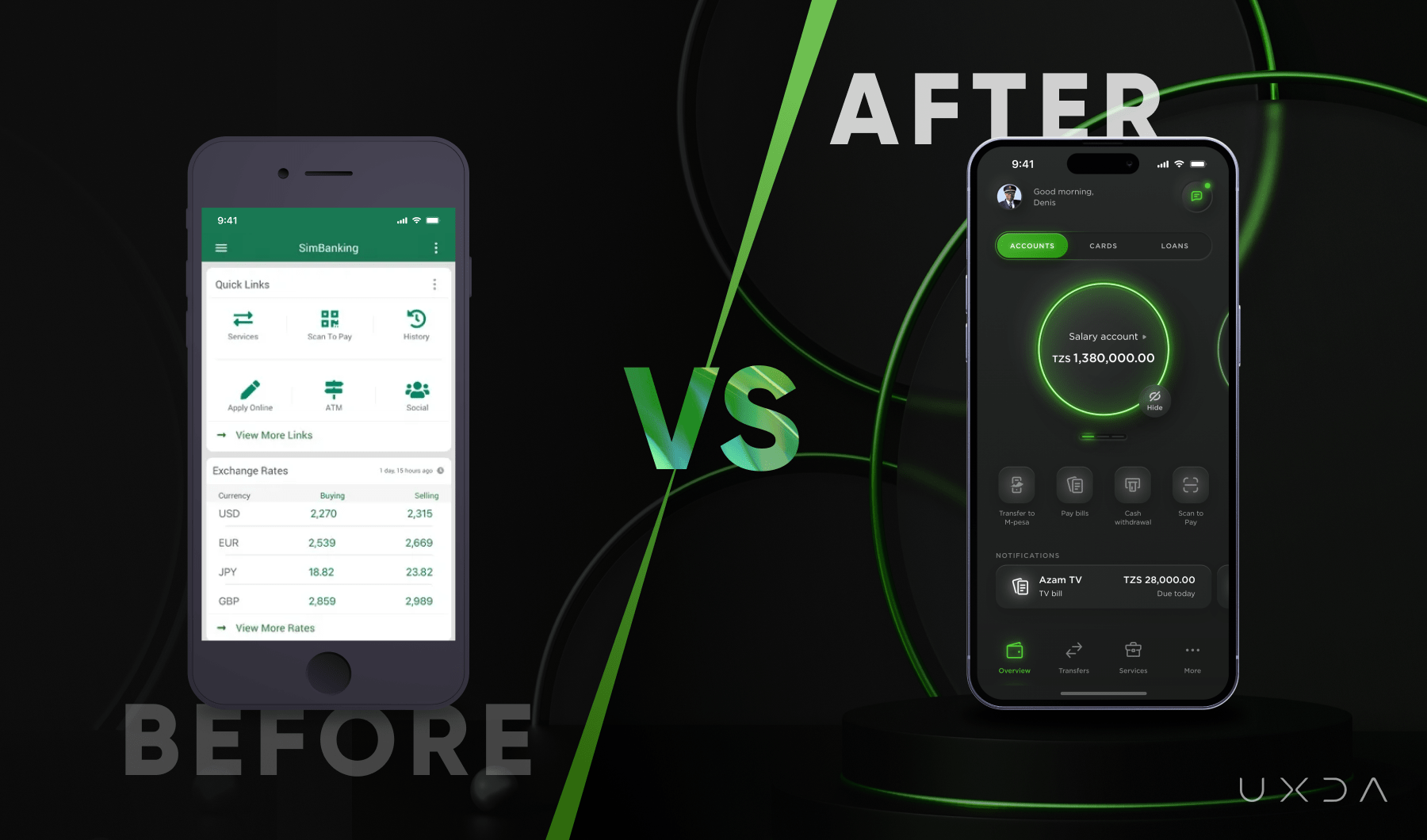

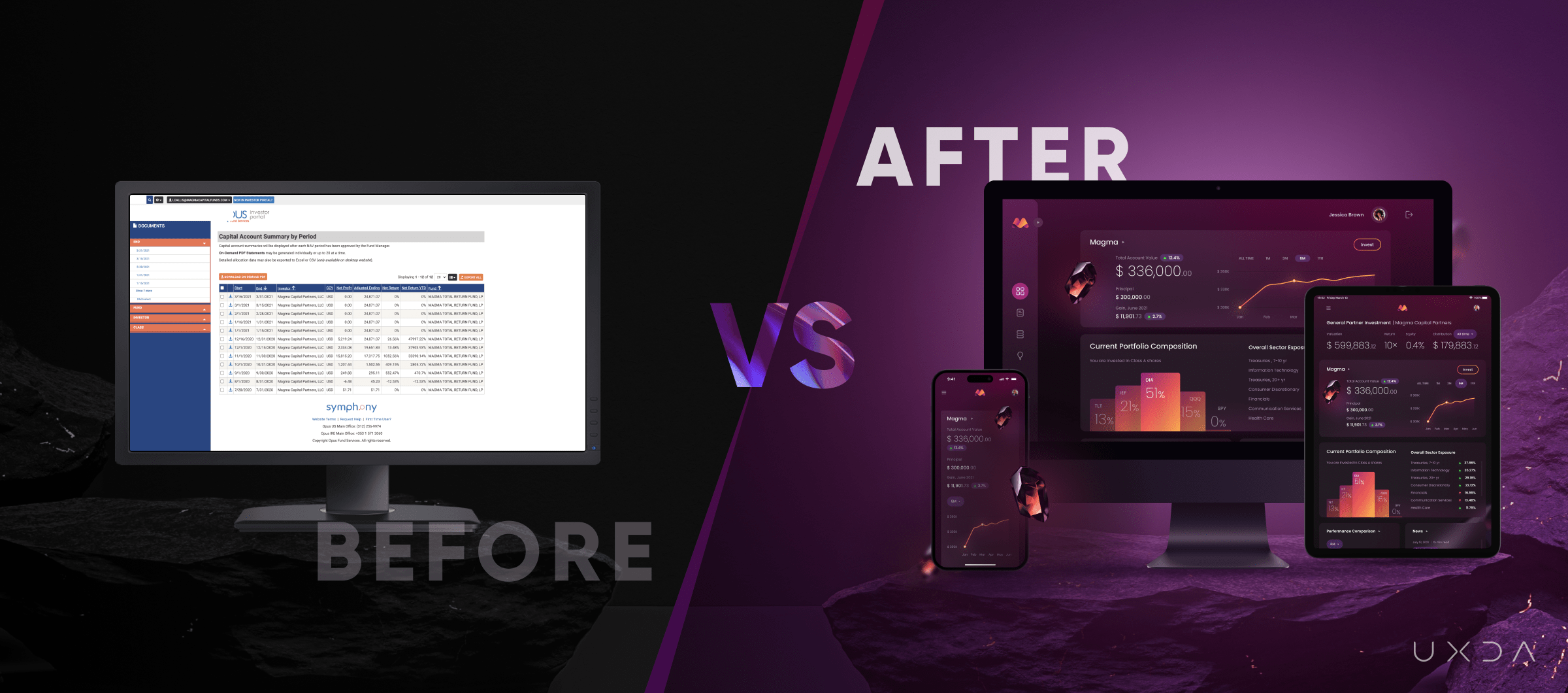

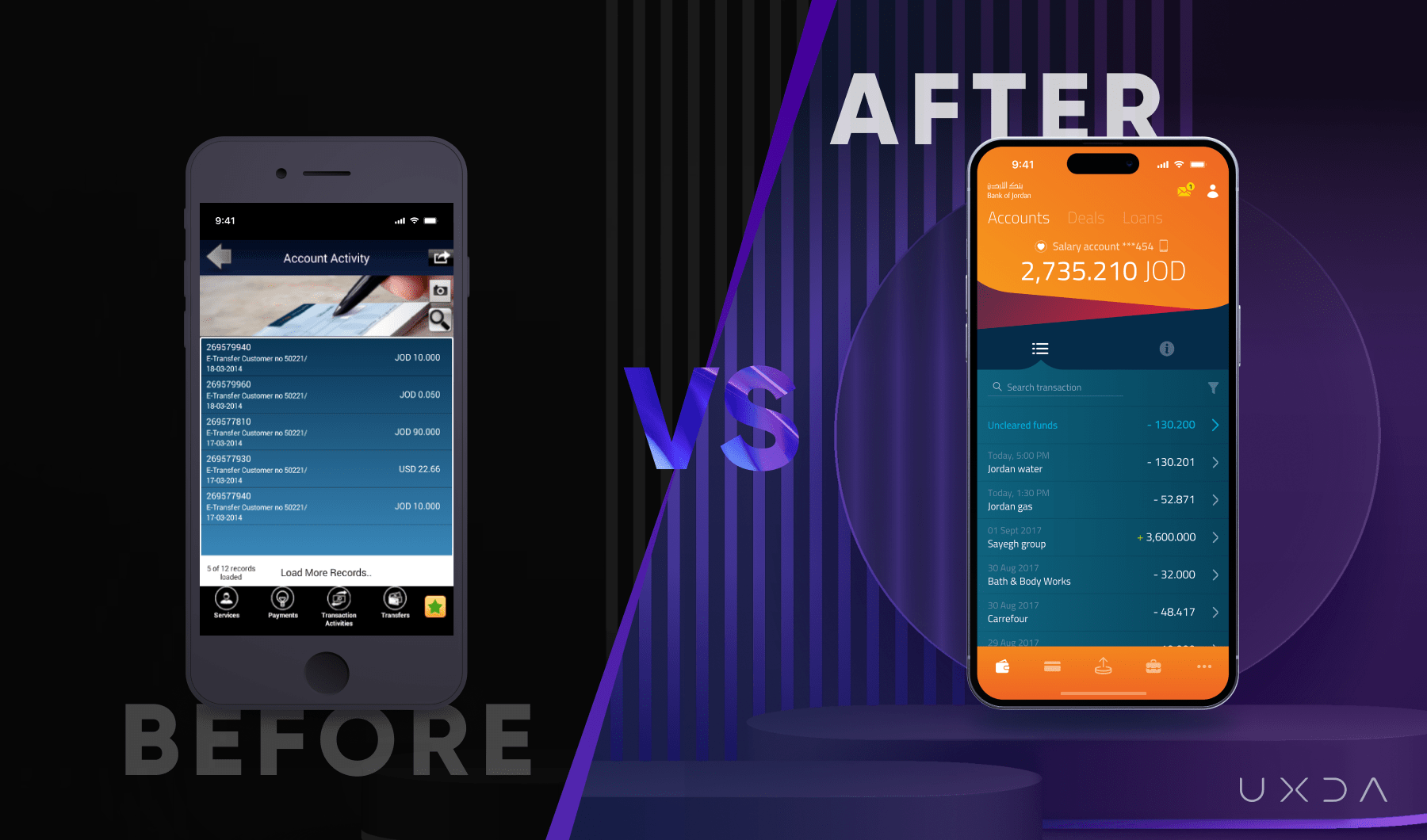

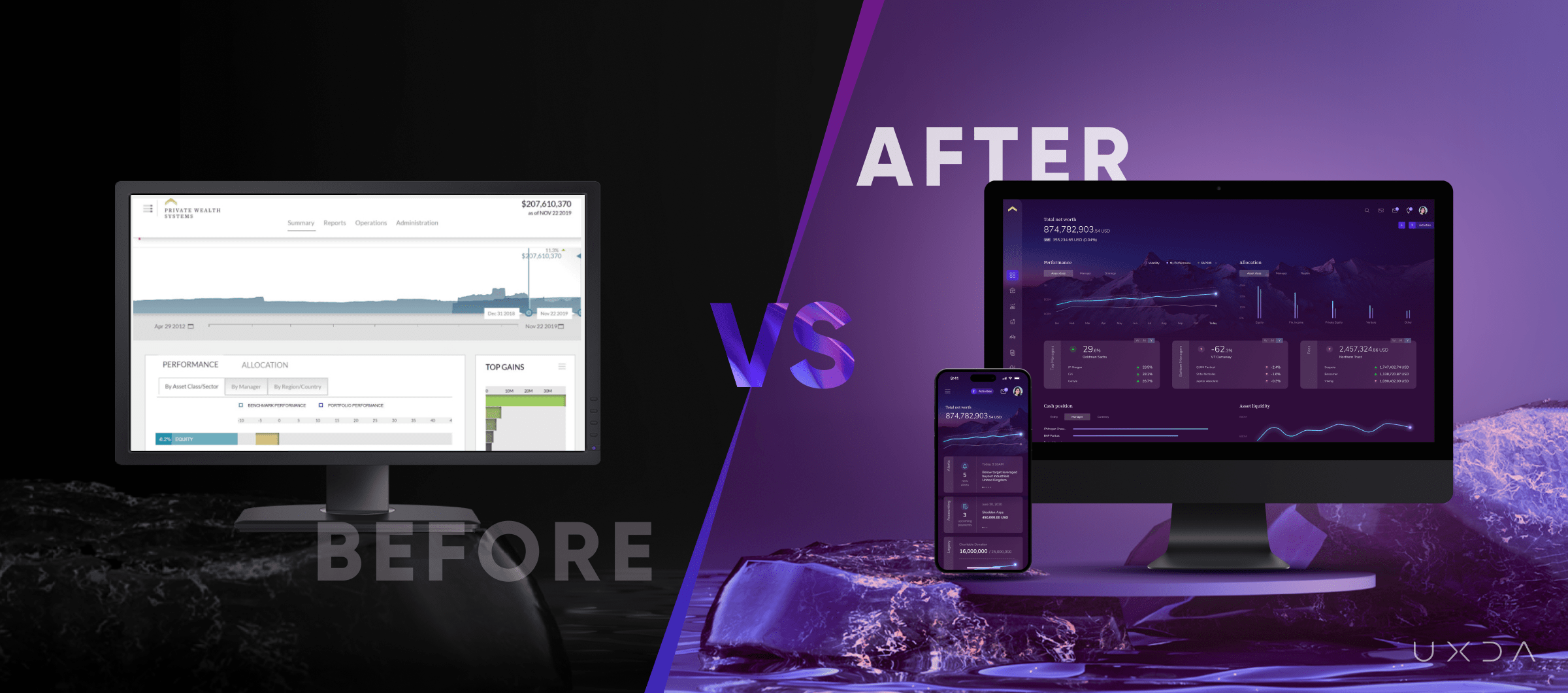

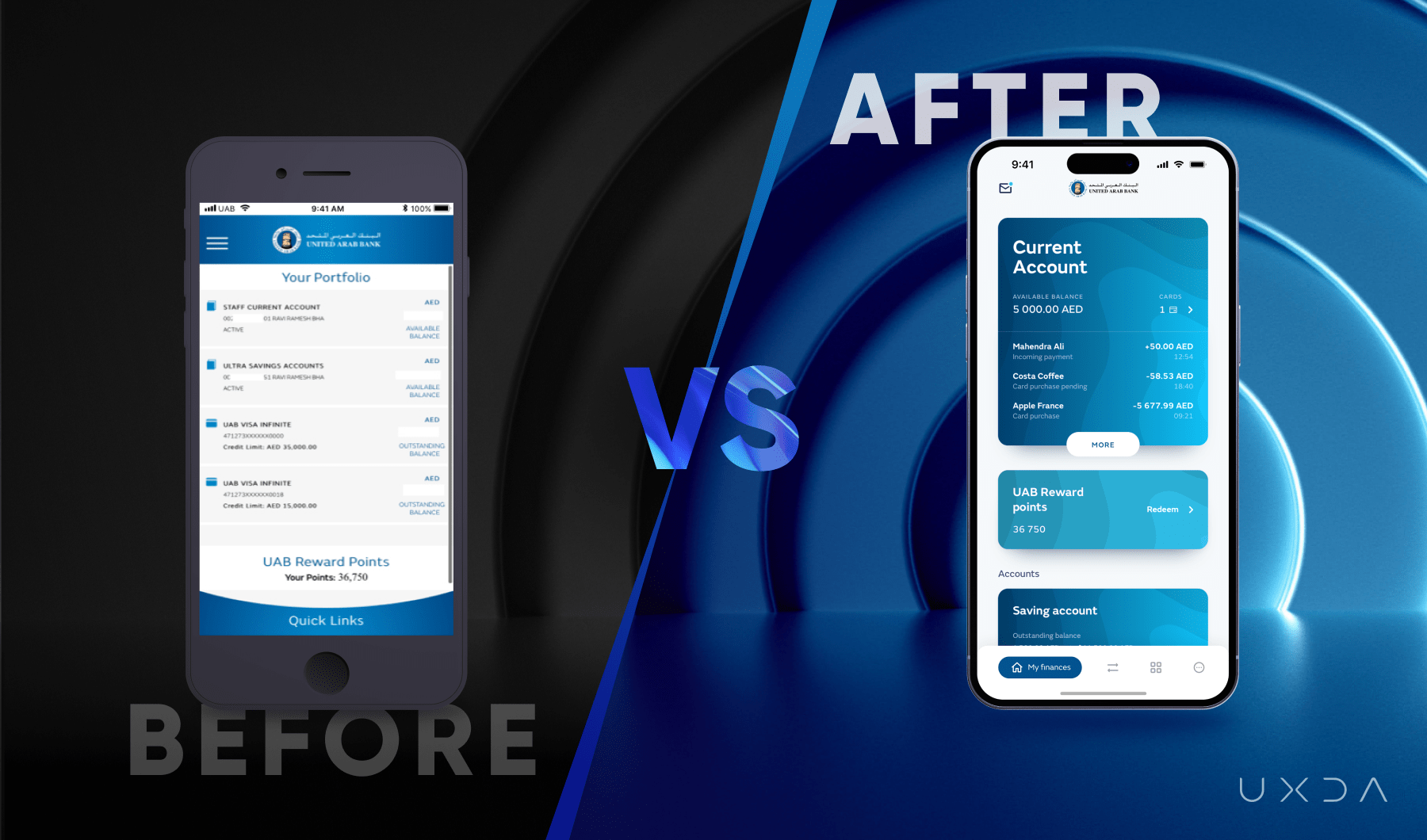

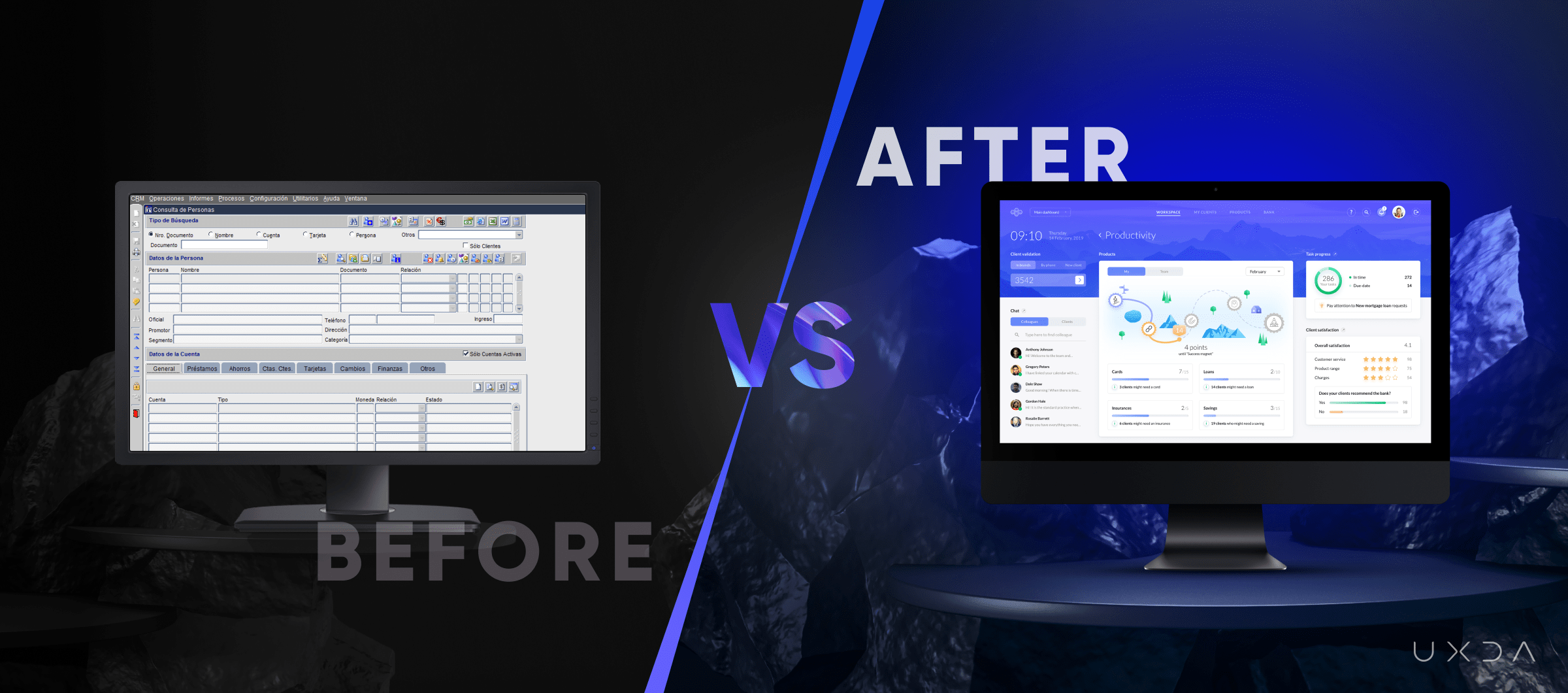

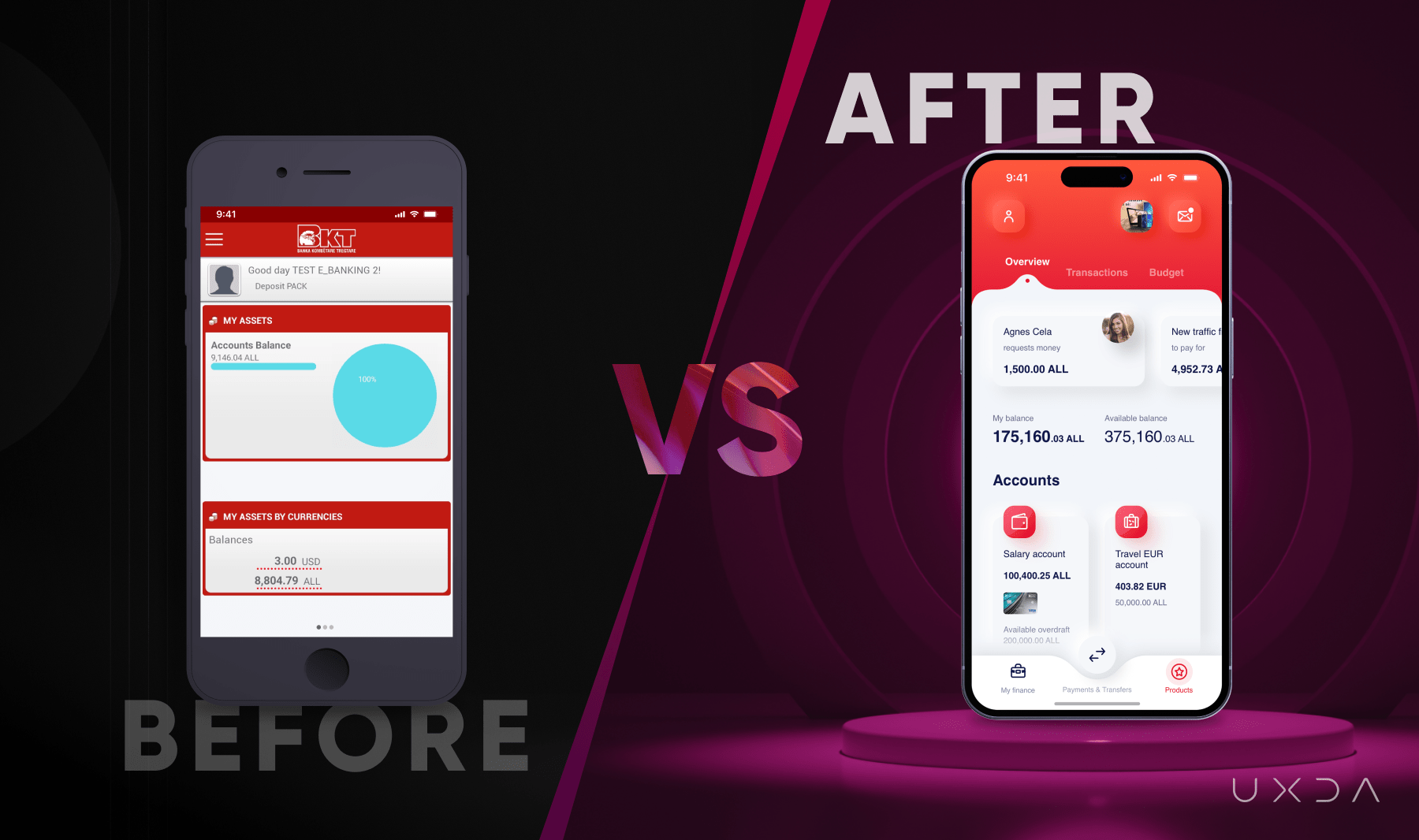

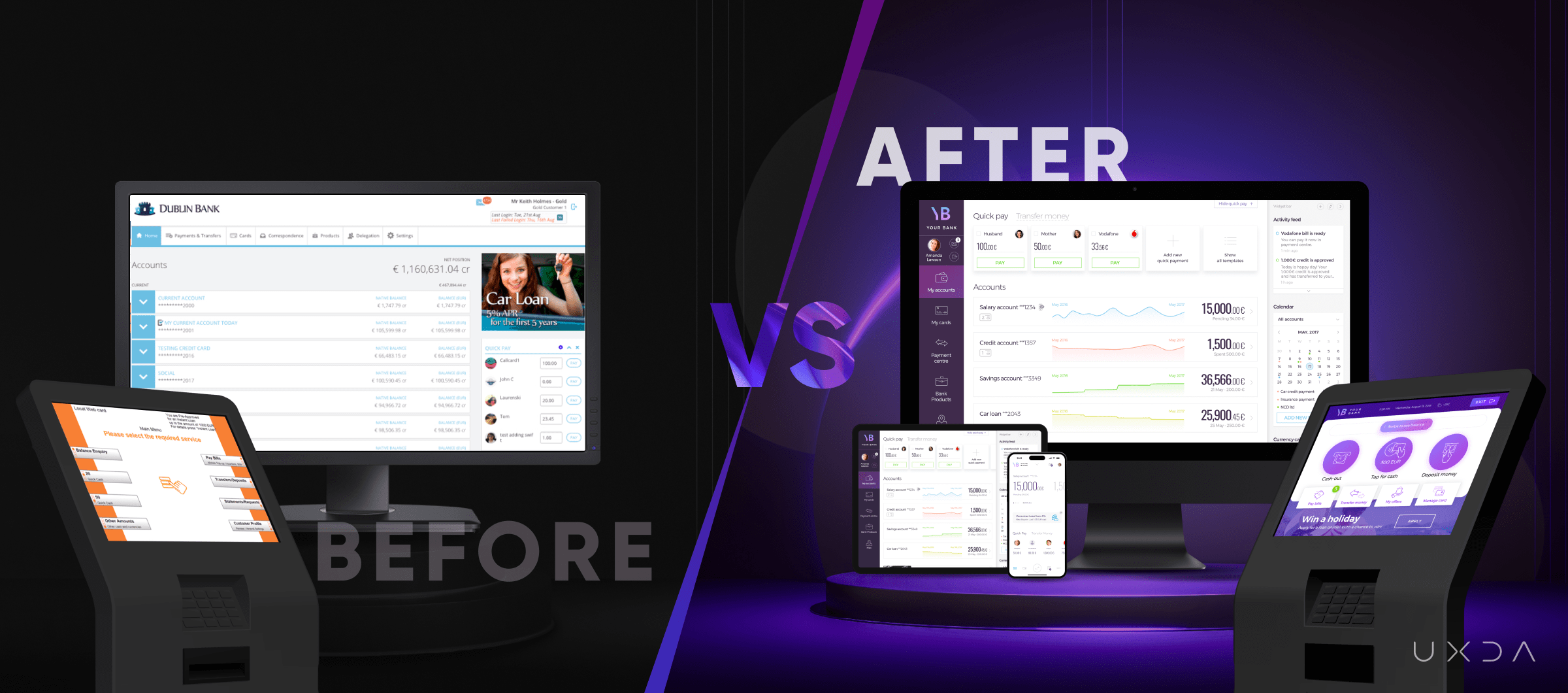

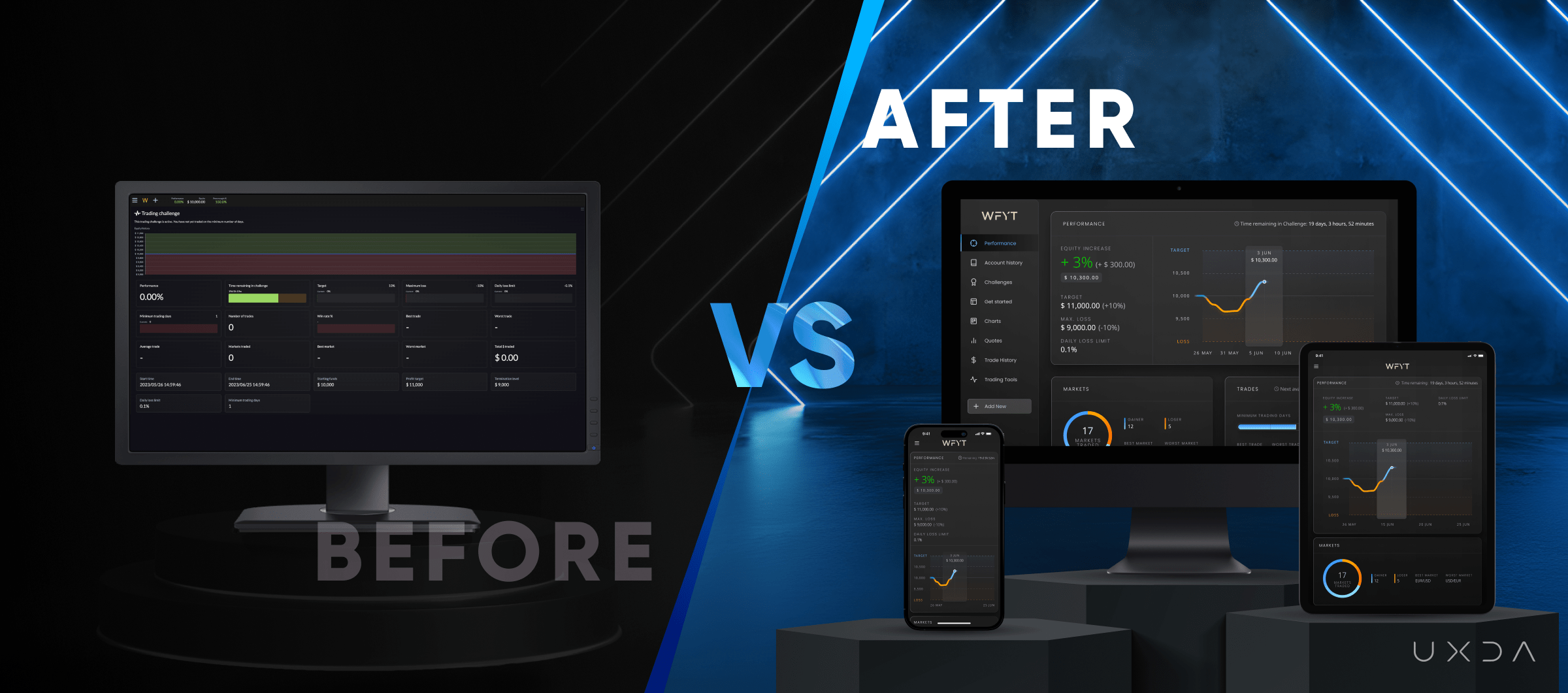

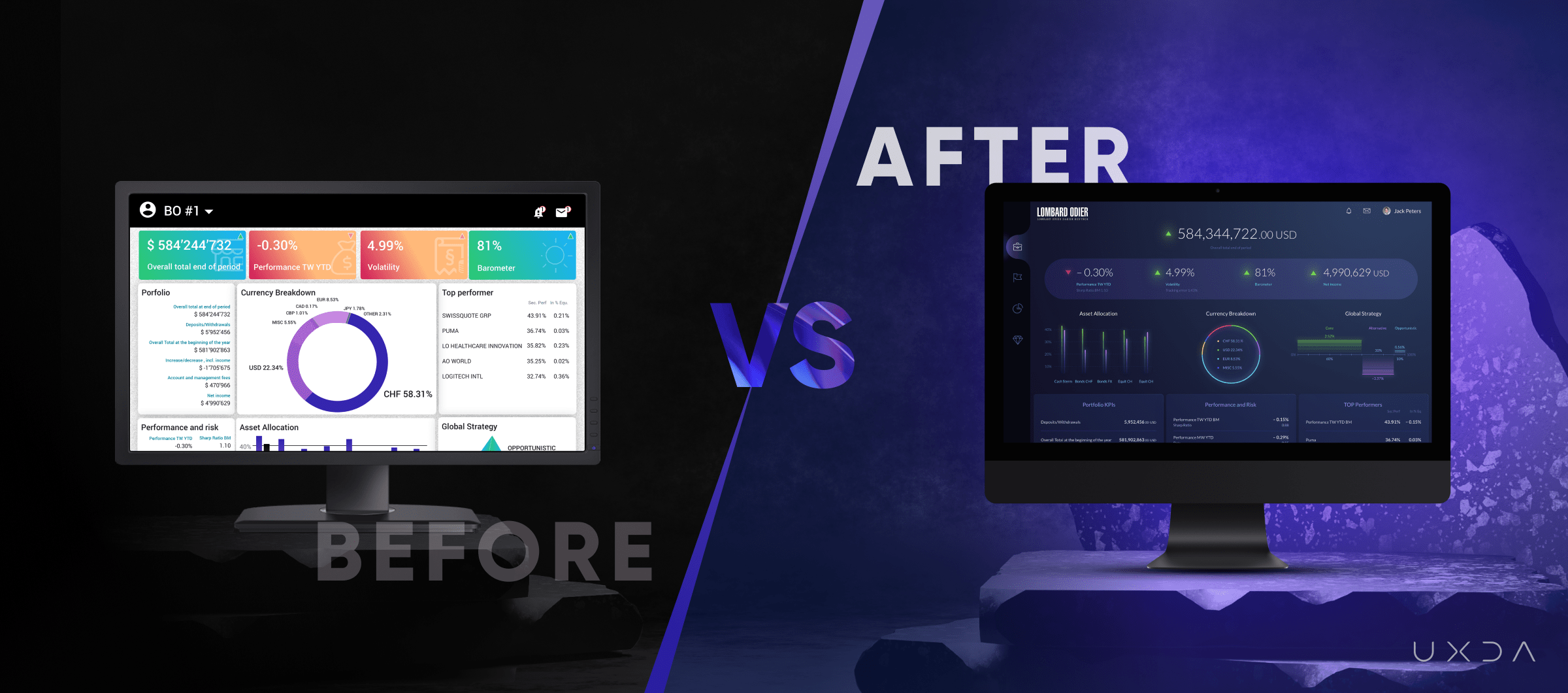

Financial product transformations by UXDA

Let's increase value of your financial product

What value should the product, user, and business receive in order to drive a digital breakthrough?

Most financial brands struggle to go beyond ordinary to make their digital service so stunning that the entire team would be passionate about it and customers would love to use it. UXDA has applied its unique UX methodology to design 100+ financial products in 36 countries that empower business digital advantage and lead to breakthroughs. It helps design successful solution that match three perspectives: user needs, business goals, and product capabilities.

Value for Product

- Inspiring vision

- User centricity

- Uniqueness and attractiveness

- Reduced friction

- Product-market fit

Value for User

- Satisfied expectations

- Emotional connection

- Delightful financial UX

- Simple to use

- Easy to understand

Value for Business

- Clear UX strategy

- Brand's digital identity

- Customer loyalty & referrals

- Customer-centered culture

- Strong digital advantage

The science behind breakthrough

A bad customer experience can cost millions. Great experience is priceless. Avoid mistakes and achieve a breakthrough with our proven Financial UX Design methodology. It's based on three key frameworks: Value Pyramid, Design Pyramid and Experience Pyramid aimed to turn ordinary financial services into extraordinary.

UXDA's Value Pyramid

We developed this formula to define and create the perfect product-market fit between the product's value proposition and the market demand. This pyramid explains how your brand can deliver the ultimate value to its customers, leading to demand and loyalty.

MISSION

Find the main "Why?" behind your product and disrupt the world

STATUS

Personalize your solution and make it part of your user’s lifestyle

AESTHETICS

Create emotional impact to engage your customers

USABILITY

Ensure ease of use that makes the experience intuitive

FUNCTIONALITY

Provide the best functionality that fits the user’s needs

MISSION

Find the main "Why?" behind your product and disrupt the world

STATUS

Personalize your solution and make it part of your user’s lifestyle

AESTHETICS

Create emotional impact to engage your customers

USABILITY

Ensure ease of use that makes the experience intuitive

FUNCTIONALITY

Provide the best functionality that fits the user’s needs

UXDA's Design Pyramid

We create top-notch financial solutions by using reverse engineering. It's a top-down approach that begins with defining the ultimate value for the user and ends with an action plan.

VALUE

Focus all efforts on delivering a true benefit for the customers

RESULTS

Measure the quality of design by the way it serves people

ACTIONS

Accelerate the design impact by defining results-driven actions

TEAM

Ensure financial design expertise by people who know how to master their craft

PROCESS

Make design the main priority in all of your business processes

VALUE

Focus all efforts on delivering a true benefit for the customers

RESULTS

Measure the quality of design by the way it serves people

ACTIONS

Accelerate the design impact by defining results-driven actions

TEAM

Ensure financial design expertise by people who know how to master their craft

PROCESS

Make design the main priority in all of your business processes

UXDA's Experience Pyramid

Our workflow is based on three tested and proven complementary approaches. Design Thinking provides us with the right strategy serving the key user’s needs. A unique BUP frame ensures that Brand, User and Product ambitions and possibilities are in sync. UX design methodology provides solid tools to turn the best experiences into reality.

UX DESIGN METHODOLOGY

Provides effective tools to reach the best insights and create an amazing product

BUP FRAME

Matches the Brand goals, User needs and Product features

DESIGN THINKING

Elevates the product's success with a proven step-by-step process

UX DESIGN METHODOLOGY

Provides effective tools to reach the best insights and create an amazing product

BUP FRAME

Matches the Brand goals, User needs and Product features

DESIGN THINKING

Elevates the product's success with a proven step-by-step process

How we make the design work for purpose-driven FIs

How do you decide which products to buy? How much time, effort, and money does it take to design and manufacture an outstanding car, awesome phone, or trendy sneakers? As a result, we love some products, and others do not notice at all. When you create a new product, there is always a huge risk of failure, leading to a painful fiasco and a loss of millions of dollars. Unfortunately, there is no perfect recipe for how to succeed. But if you dedicate your life to it with passion, wisdom, and persistence, you can get pretty close. This is what we do for you at UXDA.

Proven experts in empowering finance with design

With us, you will not need to spend months training the design agency in the specifics of financial services. Instead, we will immediately join you and enrich you with the ideas that we have collected in the industry for years. Because we are a 100% finance-focused UX design agency.

We know well that finance is a complex and specific area, and a mistake caused by incompetence can be worth millions, not only in terms of money but also in terms of customer loyalty and trust. To avoid this, our user-centric specialists have a proven track record of matching financial services to client needs as dedicated experts in both UX / CX design and finance.

Up to date experience-driven solutions

There are many experts around who talk and theorize a lot, but you look at the products they have created - and these products are outdated. We create products not looking where the industry was yesterday, but where it will be tomorrow.

It's easy to lose the game if your solution falls short of the digital age and does not meet growing customer expectations. It's not just about technology, but about removing the outdated business approach and replacing it with a digital-first strategy driven by an experience mindset.

Less is more

There is too much noise around. There are over 3 million apps in the App Store and Google Play. In order for your customers to understand and use your solution, you need to build it around the core - value for the user. This value is the answer to why your product exists and why consumers should choose it over thousands of others.

The only way to survive the digital disruption of the financial industry is to be open, flexible and user-centered. Replace complexity with ease, boredom with emotions and frustration with satisfaction─that's the way to the customer’s heart!

Deep dive into user needs

What if your product keeps letting customers down? In the digital age, only a 100% user-centric product can beat the growing competition. Starting a finance company has never been easier. Hundreds of new Fintech solutions are launched every year and entice millions of users in just a few months.

There are so many options available on the market that users don't have to put up with services that disappoint them. Don't follow the footsteps of Nokia, Kodak and other giants that relied on the success of the past and failed to adapt to the future, unlike Apple. To make a design successful, we pay special attention to the value that your product represents to customers.

Science based product architecture

Digital product creation in the financial industry definitely not cheap. You can’t take a blind shot and hope to be lucky. Entrusting the architecture of a skyscraper to a construction manager, builders or interior designers is suicide. Experienced architects are needed who can take on this enormous responsibility as they have the necessary knowledge and skills.

The same approach is true for digital finance projects. The product owner, developers and few designers will not be able to take into account all the complex details to create a financial product that delights the user. They need a team of UX / CX architects and a proven scientific methodology to prioritize and clear up the massive chaos of project data.