Almost every financial institution invests a lot of effort and money into improving customer experience in the financial service they provide. As this is the main way to ensure a competitive advantage in the digital age. Unfortunately, sometimes results are pitiful. For example, a large retail bank redesigned their 6-years old app with an in-house team of designers. Its rate decreased from 4 to 2 stars in the App Store. What could be the reasons behind such a bad outcome of digital customer experience design in financial services?

10 Reasons Why Digital Customer Experience in Financial Services is Sabotaged

1. Digital Customer Experience of a Financial Product is not Connected to its Brand

It's not enough to replicate the design of another nicely looking financial app to ensure a great quality digital customer experience in financial product. Behind every digital transformation success, there's a number of unique factors that impact the banking customer experience. User interface design is only one of those.

For a digital product to succeed it's crucial to take into account your brand uniqueness, customer expectations and cutting-edge technology. To turn your digital service into a long-term competitive advantage, conduct user research and execute a tailor-made financial CX engineering.

2. The Curse of Knowledge

When someone is communicating with others, unconsciously believing that they would have the exact same context to perfectly understand what he's saying, it's called a cognitive bias.

In many cases, the same happens when finance professionals create a digital service that they believe is easy and pleasant to use, while customers are confused by its complexity.

To architect the best possible customer experience in financial services, speak the "customers' language", become their ally. You can achieve it through in-depth empathy, knowledge of psychology, financial CX research, usability testing and user-centered business mindset.

3. False Hopes

There's no doubt about the impact of digital customer experience in creating successful digital products. However, it's faulty to assume that outstanding CX in financial services is the only element FIs need to gain instant success.

Even digital products with great financial CX are still subject to market rules and multiple business factors, like the business model, strategy, the way product's introduced to the market, the CX of support, the competitors' offers, etc. Managing all of these aspects with the right allocation of responsibility allows to become more certain that the new digital product would truly succeed.

4. Lack of Financial CX Expertise

Quite often FI executives outsource financial service customer experience designers hoping that in a few months they'll bring a new successful app design to the table. Unfortunately, this kind of scenario very rarely works out. The success of a financial app depends not only on the design skills of the designers but most importantly on an in-depth understanding of the specifics of financial products, business strategy, marketing, psychology, human behavior and digital technology.

Ensure your inhouse or outsourced team has a proper financial CX design process in place that requires expertise in financial business analysis, financial CX research, financial CX architecture, and financial CX strategy.

Read more about how to choose the right CX/UX design expert for digital banking transformation.

5. Funds Deficit

There are still companies that perceive financial services customer experience design only as a visual design that's part of marketing or product departments receiving a small fraction of the budget. The truth is, in the digital world, business success relies on digital channels, and accordingly, digital customer experience and this should be the top priority.

To create a strong digital advantage, prioritize financial customer experience design in strategy, processes, team and budgeting. It doesn't mean you need a huge funding, but a cultural transformation. Switching from push-sales approach to customer-centricity can lead to disruptive products that delight users, bring great demand and loyalty.

Read more about integrating user centricity at all levels of the financial company.

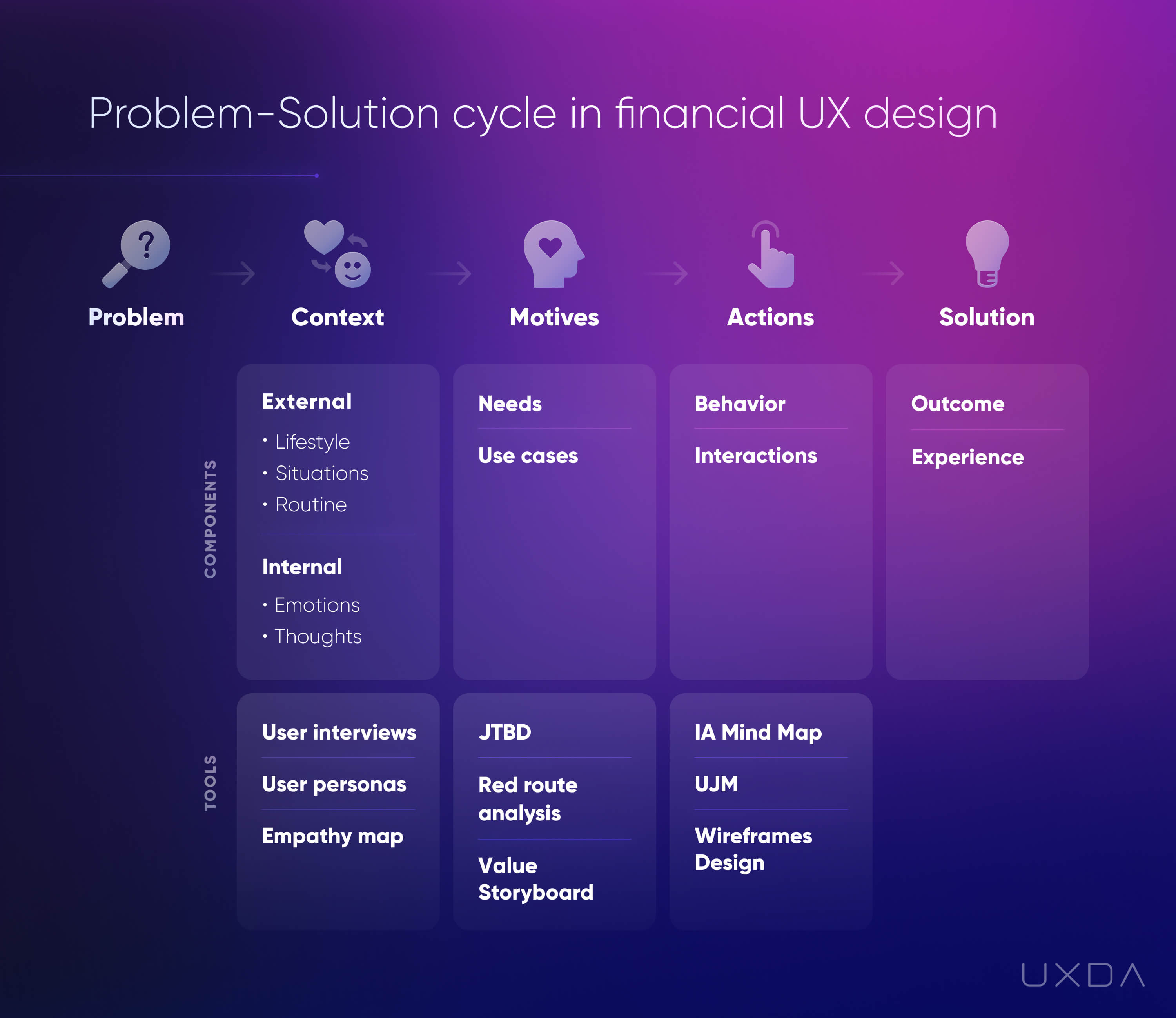

6. No Strategic Context

Sometimes the financial industry tends to perceive UX designers as artists that draw some buttons. While in reality, financial UX / CX design experts perform similarly to business consultants who research all related contexts to creating the digital product and identify bottlenecks to find appropriate solutions.

For many businesses, it's still not easy to define customer context. There are companies that aren't aware of why the customers use their service or decline it, they also don't check product reviews on the App Store or social media, though these are the main channels of consumption nowadays.

7. Bewitched by Innovation

In the rush for outstanding competitive advantage, many banks seek innovative technologies that will fascinate users. At the same time, their existing digital solutions are far from perfect and are full of friction that confuse users. A complex new innovation is hard to integrate while there are multiple issues with delivering good customer experience in financial services through the existing products.

There is no need to reinvent the wheel. In the majority of cases, patterns and solutions that are already familiar to users could be used.

The best digital innovation is one that takes the value for the customer to the next level. This requires absolutely clear and pleasant to use service, which becomes a powerful competitive advantage of the business.

8. Ignoring the Irrational

Data-driven design is an extremely powerful approach. The opportunity to statistically justify and measure the design outcome is very promising, especially for the BFSI (Banking, financial services and insurance) industry. The dark side of it could be the responsibility shift from product owners and designers to data.

Unfortunately, data can't take into account user behavior and emotional context that is variable and changes with time. As Henry Ford stated, "If I had asked people what they wanted, they would have said faster horses." Customers behavior, in general, is affected by human irrationality, that's why data provides only interpretations, not the real answers.

Read about 10 psychology insights to design user-centered banking.

9. Over-Featuring

There's a common misconception among quite a lot of FIs - the more functions we provide, the better the satisfaction of different kinds of our users will be. Actually, it's quite the opposite. When a customer is faced with plenty of options it confuses him and leads to decision paralysis. In the end, the customer quits without taking any action at all and there's a question if he will be willing to come back.

Find out the exact customer needs and tailor the services upon them, providing a simple, clear, and intuitive customer experience in financial services.

10. Underestimating Emotions

For years, banking has been perceived as a very serious institution that some are even afraid of. The world is changing and so is the finance industry. People seek an emotional connection and a personalized attitude from their services and banking is no exception. Humans are emotional beings by nature. As Don Norman, the apologist for emotional design demonstrates in his works - aesthetics bring worldwide fame even to the simplest things like a teapot. It's because it causes the users positive emotions and offers a brand new, more meaningful experience.

Find out more how to deliver the best possible customer experience in banking services:

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin