Alex is the founder and chief UX design strategist at UXDA. He has been involved with UX engineering for over ten years now, creating successful and demanded products for more than 60 multi-billion financial companies.

How to design financial product using UX

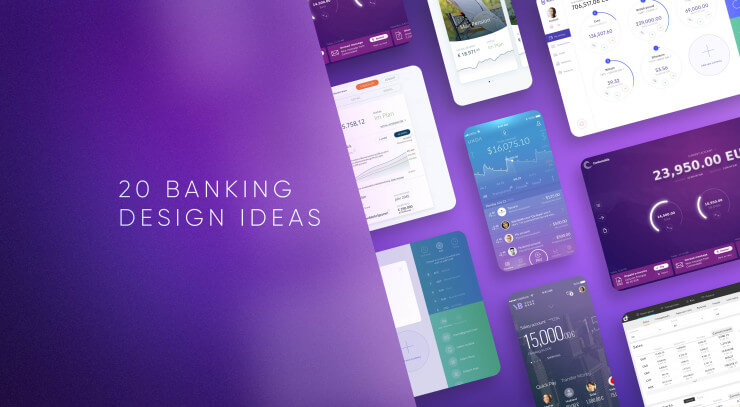

In this short but insightful interview UXDA's founder and CEO Alex Kreger gives insights and tips about creating successful financial product design and user-experiences for banking and Fintech.

Create product architecture that meets the needs and psychology of the user

There are millions of problems customers face every day. Any successful business starts with a solution-to-solve problem, but not every solution is usable enough to help customers. Service interface design ensures digital solution usability by matching solutions with user needs and psychology.

Comparing financial services experience design with the traditional service design approach it is not about art; rather, it is science that impacts user decisions and behaviours. Holistic approaches combine user-centered engineering with business needs and product capabilities to design positive user experiences utilizing financial solutions.

From our extensive financial project work, we have created step-by-step financial UX design methodology that involves marketing analysis, business expertise, research, psychology, system analysis, strategy and financial product interface design.

More about this topic: Financial UX Design Methodology: the Experience Pyramid

Make a simple, intuitive design that relies on the user's subconscious

According to scientists, 80% of consumer behaviour is determined by that part of the human brain referred to as our subconscious. Finance is an artificial concept that lies in the neocortex of the brain — our rational consciousness. That`s why people are not adept at calculations and controlling their financial behavior.

Many people don’t like banks because they don’t understand how banks work. The average bank offers many services, but 70% of it's customers use only a few of them. Digital technology can reinvent this system to make it more transparent and user-friendly.

Only through understanding users it is possible to make finances more comprehensible for people. That`s why the mission of the UX Design Agency (UXDA) is to raise consumer understanding about financial services by engineering simple, intuitive design.

More about this topic: 7 Steps to Make Your Banking Service or Fintech Simple

Think and act like disruptor

The average consumer’s trust level in banks is about 40% compared with 70% trust level in technology companies. Technology firms design a user experience as part of a value-generating process instead of old-school push marketing.

There is a plethora of financial products, most of which are complicated and confusing. Statistics shows that 50% of financial service customers switch providers because of a bad experience. Disruptive Fintech startups have a vision that traditional services lack, and that vision is user-centered design.

Financial disruptors think and see finance through the customer’s eyes. They choose to be all about the customer and design financial products they want to use. They have an understanding that finance is not the easiest thing in the world, and it confuses and even scares many people.

Disruptors build technology and finances around customers and deliver needed solutions in a simple way using financial services experience design. They don't just build useful and appealing software; rather, they seek to change the whole financial experience for users.

More about this topic: The Financial UX Matrix: How to Become a Disruptor in Banking

Use proven UX methodology to create best products

Our financial user experience design process includes three key stages: Research, Engineering and Design.

It starts with understanding the business, followed by user research and product-feature audit. Our team is experienced in lean UX, so we only conduct research and offer tools that provide key insights.

By understanding core product user personas, it is possible to understand users’ needs and gain insights in order to engineer UX strategy, information architecture and user journey maps. Based on that insight, we can implement key screens in wireframes that allow us to deliver initial products to test our core hypothesis.

Financial product UI design completely differs from traditional web design. Our main challenge is to convert complex multi-feature solutions into user-friendly, intuitive interfaces that are portable to different platforms and resolutions. To achieve this, we consider usage patterns and habits, usability research, cognitive psychology heuristics and trending UI approaches.

More about this topic: How to Design The Most Beautiful Banking App

Speed up with modern cloud solutions and remote control

All of UXDA projects are conducted using online communication tools. All project files and progress are tracked in the cloud. This allows to share design prototypes and interactive concepts with the team, so everyone can fully participate in the engineering process.

UXDA's regular collaboration includes daily check-ups, hourly reports and cloud-based interactions to ensure financial brands have full "flight control" of UX services provided by UXDA. We operate as a remote part of our client team. Thus, we are not only helping to create an optimal financial user experience, but also ensure that our client team employs best practices in a user-centered approach.

Our hourly-rate invoices are based on regular reports of what we have done in the previous period, with time and UX design tasks explained, thus achieving flexible, transparent, fast and agile-friendly process and budgeting.

More about this topic: Core Banking Digital Transformation Allows to Expand Globally

Switch to customer-centered mindset

Today’s digital customers have higher expectations than ever. To be successful, financial companies need new and innovative approaches to attract and retain customers through highly relevant and personalised experiences across multiple channels. Customers now have the freedom to switch providers more easily than ever before, so it is our number-one priority to switch from product-centered to customer-centered mindset.

To meet customers’ expectations successfully, we need to look outside of the traditional finance industry. That means hiring designers, financial services experience design professionals, FinTech developers and innovators who have an understanding of customers’ needs and expectations. This strategy, mixed with a flexible in-house innovation culture, provides a formula for success.

More about this topic: Does Your Mindset Fit the Digital Age

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin