In 2016, 413 European companies were nominated for European FinTech Awards TOP100 that was held April 14 at the ABN AMRO Head Office in Amsterdam. UX Design Agency entered TOP3 in category of Innovative Banking Software, and was exclusively selected to present its approach at FinTech Awards 2016.

On the basis of votes from over 55.000 FinTech enthusiasts, and judge decisions, TOP100 most promising FinTech companies in Europe by 9 categories were selected from 413 nominees.

Best UX design agency for innovative digital banking solutions

UXDA UX design agency on the results of public voting and jury decision became first design agency included in the TOP3 of European companies in the category — Innovative Banking Software, competing more than 40 Fintech companies. UX Design Agency is the first and leading boutique agency delivering user experience design for digital financial services: banking, FinTech, insurance, trading, payments, bitcoin, lending, etc.

The innovation in banking services provided by UX design agency UXDA takes into account business and technological opportunities and focuses on the needs and behavioral patterns of users. As a result, our UX agency makes digital banking interfaces and other financial startups customer-centered and frictionless. UX Design Agency service is in demand among banks and FinTech startups from Europe and the United States.

How to create banking innovations

For past years our UX design studio sharply focuses on delivering innovative digital banking solutions and became first and leading UX design agency for the financial industry. In this post, you will find fundamentals and receipt of banking UX Design Agency approach as that were revealed at the European FinTech Awards stage in 2016.

Explore human nature

Alice is only four years old, but she has already jumped into modern Rabbit-Hole of technology. When I was watching her, she took my smartphone, and launched camera app. In half an hour she overloaded phone memory with dozens of photos.

Imagine my surprise of how such a small kid figured it out. For guys in Cupertino it`s not a surprise, obviously, because they succeeded to made this feature deadly simple. Just open Camera app, tap Magic Button and that’s it. Think about it, from a little Magic Button a 4 year old gets happier than from an ice-cream, because it delivers breathtaking creative experience.

So, what do you think. could it be possible hundred years ago with manual camera like in the picture below?

And what about finance, are they deadly simple our days, and does they deliver delightful experience? Definitely not. There is a lot of work to do, but one of the main issues lies in our human nature.

According to scientists, 80% of consumer behaviour is determined by ancient parts in human brains — our subconsciousness. Finance is artificial concept that lies in Neocortex — our rational consciousness. That`s why we are not perfect with calculations and controlling our financial behaviour.

In UX Design Agency our mission is to rise consumers understanding about finance, by making it deadly simple. Similarly to a camera app for Alice.

Recognize the gap between customers and banking

Unfortunately not every service provider realizes this problem. Research shows significant gap in understanding customers. 81% of service providers believes they fully understand customer needs, but only 37% of clients agrees with that. It seems like there is a lot of misunderstanding and miscommunication.

That’s why 70% of online banking users uses only 2 to 4 of their primary bank products. And that’s incredibly small number comparing to available products. Why? Because consumers do not understand value of other available products.

Actually it’s only a small part of overall customer experience, that makes direct impact on consumers loyalty. Statistics shows that half of switched customers did it because of a bad experience.

Today’s consumers prefer to trust their phone, more than their banker. Tech companies bets on design user experience as part of value generating process instead of old-school marketing. As humans can`t deliver bright idea without human language, so technology can’t provide it`s value without design. And tech companies cracked it. They communicate, teach and gain customers through design as a language.

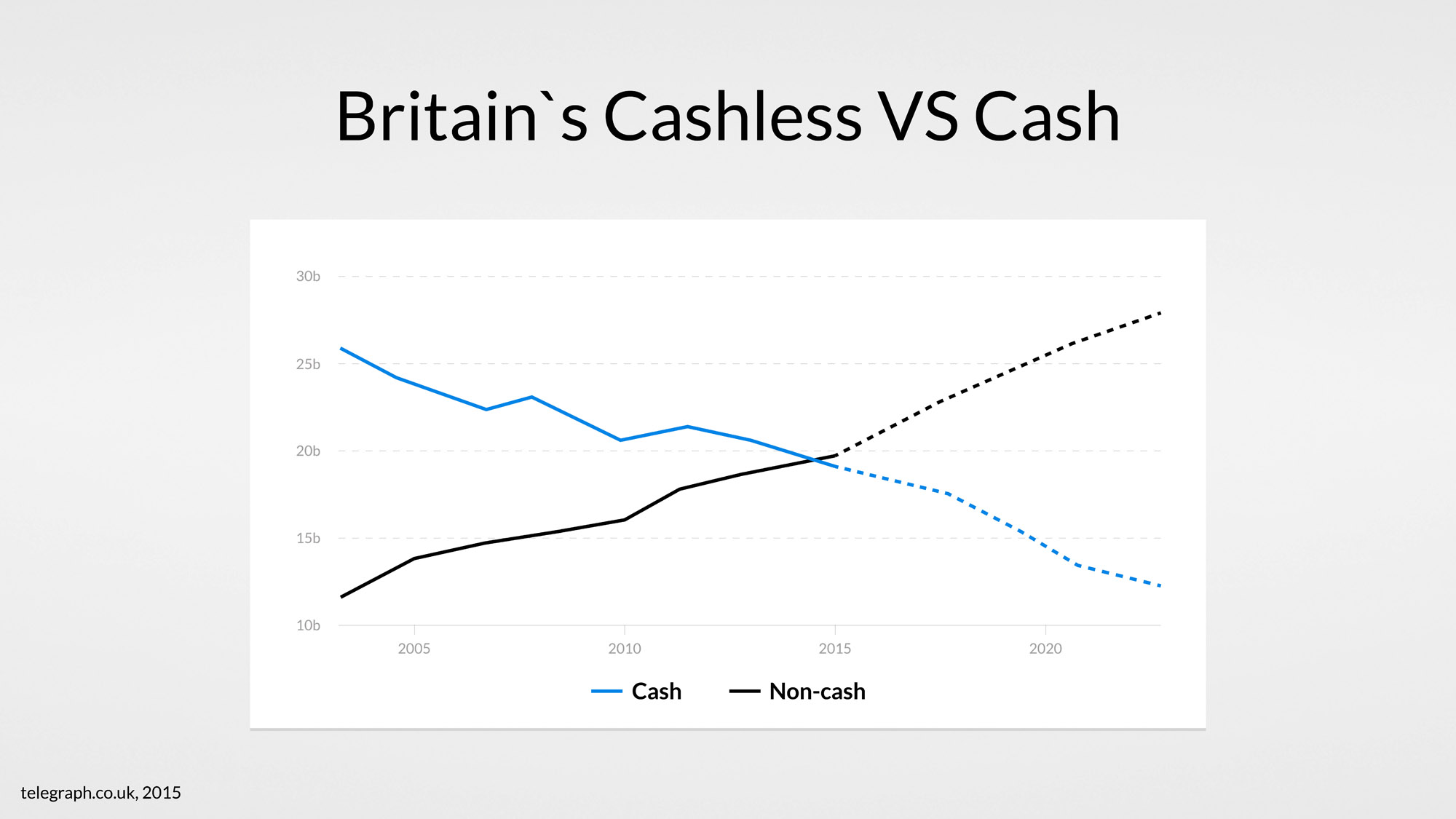

And now technology focuses on money. There is a technological revolution, and financial industry is no exception. World’s economy is rapidly increasing volume of electronic payments, which already is dominating. Major European banks HSBC, Deutsche Bank, Lloyds Bank, DNB, Banco Santander, Royal Bank of Scotland, Barclays during the last month announced plans to close more than 1,000 branches.

Experts predict that by 2030 Sweden becomes the first country to completely become cashless economy. Due to innovative digital banking solutions we are moving extremely fast from cash society to completely digital finance. And this changes everything.

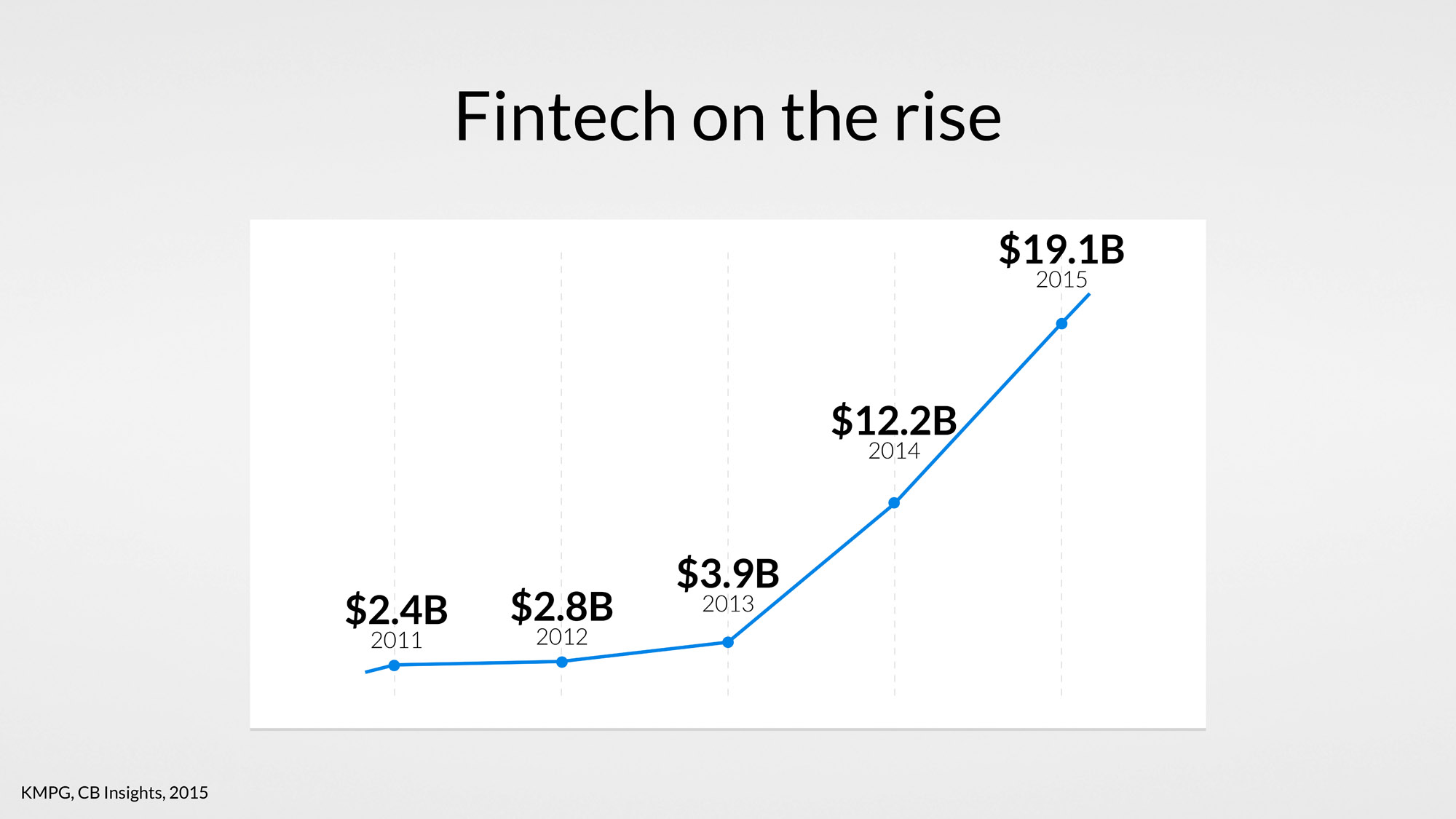

Just look at FinTech right now. FinTech startups noticed this window of opportunity to deliver innovative digital banking solutions. And now there are thousands of them, but they all have one thing in common — they have best digital banking experience design as main advantage.

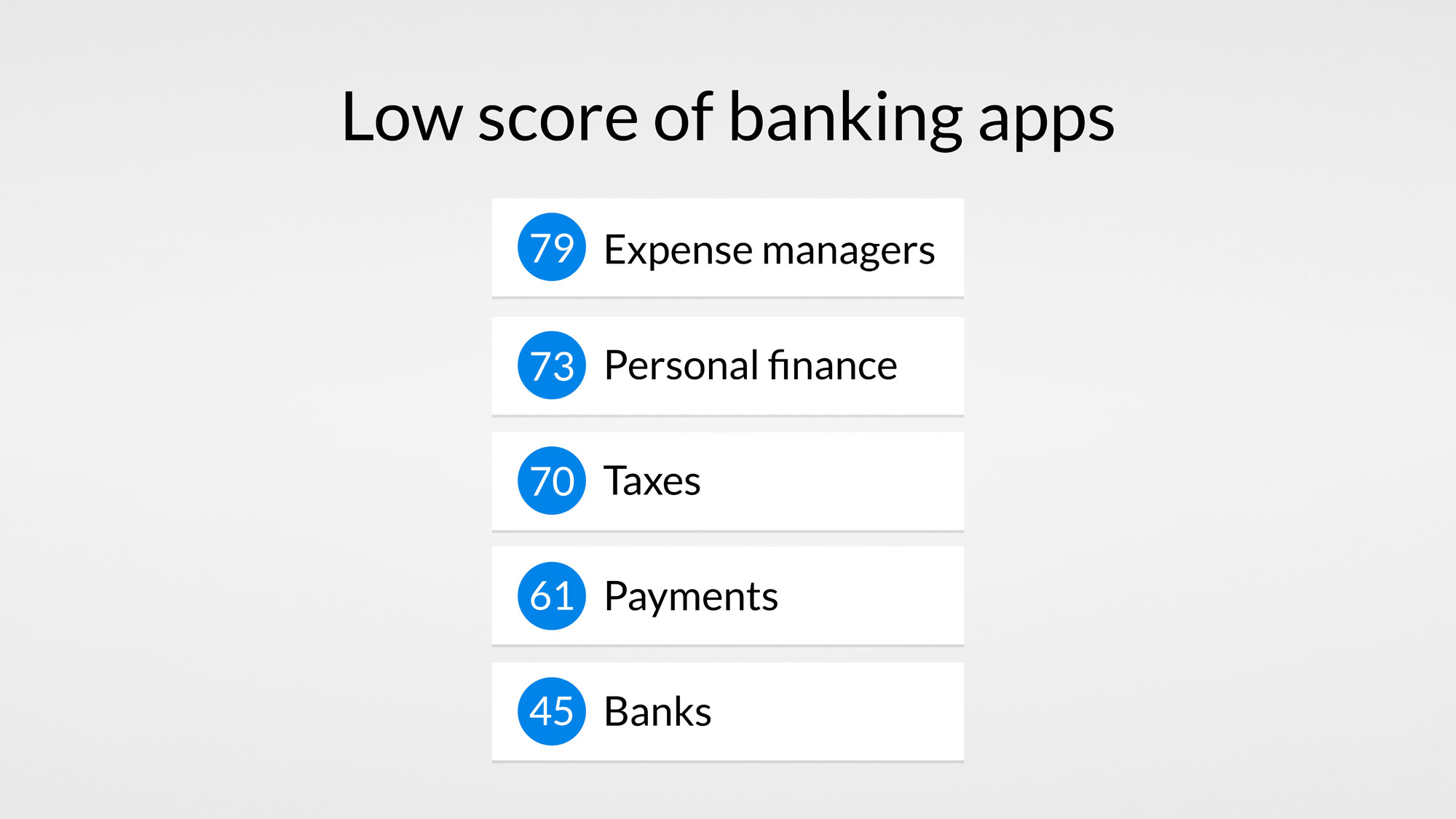

And this is clearly seen in Appstore. Average rating for personal finance apps is near to 80, comparing with half less for banking apps.

Learn ''customer language''

So, what can be done? First of all, we have to clarify that having so many FinTech products put us in customer-centered economy where the best UX design means more than a huge advertising budget.

And the only way to be successful is understanding customers and stepping into “Customer Shoes”. We do it by making researches, interviews and polls to understand users pains and passions using financial service.

We also need to speak “Customer Language”. To learn it we have to discover users perceptions, cognitions, behaviours that allows us to provide effective service design and taxonomy based on user psychology and patterns.

All of gathered insights we pack into User Experience (UX) design. In our UX agency we call it — “the Magic Button” experience.

Everyone is dreaming about magic button, that solves any problem with single tap. Erase all those multi-field forms, remove complexity. You don’t want to disappoint Alice, when she becomes your customer, right?

In future, innovative banking products have to move financial service complexity to the background, providing intuitive and dead-simple interface. We will not force users to fill out all those multi-step forms because we will are able to import all required info through APIs.

Use UX design methodology to deliver " the magic button"

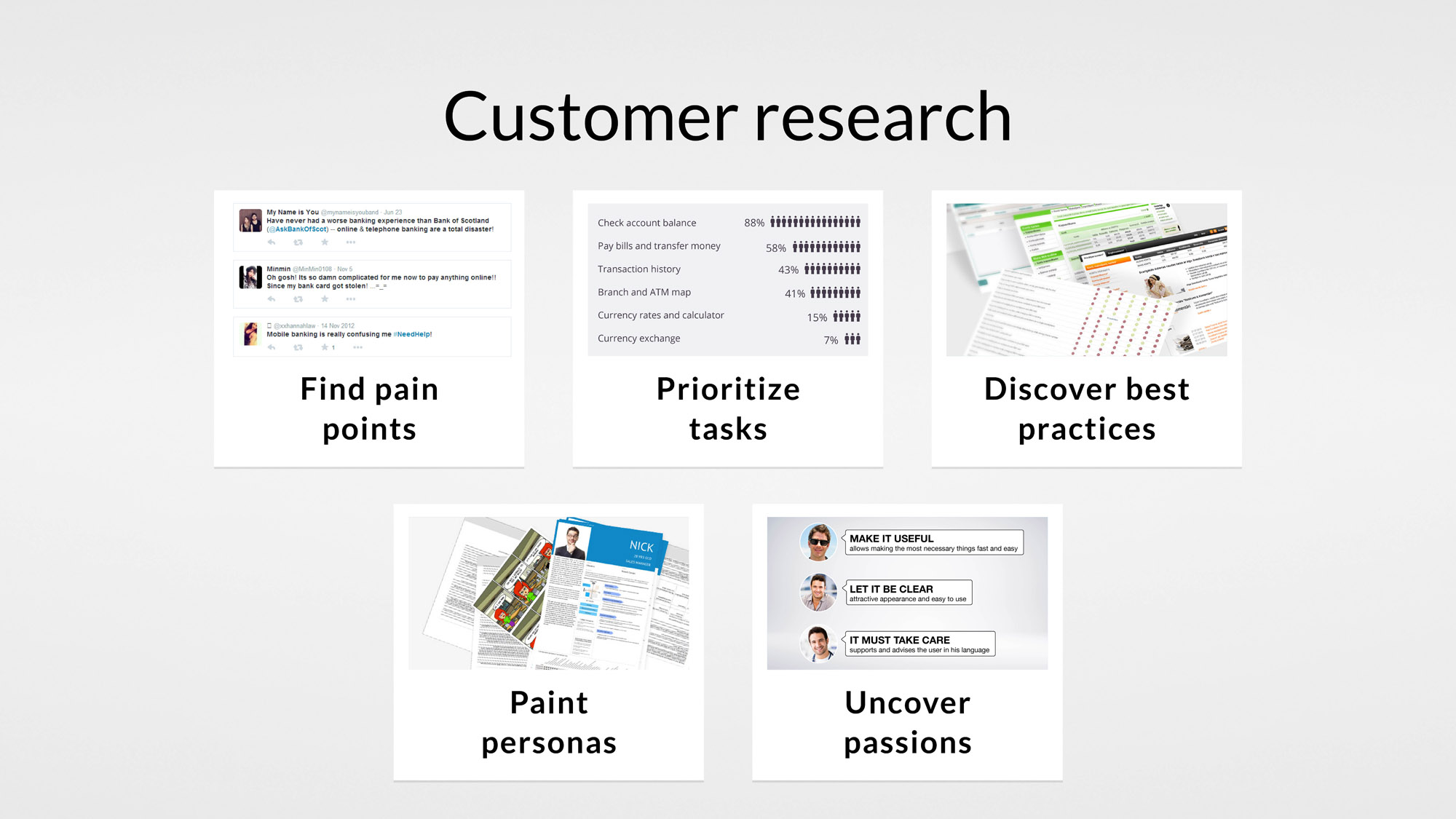

And now lets see few insights of how we handled it from our digital banking UX design case-study. We started from a research:

- We found user pain points, that pains them when using any online banking

- Prioritized their preferred tasks.

- Discovered worlds best practices

- Painted personal portrait of our end user

- Made interviews to Found their motivations.

And we put all of this in holistic step-by-step user journey Map. It gives perfect User Experience that our service delivers. And shapes the design we have developed.

Through Information Architecture, Wireframing and UI design we delivered simplicity and magic in our interface resulting in online banking innovation.

Focus on innovative experience

So let’s check out few features of innovative banking solution we have achieved in 2014.

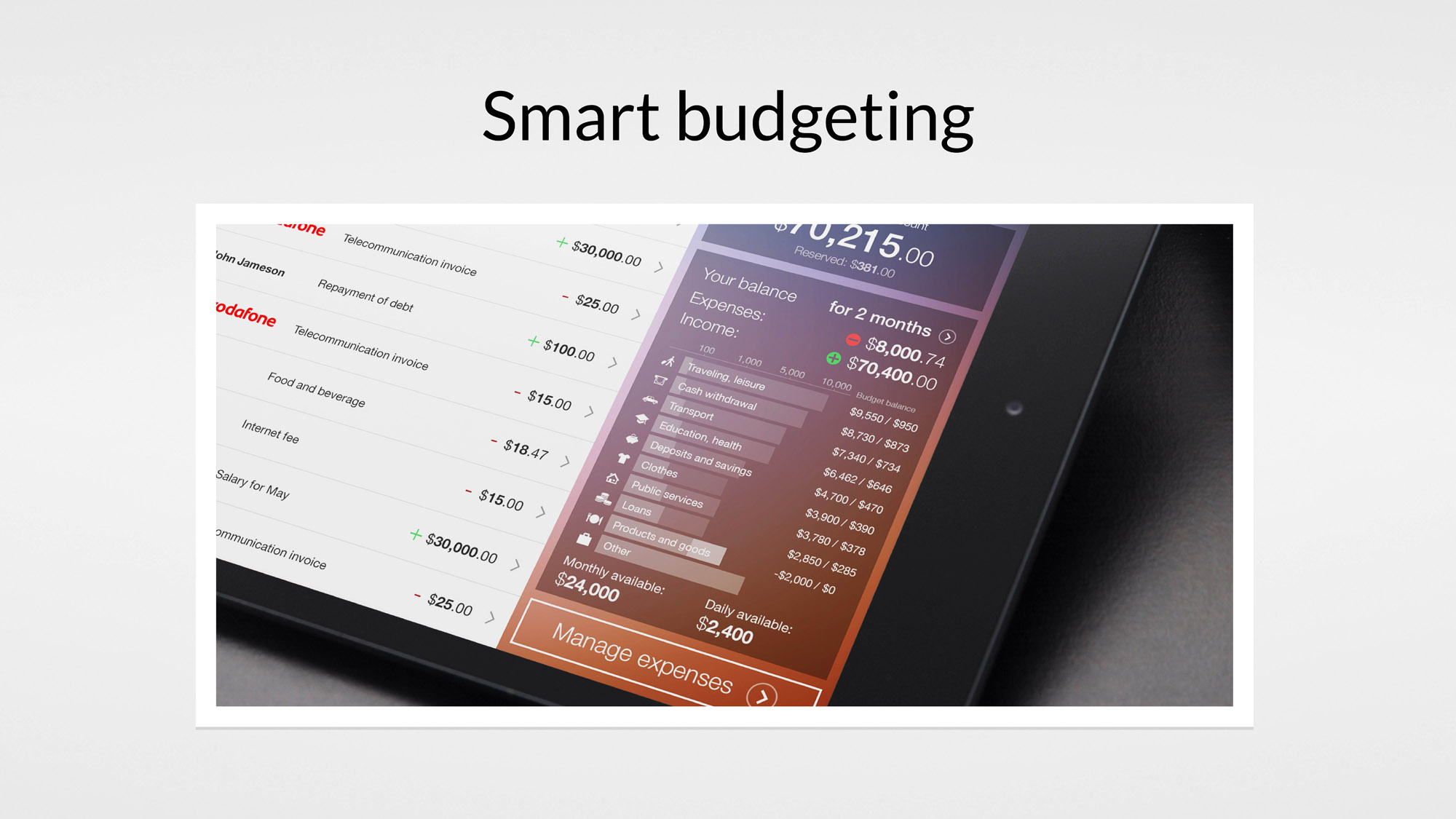

To simplify user’s finance management we have created smart budgeting, that shows day to day and month to month safe to spend sum on each spendings category.

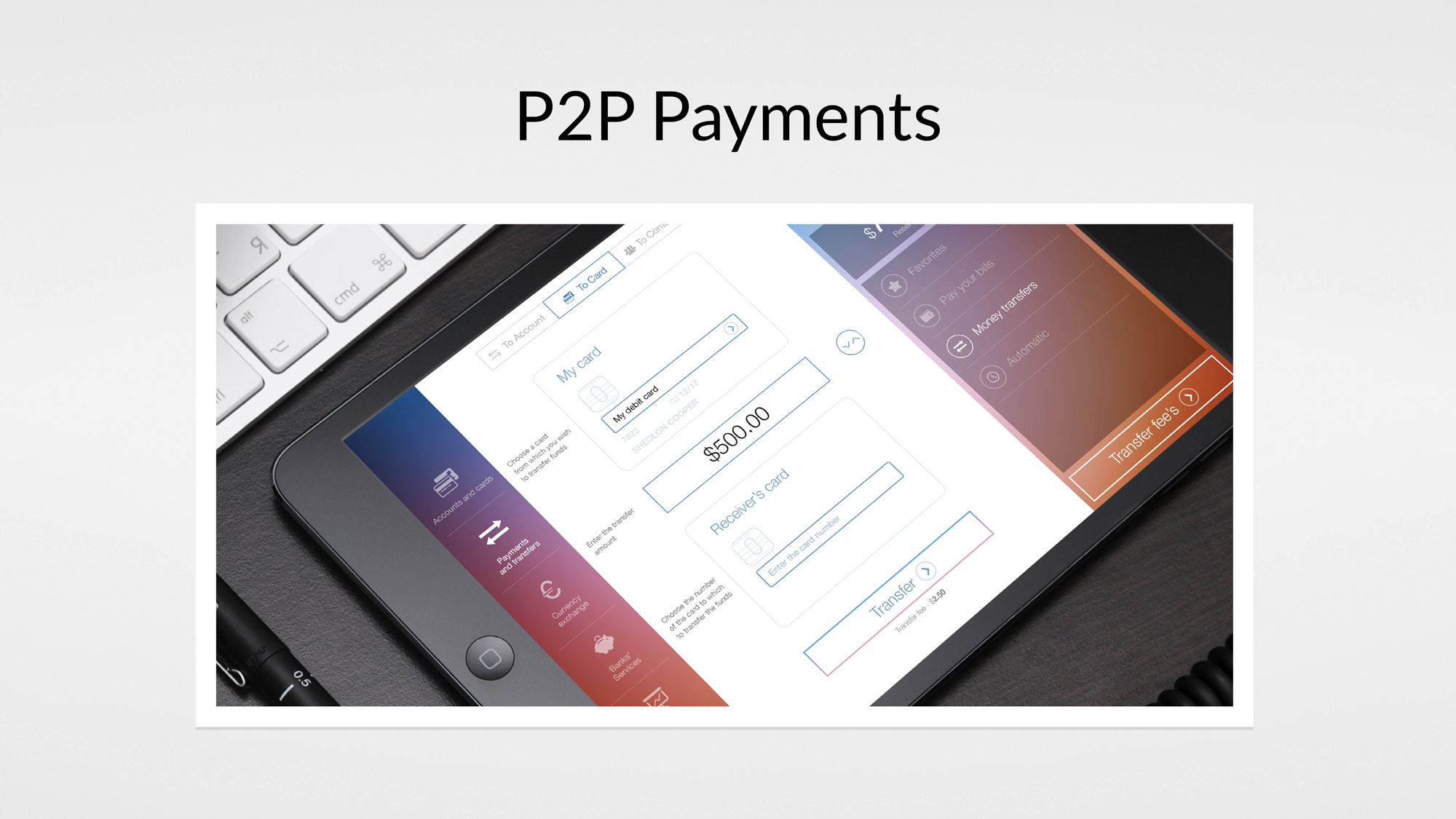

Another feature is person to person payments that offers to choose recipient from Facebook, Twitter or your contact list, even not knowing his payment details. Of Course if you know them, you can choose account to account transactions.

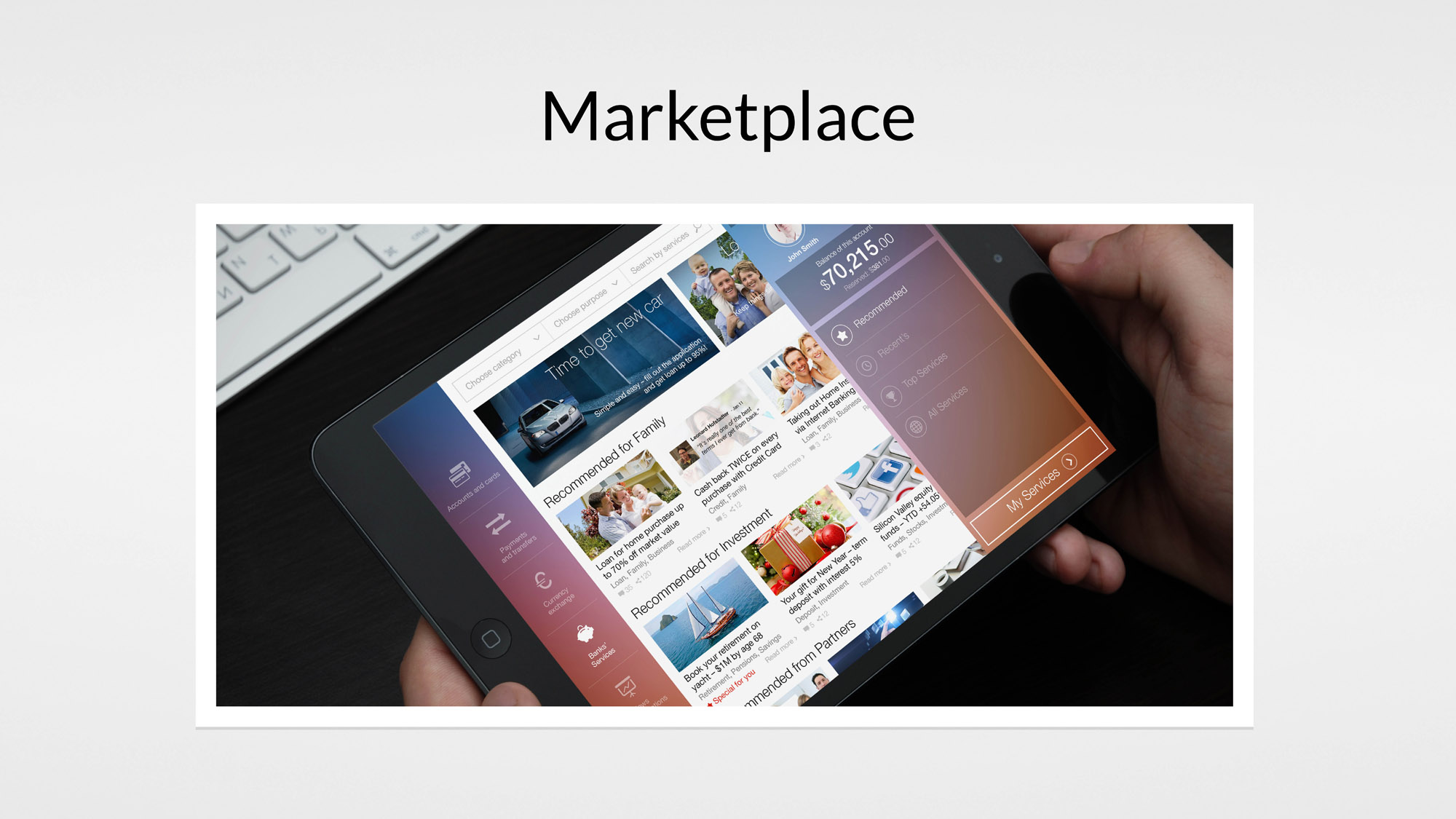

And last feature I want to mention is financial marketplace that actually transforms boring product list into highly engaging banking App Store. With attractive images, personal recommendations, testimonials and support from banking community. It provides financial experience in the modern way that we are already used to.

If you want to find more, check our full case-study. (updated in 2020 as VR / AR Banking Design Concept)

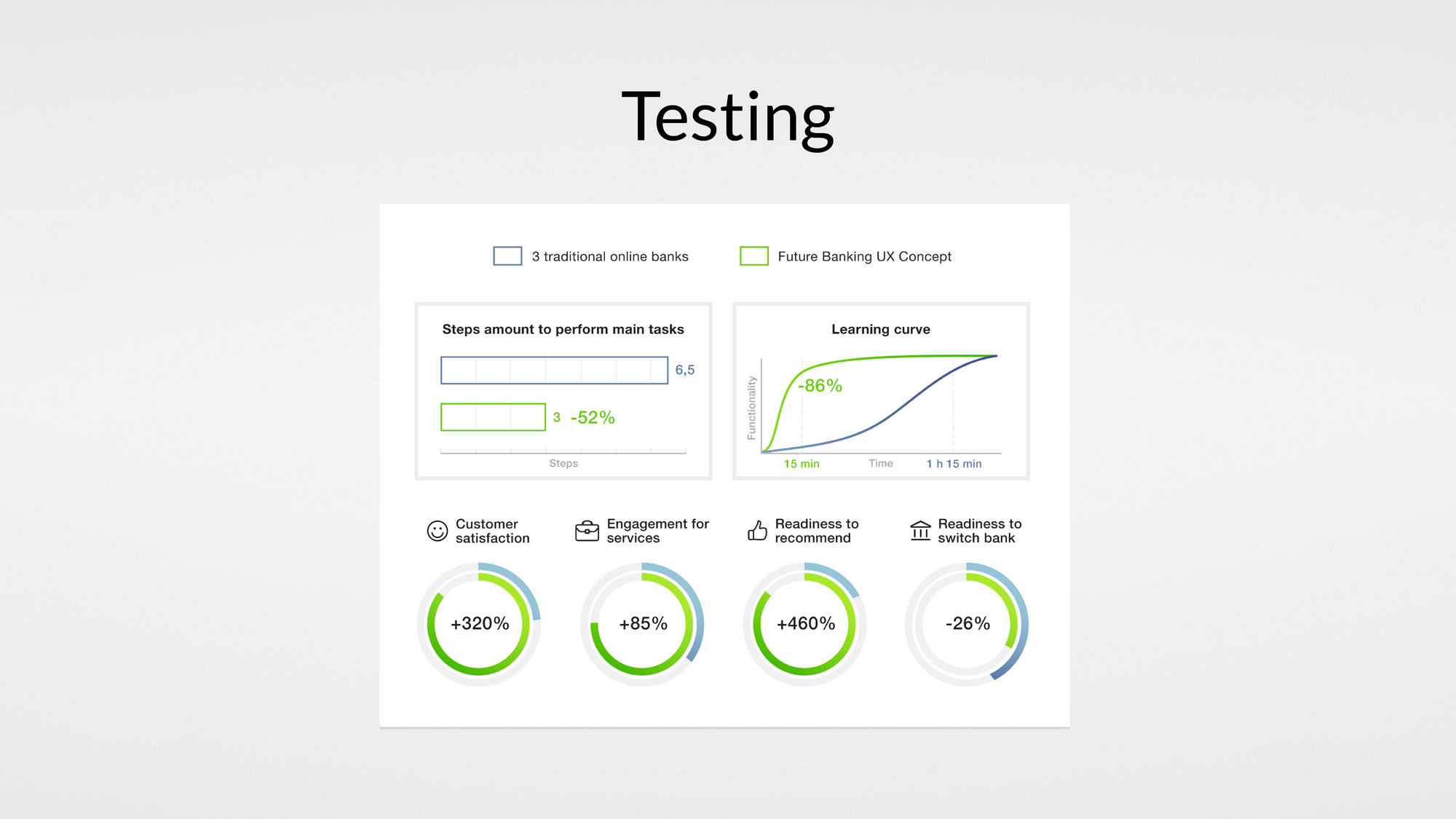

And in the end there is testing.

We have to prove our design theory in a field by showing prototypes to actual users. In our case we raised customer satisfaction by 320% and engagement by 85%. You can imagine what is all about in terms of revenue.

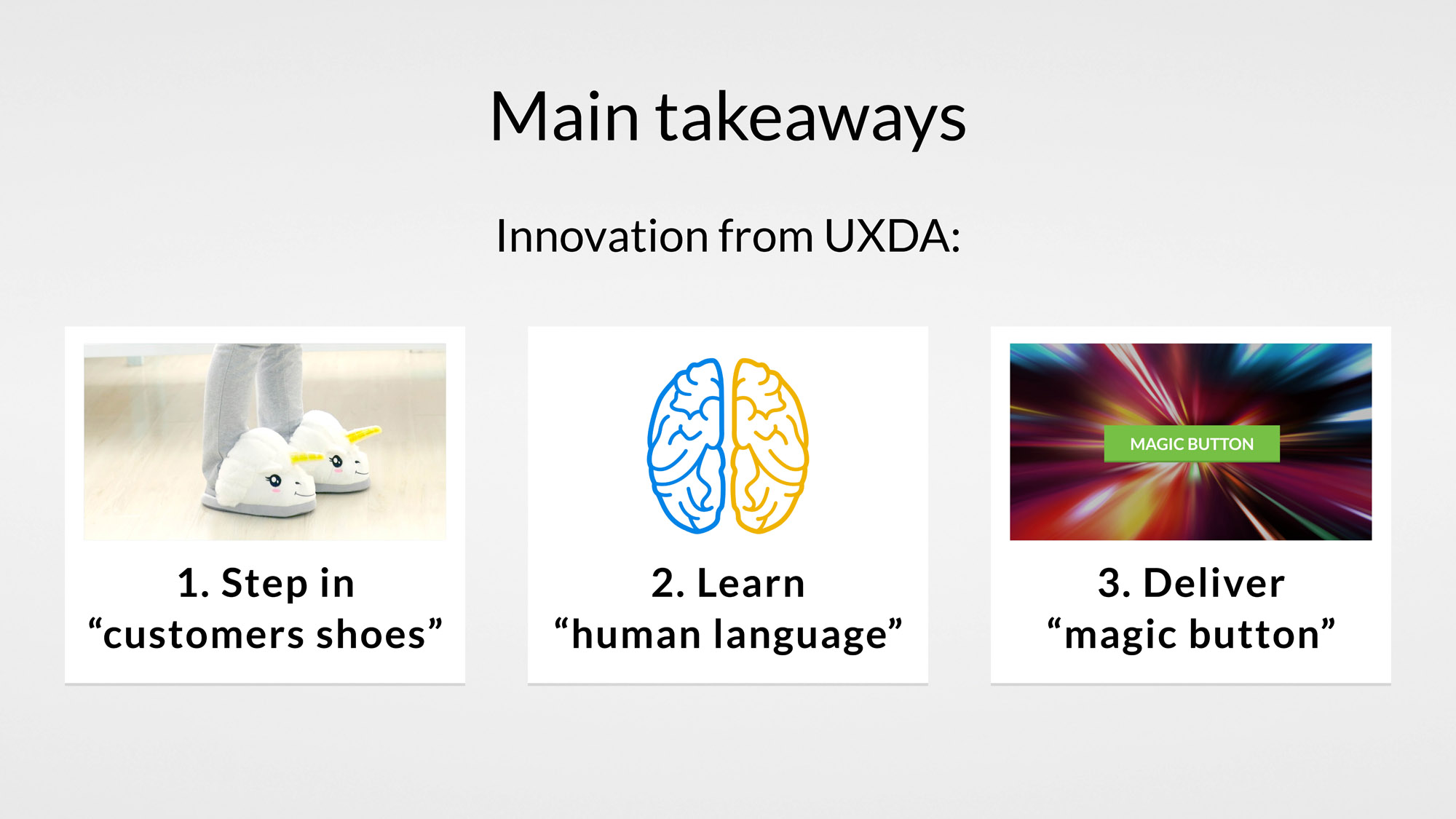

Main Takeaways

Digital bank innovation from UXDA | UX Design Agency is simple —

- jump in “customer shoes”,

- learn “customer language” and

- in result deliver “magic button” experience.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin