The fintech designers and UX consultants hired for financial product creation can either leverage the impact of design and customer experience (CX) or completely sabotage the entire digital project leading to huge losses not only in terms of money but also customer trust and loyalty. Financial companies are required to digitalize quickly and do it according to the growing customer expectations. How to empower your business and secure a competitive edge by choosing the right fintech designers and UX consultants in banking?

The financial industry is highly competitive and regulated, so financial companies must have a professional and reliable image. A good designer can help create a digital product that is not only visually appealing but also easy to use and navigate. This can help improve the user experience and build trust with customers. A well-designed digital product can also help a financial company stand out from its competitors and effectively communicate its brand and services.

Choosing the right fintech designer and UX consultant for a financial company's digital product is crucial for building a great service and a solid and positive financial brand image. The Pareto principle states that 20% of efforts impact 80% of success. In terms of digital financial products, actions related to customer experience have the biggest impact and often determine whether a financial brand will be demanded by the customers.

88% of customers expected companies to accelerate their digital initiatives, while 68% stated that COVID-19 has elevated their expectations of brands’ digital capabilities, according to Salesforce. Despite the fact that 87.2% of organisations recognize the importance of CX, especially when it comes to building customer loyalty, only 30.4% of organisations have an executive on the board accountable for CX. Most companies are managing CX solutions at a business unit level and don't have strong teams of UX/CX specialists to bridge the gap between customer needs and their products, according to Dimension Data.

Who are Fintech Designers

Fintech designers specialize in designing financial technology products and services. They use their expertise in user experience (UX) design and user interface (UI) design to create innovative solutions that improve the way people manage their finances and access financial services. Fintech designers may work on a range of products, including mobile financial apps, personal finance management tools, and online investment platforms. They collaborate with developers, product managers, and other team members to bring financial product designs to life.

Many modern mobile banking, wealthtech, insurance and other financial service design examples are found on Google and Pinterest. Though the visual appearance is important, often these products turn out to be a nightmare for the customers. Due to an over-stylized UI and complex financial information architecture, users are unable to find the necessary elements and important user scenarios.

In digital financial product design, we can divide fintech designers into two categories─those focused on the artistic side with the goal of making an impression and those who aim for a beautiful design that would meet the user's needs and be intuitive and easy to use.

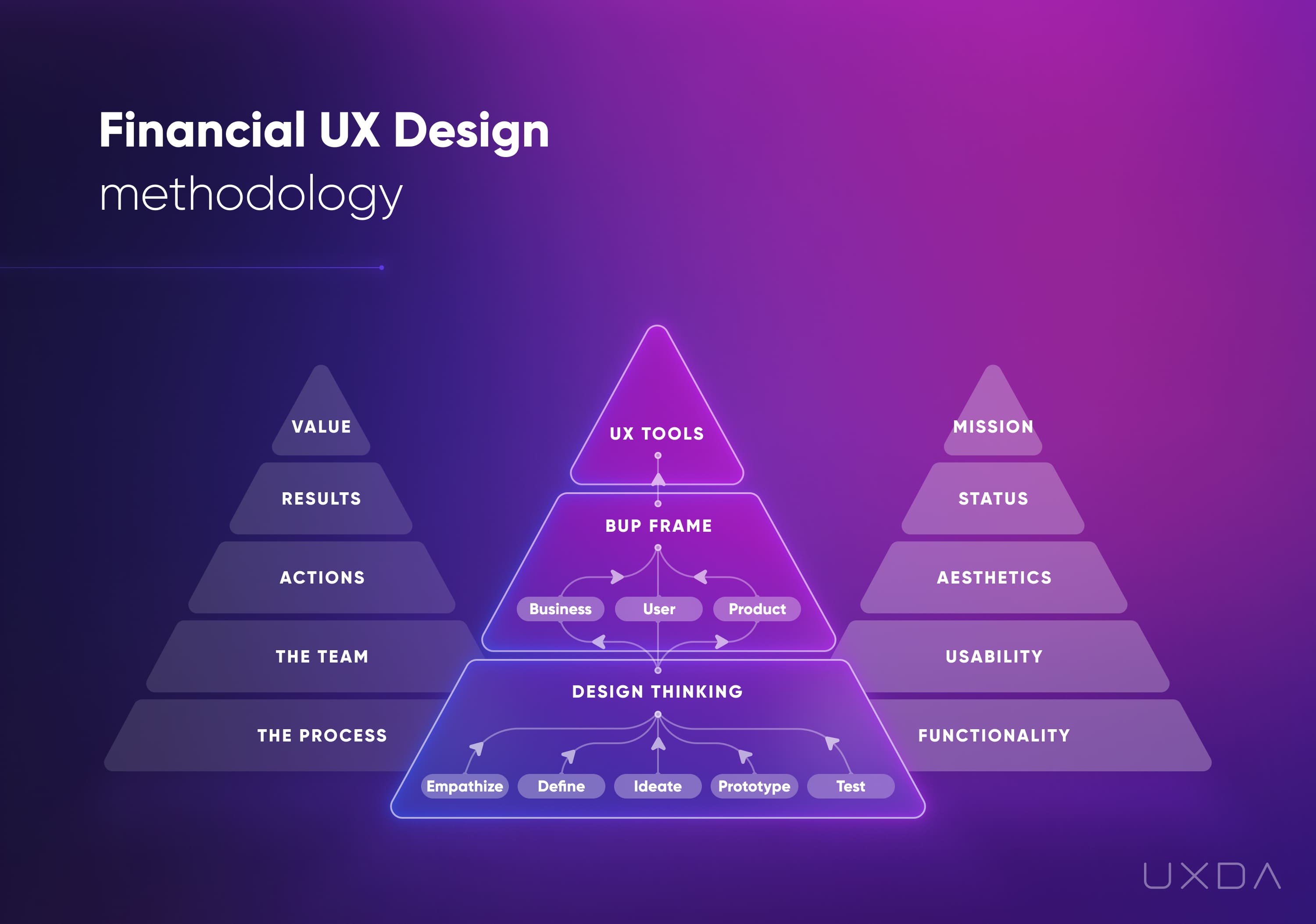

In the financial UX design methodology, the design is only one of seven stages toward creating a beloved financial digital product and brand. The other stages include business and market analysis; user research; engineering; prototyping; creating a design system; and ensuring UX assistance during implementation.

The seven stages of the Financial UX Design Methodology by UXDA

When it comes to finance, the ability to create an attractive design covers only 1% of the required competence. If you decide to hire designers who do not have enough competence and experience in human-centered fintech design it's not possible guarantee great product usability in sync with user expectations and the specifics of the business strategy.

Here's an example from UXDA's experience. A huge insurance company requested a redesign of a recently launched product. They had hired seemingly talented designers with track records in multiple domains and spent a great deal of money on creating a fancy product that turned out to be unusable. These creative designers had made a beautiful flow with tons of pleasing illustrations and animations but it was overwhelming and distracting. From the user point of view, the process of getting insurance was a nightmare. We were forced to start with user research in order to create an intuitive information architecture and to ensure that all flows are aligned with the user's needs. In the end, we crafted an inspiring design that was attractive and easy to use.

To avoid this unusable beauty trap when you're ready to hire designers, it's handy to explore not only the social profiles of the designers but also the status and essence of their product designs. Are they launched? What are the customer reviews? What kind of methodology do the designers have? Do they pay enough attention to the research and the engineering phase or go straight to design?

Here are some steps to follow when hiring fintech designers for your digital financial product or service:

1. Identify the specific skills and expertise you need

Fintech designers have a wide range of skills and expertise, including UX design, UI design, and knowledge of the financial industry. Identify the specific skills and expertise that are most relevant for your project and look for designers who have those skills. Do designers have expert publications and case studies that confirm their competence, as well as UX and design awards?

2. Look for designers with experience in the financial industry

Fintech designers who have experience and methodology in the financial industry will have a better understanding of the unique challenges and opportunities in this field. This can help them create designs that are specifically tailored to the needs of financial institutions and their customers. How extensive is their experience of working with complex financial companies that have many stakeholders and requirements, such as banks, for example?

3. Consider the designer's portfolio and work samples

A designer's portfolio and work samples can give you a good idea of their skills and expertise, as well as their design aesthetic and approach to problem-solving. Review these materials carefully to ensure that the designer's work aligns with your vision and goals. What financial products did they design, and how unique and innovative are these solutions?

4. Talk with the designer via video conference

Meeting designers via video conference can give you a better sense of their personality and communication style. This can help you determine if the designer will be a good fit for your goal and your project. Are they ready to take on any job and promise whatever you want, or do they approach the task strategically and comprehensively analyzing it based on their experience?

5. Check out the reviews

Read reviews of the designer from previous clients and explore track records. This can give you insight into a designer's work ethic, reliability, and ability to deliver on their promises. Do these reviews reflect the specifics of the task and design approach, or is it more of an abstract praise left by friends?

Overall, when hiring fintech designers to create digital financial products and services, it is important to look for individuals who have the relevant skills and expertise, as well as a proven track record of success in the financial industry. By following these steps, you can find the right designer to help you create innovative and user-friendly digital financial solutions.

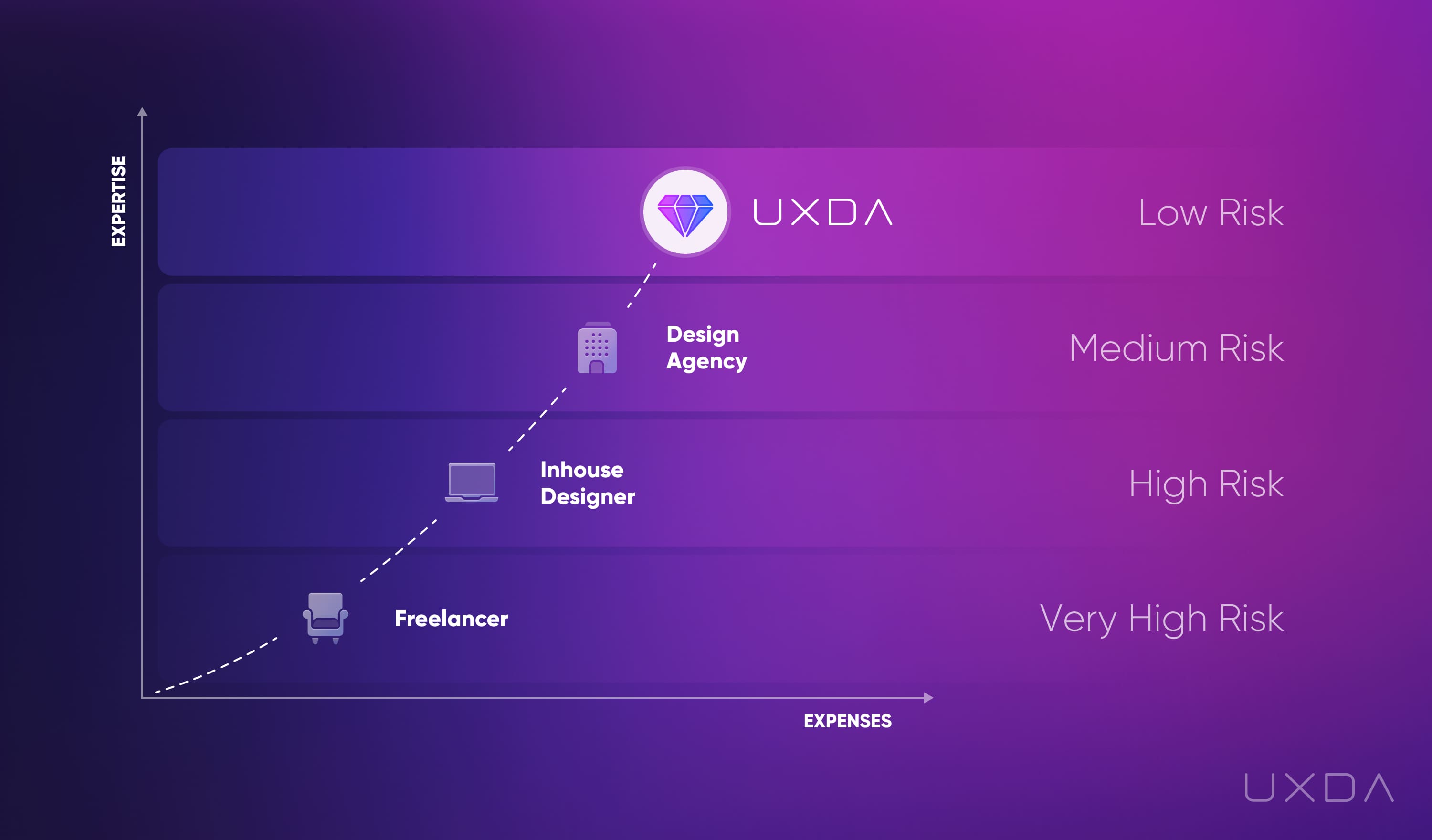

Don't Take Risks With Unverified Designers

There are cases in which a financial company decides to hire fintech designers to create a great product, but the end result is far from perfect. This is because even a skilled design specialist might not be able to bring his A-game when it comes to the specifics of financial services or bank digitalization.

In financial user experience, the smallest mistake can lead to both financial losses and loss of customer loyalty and trust. It's extremely important to have in-depth knowledge and understanding of the specific financial product and the industry at large. To work with financial services, it is crucial to have knowledge and experience in the specifics of this complex industry as well as user psychology behind finances.

This is the reason why UXDA spent 15 years developing the Financial UX Design methodology - to have a specific approach that helps to maximize the potential of financial brands and allows them to establish long-term connections with their customers through digital products that provide an exceptional experience.

Hiring a UX designer without in-depth financial knowledge might seem like a win in the short term due to the possibility of cutting expenses, but might incur a high cost in the end.

Main risks of a bad product design in the financial industry include:

Loss of customers

Poor product design can lead to a bad customer experience, which can result in customers switching to other banks or financial institutions.

Reduced revenue

Bad product design can make it more difficult for banks to generate revenue from their products and services, which can impact their overall profitability.

Security risks

Poorly designed financial products and services can be more vulnerable to security threats, such as cyber attacks or fraud. This can put customers' personal and financial information at risk, which can lead to damage to the bank's reputation and legal liabilities.

Loss of trust

Bad product design can make it difficult for customers to trust a bank, which can impact the bank's overall reputation and its ability to attract new customers.

Regulatory issues

In some cases, poor product design may result in products and services that do not comply with regulations or industry standards, which can lead to fines and other penalties.

Here's a real-life example. A certain bank had hired UX designers to redesign their mobile financial app as part of the process of the bank digitalization. Shortly after the launch, the bank’s support team received thousands of customer calls with similar struggles. This was because an “unimportant” detail missed by the designers was actually a major element for its usability. This is why UXDA's UX architects have several years of experience working at a financial institution.

When it comes to finance - a mistake caused by incompetence can cost millions not only in terms of money but also in customer loyalty and trust.

To avoid this, it's critically important to work with user-centered fintech designers with a proven track record of specializing in matching digital financial products with customer needs. For example, UXDA's track record includes design of over 100 digital financial products from 36 countries. It's very important to have a team of professionals who are dedicated experts in both UX and finance and have a proper financial UX design methodology in place that requires expertise in financial business analysis, financial UX research, financial UX architecture and financial UX strategy.

The success of the financial brand and its products depends on an in-depth understanding of the specifics of financial products, business strategy, marketing, psychology, human behavior and digital technology.

Design potential can be empowered by outsourced competence like financial UX consultants and agencies to help integrate a user-centered mindset throughout the financial company.

Use Fintech Designers to Achieve Digital Breakthrough

Even the most skilled financial design experts might still not deliver the desired results. This is because the impact of the designer's knowledge and skills is decreased if their influence is limited to the surface level of the product.

If the designers aren't able to thoroughly analyze the product and design experience at a deep level, it might lead to a standardized, non-competitive solution. This explains how boring digital financial solutions appear in the process of bank digitalization.

It's important for fintech design specialists to become user-centric facilitators at every level of the company, integrating these values into the company culture and inspiring and coaching the employees to become user advocates who ensure the best possible customer experience in finance.

From a financial businesses' perspective, the top benefits of hiring fintech focused designers compared to traditional designers are:

1. Improved customer experience

Fintech designers have a deep understanding of user experience (UX) design and user interface (UI) design in the financial domain, which allows them to create financial products and services that are easy to use and intuitive. This can result in a better overall customer experience and can help banks retain customers and attract new ones.

2. Faster time to market

Fintech designers are skilled at creating financial products that are both innovative and feasible, which can help banks bring new products and services to market faster than they would be able to with traditional designers.

3. Increased competitiveness

Fintech designers can help banks create designs that are at the forefront of the industry, which can give them a competitive edge over other financial institutions.

4. Greater potential for growth

Fintech is a rapidly growing field, and hiring fintech designers can help banks stay ahead of the curve and capitalize on new opportunities for growth.

5. Better collaboration

Fintech designers often work closely with developers, product managers, and other team members, which can help foster collaboration and drive innovation within the bank.

6. Improved efficiency

Fintech designers are skilled at creating designs that are efficient and streamlined, which can help banks reduce costs and improve their overall operations.

7. Higher customer satisfaction

Fintech designers are focused on creating designs that are specifically tailored to the needs of financial institutions and their customers, which can result in higher levels of customer satisfaction.

8. Enhanced ability to adapt

Fintech designers are well-versed in the latest technologies and trends in the financial industry, which can help banks quickly adapt to changes in the market and customer needs.

9. Greater potential for revenue growth

By creating innovative and user-friendly financial products and services, fintech designers can help banks generate more revenue and achieve their business goals.

The overall success of financial digital products and the financial brand often depends on the actions taken by the UX experts. The decision to hire UX designers hugely impacts the end value the customers will receive, as well as the speed at which the product will be implemented.

To avoid the trap of limiting the power of design in financial products, fintech designers need to have the appropriate influence over the company’s inner processes. It's also crucial that the C-level executives support the designer’s efforts and ensure the whole team is engaged in the process of user centricity and deliver the best possible experience.

Additional answers that might be helpful:

What is the role of fintech designers in a financial institution?

Competent fintech designers are crucial in the banking industry because they are responsible for creating the software and systems that enable banks to provide financial services to their customers. These systems must be reliable, secure, and easy to use, as they handle sensitive financial information and transactions. In today's digital age, a large portion of banking is done online or through mobile apps, so it is essential for fintech designers to create intuitive and user-friendly designs that make it easy for customers to access and manage their accounts. Additionally, fintech designers must stay up-to-date with the latest technological innovations and industry standards to ensure that the systems they create meet the needs of both banks and their customers.

What are the primary responsibilities of UX architects and designers in banking?

The primary responsibilities of UX architects and designers in the banking industry include designing and improving the user experience of the bank's digital products and services, such as its website, mobile app, and online banking platform. This may involve conducting user research and usability testing to understand how customers use the bank's digital products and where they encounter difficulties, and then using this information to design solutions that address those issues. UX architects and designers may also be responsible for creating wireframes, prototypes, and high-fidelity mockups to communicate their designs to developers and stakeholders, as well as working with developers to ensure that the final products are implemented according to the design specifications. Other responsibilities may include staying up-to-date with the latest design trends and best practices, collaborating with cross-functional teams, and participating in design reviews and presentations.

What are the specifics of fintech designers?

Financial UX designers are different from designers in other industries in that they must have a deep understanding of the financial industry and the specific needs and requirements of financial institutions and their customers. This includes an understanding of financial concepts and processes, such as payments, loans, and investing, as well as an understanding of relevant regulations and technologies, such as data security and privacy laws, and blockchain and API's. Financial UX designers must also be able to design systems that are easy for customers to use, but also meet the complex and often specialized needs of financial institutions. This may require designing for a wide range of user types, including retail customers, small business owners, and financial professionals, and being able to create solutions that are suitable for each user group. In addition to these specialized skills and knowledge, financial UX designers should also possess the general skills and competencies that are common to all UX designers, such as user research and usability testing, design thinking, and prototyping.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin