What is the banking industry and how is it affected by design?

The banking industry is defined by all the offline and online infrastructure that handles money (cash and cashless), credit, transfers and hundreds of other financial transactions or services.

Today, we all see global digital transformation in banking that digitizes the banking industry. Bank customers prefer to use mobile banking or desktop solutions and minimize their time visiting bank branches. Thousands of branches are closed, and millions of bankers will lose their jobs in the banking industry in the next decade.

The financial industry actively switches to digital products and is disrupted by Fintech solutions. The Fintech industry provides a modern service for banking customers based on the latest technology in the banking industry. Fintech uses User-Centered Design and a UX approach to deliver the best possible solutions for users worldwide.

The banking sector must integrate a design approach and user centricity deep into its operational and strategy model to compete with Fintech for the digital future.

Check out the best articles by UXDA about the banking industry and the power of design.

Future Banking Trends: Enable Next-Gen Financial UX

Future Banking Trends include technologies such as Generative AI, the metaverse, the blockchain, embedded banking, DeFi with CBDCs, and open banking which are creating the next-gen financial UX.

To Turn X into a Global Bank, Musk Must Overcome Critical UX Challenges

Knowing Elon Musk's large-scale approach, his intention to turn X into a bank could have disruptive consequences for the banking industry. However, the conflict between the existing UX patterns of a social network and the implementation of financial functions can complicate the transformation.

Banking Innovation: Next-Gen UX to Survive Industry Disruption

As the usage of physical cash diminishes and digital consumption skyrockets, traditional banks are undergoing a seismic shift to adapt to changing customer preferences. Digital transformation is reshaping industries and consumer behaviors, and the banking sector stands at a crossroads, poised to redefine our financial experiences in unprecedented ways.

CBDC Banking Could Disrupt Banks and “Steal” Their Funds in Three Years

The Central Bank Digital Currencies (CBDCs) could start a new age in banking by impacting the financial customer experience and, as a result, disrupting the traditional business model. Will this CBDC trend be a threat or bailout for the industry, and how can UX design help banks to prepare for it?

Key Thing for Successful Bank Digital Transformation

Why are 78% of companies failing to achieve their digitalization goals? The digital transformation in banking must consider one key thing to succeed.

UXDA Wins the Prestigious UX Design Award 2022

UXDA team's work has been awarded by the global design competition for excellent experiences - The UX Design Awards 2022.

Financial Services In The Metaverse: The Glue For A Creative Economy

The metaverse will become the next global milestone after the digital transformation in the next few decades.

Big Tech or Big Curse on the Banking Experience?

As part of global digitalization, Big Tech is using its power and resources to expand into the financial industry, but only a diversity of financial alternatives and healthy competition will ensure a customer-centric development in the financial industry.

Why Non-Purpose-Driven Banks Are Losing Customers

How can purpose-driven banking save banks from losing millions? The main challenge is how to align banking services and products with a human-centered purpose.

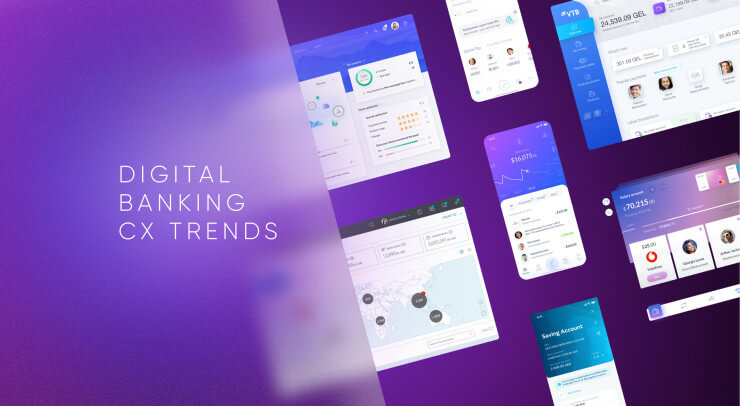

Digital Banking Customer Experience Trends for the Breakthrough

What is needed to achieve a breakthrough in the post-pandemic world? Here are 10 digital banking customer experience trends to find the right strategy.

Digital UX Design Trends: 10 Banking Innovation Ideas

The UXDA team has highlighted 10 design trends that demonstrate the evolution of digital financial products and the way financial interfaces are created and perceived by the users.

- 1

- 2