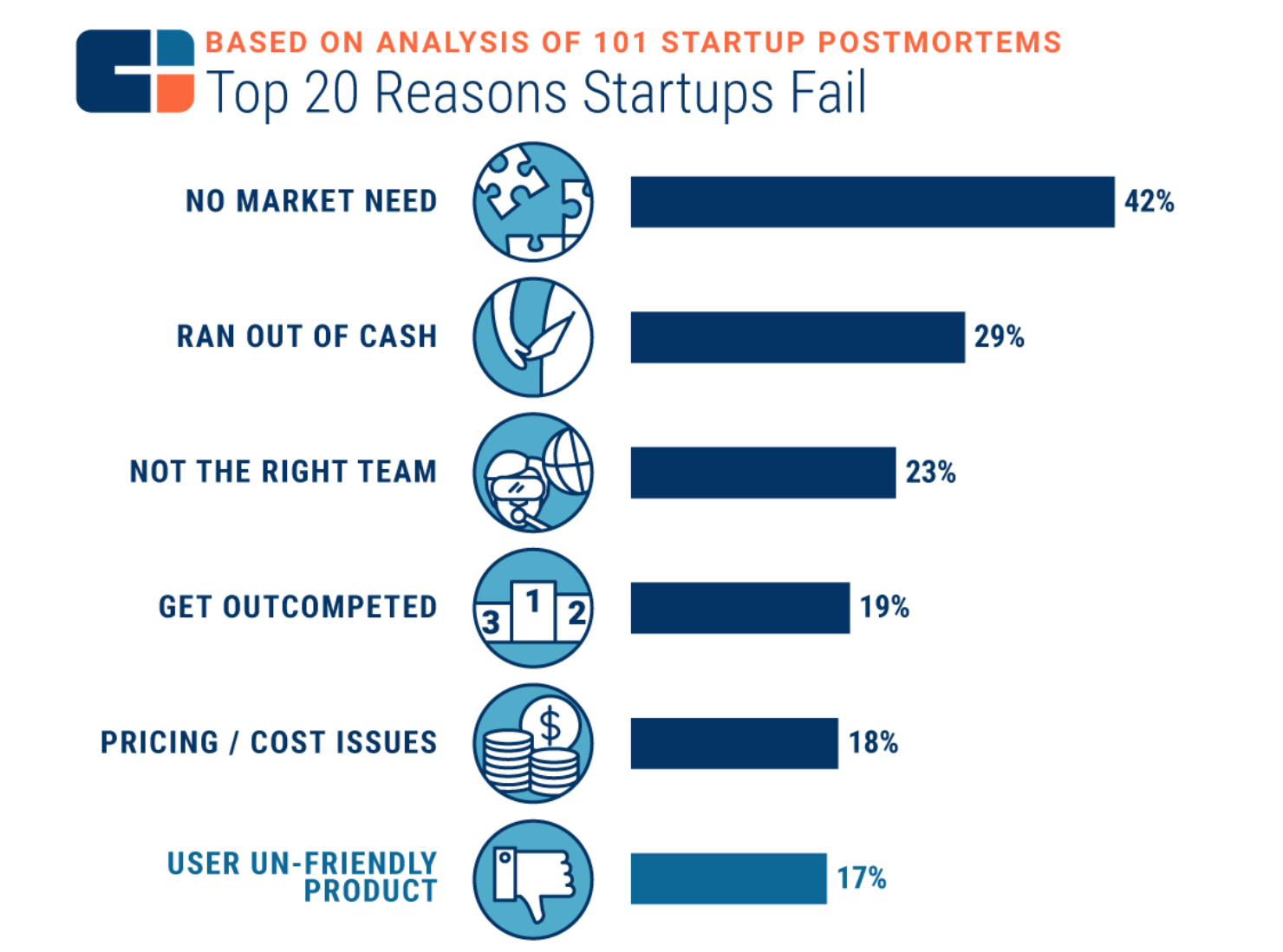

The pandemic fast-forwarded the finance industry several years ahead. Digital transformation in banking is rapidly impacted the financial industry. As a result, the way that financial companies design and deliver products and services to their customers is also changed. However, this is an incredibly difficult task. Аccording to a study by Everest group, as many as 78% of companies fail at their digitalization goals. How can digital experts make bank digital transformation successful? There is one key thing to consider. According to CB Insights research of 101 startup failure post-mortems, 42% failed because they lacked market need. It's not only about “inexperienced” startups, this happens even to the “best of us”. Google failed with Google+ and Google Wave, despite enormous marketing budgets and award-winning ads. We see the same happening in digital banking.

According to CB Insights research of 101 startup failure post-mortems, 42% failed because they lacked market need. It's not only about “inexperienced” startups, this happens even to the “best of us”. Google failed with Google+ and Google Wave, despite enormous marketing budgets and award-winning ads. We see the same happening in digital banking.

Listen to this article in audio format:

The rapid development of digital technology is making new demands on financial brands. Marketing methods that used to work perfectly only a decade ago, don't deliver the expected results anymore. There are so many alternatives available on the market that a pretty package and a catchy slogan aren't enough to convince people to buy and stay loyal to the brand and the product.

In the digital age, it's all about the emotional connection customers have with the financial brand that is formed through the value they get out of its digital financial solution. Making financial product and trying to convince everyone that they need this is a very expensive russian roulette with no guaranteed outcome. A much more reliable way would be to do it the other way around - first define and then match the market need with the exact solution that the customers seek.

Explore how to focus on customer needs

What is Bank Digital Transformation

To stay competitive and meet the evolving needs of customers during lockdowns, banks were turning to digital technologies to streamline processes, improve efficiency, and enhance the overall customer service. But as with any major change, designing and implementing a successful bank digital transformation can be a hard challenge.

Experts define bank digital transformation as the use of digital technologies to fundamentally change how financial companies operate and deliver services to customers. This can include a wide range of activities, such as automating processes, improving customer experience, increasing efficiency and productivity, and introducing new products and services. Some specific examples of digital transformation in banking may include:

- Mobile banking: Providing customers with the ability to access their bank accounts and perform transactions using a smartphone or tablet.

- Online banking: Allowing customers to access their accounts and perform transactions through a web browser.

- Robotic process automation (RPA): Using software bots to automate repetitive tasks, such as processing loan applications or handling customer inquiries.

- Artificial intelligence (AI) and machine learning (ML): Using advanced algorithms to analyze data and make decisions, such as detecting fraudulent activity or personalizing financial recommendations for customers.

- Blockchain and distributed ledger technology (DLT): Using decentralized, secure databases to facilitate transactions and track assets.

- Cloud computing: Storing data and running applications in the cloud, rather than on local servers, to reduce costs and improve scalability.

Bank digital transformation aims to improve the effectiveness of financial institutions, providing convenient ways for customers to access and manage their finances. There are several areas in which bank digital transformation is having a significant impact:

1. Convenient customer service

Digital transformation improves the customer service by providing convenient, personalized, and seamless access to financial operations through digital products.

2. Operations and efficiency

Process automation and artificial intelligence are helping banks to improve operations and reduce errors, resulting in increased efficiency and productivity.

3. Product and service innovation

Bank digital transformation delivers new products and services, such as personalized financial planning, real-time fraud detection, and virtual financial advisors.

4. Risk management and compliance

Machine learning and blockchain are helping to improve risk management and compliance.

5. Data and analytics

Analyze vast amounts of data using advanced algorithms to gain insights and make more informed decisions.

Explore digital banking trends of 2023

Main Challenges of Bank Digital transformation

Here's the paradox: everybody knows that digital transformation is a must to succeed in the digital world. At the same time, not many are aware that digitalization itself isn't enough to guarantee success. This is the reason why so many banking digital transformation attempts end up in failure and huge losses of invested time and money resources. In fact, studies show that "70 percent of complex, large-scale change programs don’t reach their stated goals" according to McKinsey.

Meanwhile, digital “unicorns” clearly demonstrate that, in the digital world, success is empowered not by new technology implementation, but by the right mindset and inner culture.

The fact that a bank creates a mobile application doesn't guarantee successful digitalization. As an example, a bank launched a mobile application with the intention to keep up with the requirements of the digital age. To open an account, customers had to visit the branch and wait in line for about an hour. The same effort was needed to add additional users to the account, transfer large amounts and apply for a loan. In the end, there was really no use for this mobile channel as the customers had to waste their time physically visiting the branch.

Yes, the bank had created a mobile app, but can we really call this a successful digital transformation? I doubt that.

Banks have to face the harsh reality of the digital age: if they don't focus on customers and their expectations, they will lose their clients to financial companies that have customer-centricity set as their TOP priority.

There are many challenges that banks face when implementing digital transformation initiatives:

1. Cultural resistance

Employees may resist the digital change to processes, particularly if they are accustomed to traditional ways of working. Digital transformation requires a shift in corporate culture and mindset, with a focus on customer-centricity, continuous learning and adaptability. Financial organizations should have a clear strategy and roadmap for managing the transition to new digital processes and technologies.

2. Talent shortages

Digital transformation should involve the introduction of new products and services, but can be difficult for banks and other financial organizations to find and hire skilled employees with expertise in digital user experience design and in digital technologies such as artificial intelligence (AI), machine learning (ML), and cloud computing.

3. Data security and privacy

Ensuring the security and privacy of customer data is a critical concern for banks, particularly when implementing new digital technologies. Banks should leverage data and analytics to gain insights and make more informed decisions, using technologies such as artificial intelligence (AI) and machine learning (ML).

4. Regulatory compliance

Banks must ensure that they comply with various regulations and laws related to data privacy and financial services, which can be challenging as they adopt new technologies.

5. Integration and interoperability

Ensuring that core systems and technologies work seamlessly together can be a complex and time-consuming process. Also, digital transformation often requires collaboration and partnerships with other companies, including fintechs, to leverage their expertise and bring new solutions to market.

6. Cost and ROI

Implementing digital transformation initiatives can be expensive, and it may be difficult for financial companies executives to justify the investment if the return on investment (ROI) is uncertain.

7. Change management

Managing the transition to new digital processes and technologies can be challenging, particularly if it requires significant changes to how employees work and interact with customers. Successfully implementing digital transformation in banking requires digital strategy, careful planning, clear goals, and the ability to adapt to changing technologies and customer needs.

How to establish customer-centric culture

The Key to Bank Digital Transformation Success

Unfortunately, when it comes to digitalization many finance companies still make the same mistake - they put all of their main efforts into creating a product and thinking about the benefits it should provide to their business, instead of focusing on the value for the users.

So, if the focus on technology and product alone leads to failure in bank digital transformation, then what's the key thing to success? The answer is simple:

Successful bank digital transformation means improving the customer experience by applying the possibilities of modern digital technology.

And this is what ChatGPT AI told us when we asked it about one key thing for the bank digital transformation:

So one key thing that should be considered in the bank digital transformation to avoid failure is the customer experience. Banks need to ensure that their digital services are easy to use, secure, and provide value to their customers. Of course, additionally, they must take into account regulatory compliance, data privacy, and security issues when implementing new digital technologies.

After all, customers are the ones deciding product's success. What if they don't care about all of the features and technological advancements of your financial product?

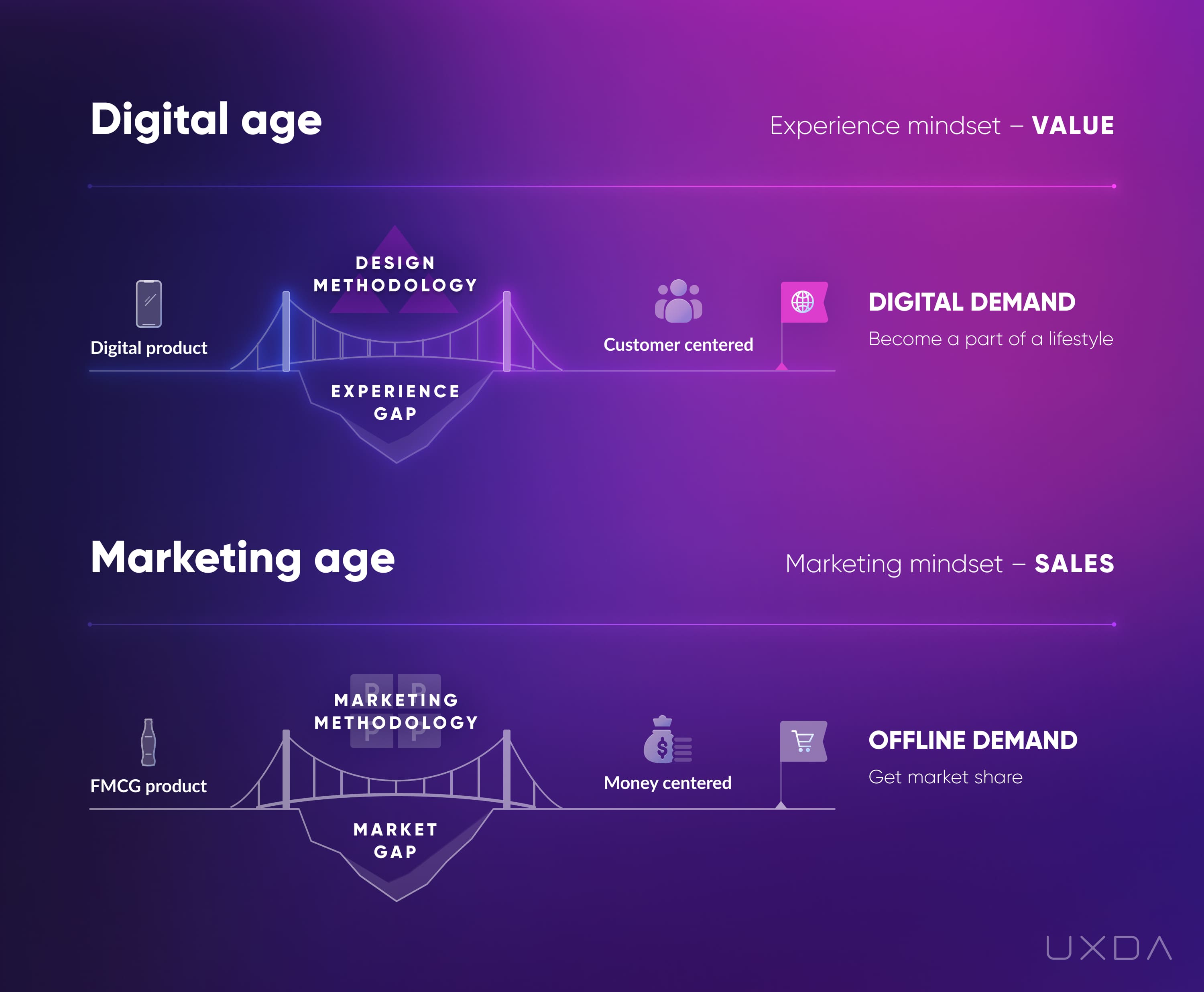

In the previous Industrial age, the gap between the FMCG brands (fast-moving consumer goods) and the sales was about lack of market distribution and promotion. Times have changed and for digital products, this is not the largest issue anymore. In the digital age, it's possible to reach almost anyone, with small or even without any marketing budget, using social networks, blogs and SEO (search engine optimization). The main gap today is - can you provide something the customers actually need? A product that would solve people’s problems and make their lives easier?

In the digital age, it's possible to reach almost anyone, with small or even without any marketing budget, using social networks, blogs and SEO (search engine optimization). The main gap today is - can you provide something the customers actually need? A product that would solve people’s problems and make their lives easier?

Those who can reply with a confident “yes” will be able to succeed even without huge marketing budget. That's because in the digital age you can bridge the gap between your financial app and the customers only by providing an exceptional customer experience in banking. Huge advertising budget, nor nice packaging won't help here.

A user-centered mobile banking app that's based on the customer wants, needs, and expectations will always be able to market itself without almost any marketing budget.

For example, we can probably all name some local restaurant that offers unforgettable experiences to its customers and creates a ton of positive emotions. After visiting, everyone tells their friends about it, post about it on Instagram, and it's not long before it's almost impossible to book a table because it has become SO popular. And it's not thanks to intensive advertisements but the word of mouth because people were so happy and satisfied with it.

It is no miracle, anyone can integrate this into their own financial business, whether it's a huge bank or a tiny fintech startup. All it takes is a true dedication to satisfy customers in the best way possible by creating an unforgettable digital banking customer experience.

To demonstrate the mismatch between what the customer expects in the digital age and what the financial companies or banks provide, we might ask: how many users would Instagram, Facebook, Twitter or TikTok have if people had to visit their headquarters and spend hours opening an account? Seems quite absurd, right?

Sadly, in the banking industry, it's often a common practice. The marketing department showcases glossy online and mobile banking solutions that might have an attractive interface, and they think this is enough to convince the shareholders that company will have a successful digital transformation.

Banks have to understand that the customers won't buy it. In the short term, these “digital” products might attract the attention of users because of their appealing visual transformation, but, in the long term, we can't call this a successful digital transformation as the number of customers for this bank will gradually decrease. Users will be disappointed by the experience this product provides and choose other alternatives on the market that can deliver up to their needs and wants. There are plenty of examples of this on social networks where people are posting about their horrible experiences with digital financial products.

I believe that this is due to the fact that often the approach to digital transformation is too superficial. Digital technology and innovation itself is not enough to ensure customer satisfaction. Digital transformation is all about transforming the experience to one that fits digital customer expectations. This requires a shift of the transformation process objectives and the evaluation metrics across all service ecosystem. That's why we should focus on experience transformation instead to ensure successful digital transformation in banking.

How to improve your banking customer experience

Creating Products Reversely

In the case of experience transformation, it is important to understand exactly what the customers need and how the bank can deliver the best value to them. Financial companies need to provide such a service that would make the customers feel cared for so that they would be eager to share this experience with their peers.

Here, I'd like to share example from UXDA experience. We created a UX transformation for a 15-year old core-banking solution that was aimed at improving the experience of bank employees and leveraging service quality as a result. This became a revolutionary switch from table-formed, outdated, boring back-office to a modern, clear and intuitive solution with elements of gamification and emotional design. The result surprised everyone: the learning curve of banking employees reduced from several months to only a few hours. Also, the potential for human error decreased significantly. All of this ensured an amazing acceleration in service speed, employee productivity and, of course, resulted in increased customer satisfaction.

This example demonstrates quite clearly that digital transformation in banking could be driven by a sharp focus on customers’ requirements and desires. In the digital economy, understanding customer perception, needs and expectations, and turning that into a delightful experience, is the key to creating successful digital products. In this case, we perceive digital technology as a tool that allows the realization of product value.

I mean financial companies should not primarly focus on creating a selling package for a product as usual, but on turning the product into a value that sells itself.

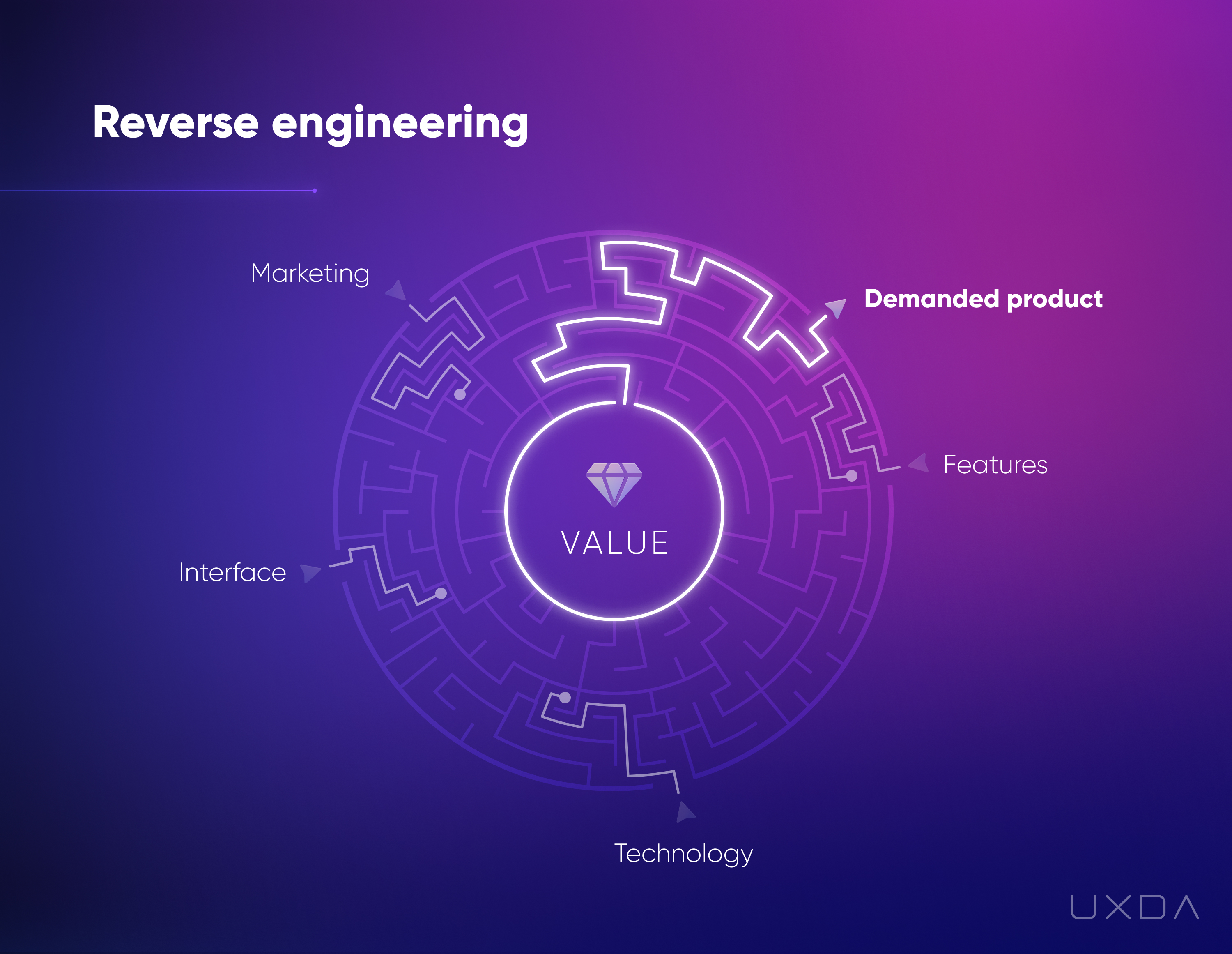

The secret of creating such a user-centered product is to base it on the solution demanded by customers, not only the market segmentation and competitive strategy.

This means, using reverse engineering - a top-down approach that starts with customer research to define the ultimate value for them and proceeds with an action plan of how to execute it in your digital banking strategy. As Steve Jobs said, you've got to start with the customer experience and work back toward the technology - not the other way around.

The important strategy to making bank digital transformation successful is a multi-faceted customer-centered approach that includes:

1. Customer experience design

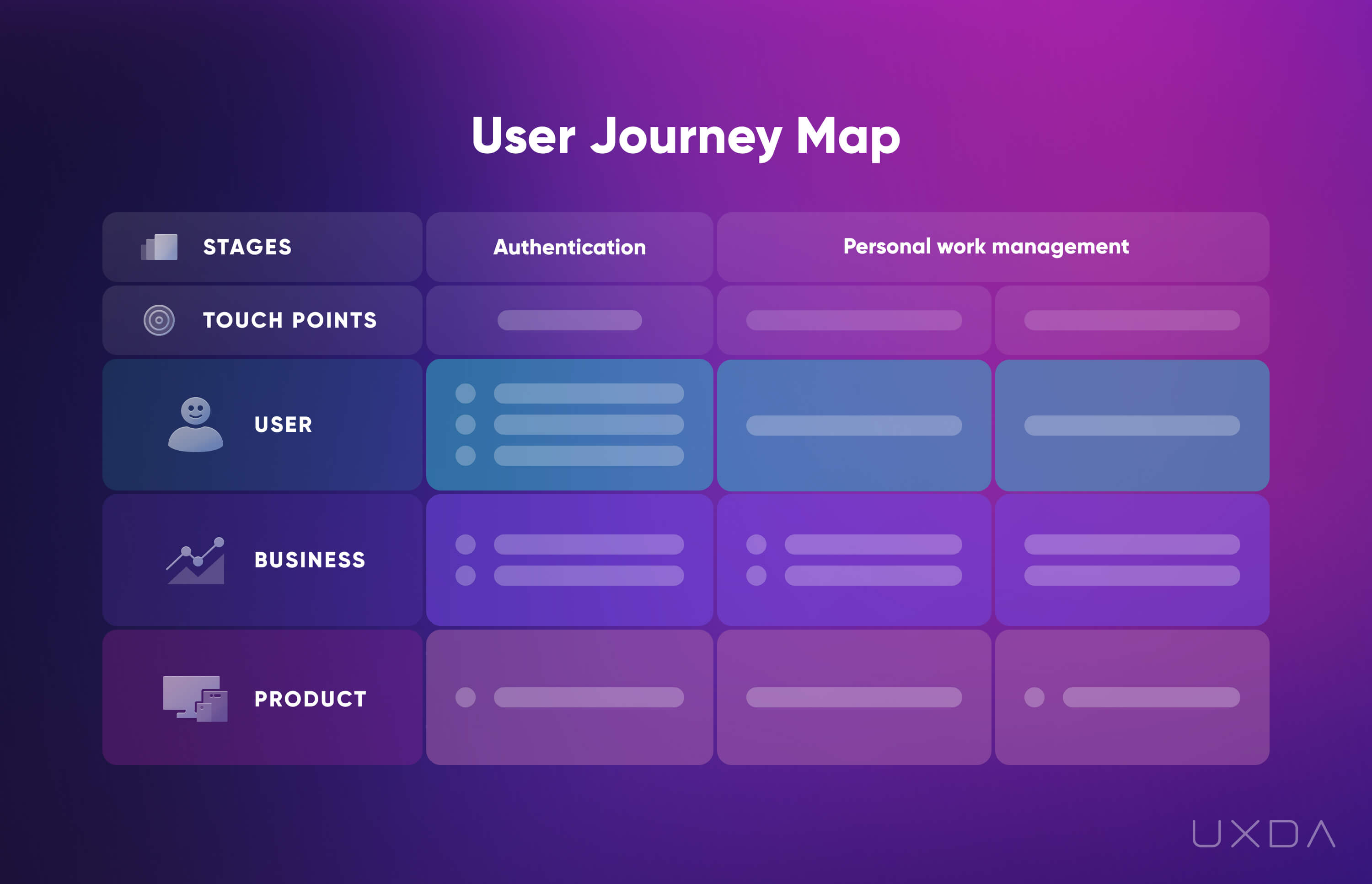

Focusing on the customer and their needs is crucial to making digital transformation a success. Digital transformation offers an opportunity for banks to create personalized, seamless, and frictionless customer experiences. Banks need to invest in UX design and customer journey mapping to ensure a deep understanding of customer preferences, behaviors, and pain points, and then designing digital products and services that meet those needs.

2. Agile and innovative culture

Banks need to create a culture that fosters experimentation, risk-taking, and innovation. This means breaking down silos and empowering teams to collaborate, test new ideas, and iterate quickly.

3. Data-driven decision making

Data is the lifeblood of digital transformation. Banks need to invest in robust data management capabilities, including data analytics, to capture, analyze, and act on customer data in real-time.

4. Technology infrastructure

Banks need to build or upgrade their technology infrastructure to support digital transformation. This includes investing in cloud computing, APIs, mobile applications, and other digital technologies that enable banks to deliver products and services to customers in a fast, efficient, and seamless manner.

5. Talent management

Banks need to attract and retain talent with the skills and experience needed to drive digital transformation. This includes hiring data scientists, software developers, UX designers, and other professionals who can help banks innovate and create new digital products and services.

6. Partnership ecosystem

Partnering with fintechs, startups, and other technology companies can help banks accelerate digital transformation. Banks can leverage the expertise of these partners to develop new products and services, test new business models, and drive innovation.

7. Regulatory compliance

Banks must ensure that their digital products and services comply with relevant regulations, such as data privacy laws, anti-money laundering regulations and standards. Banks need to invest in technologies and processes that enable them to monitor and manage compliance risks in real-time.

8. Change management

Digital transformation requires a significant shift in mindset and culture, which can be challenging for many organizations. Banks need to invest in change management strategies that enable them to communicate the benefits of customer-centered digital transformation to employees, manage resistance to change, and support the adoption of new digital tools and processes.

9. Metrics and measurement

Banks need to establish clear metrics and KPIs to track the progress and impact of digital transformation initiatives. This includes tracking customer adoption rates, engagement levels, revenue growth, cost savings, and other key metrics that demonstrate the value of digital transformation to the business. Banks should also regularly review and adjust their digital transformation strategies based on data-driven insights and feedback from customers and employees.

10. Cybersecurity and risk management

Bank digital transformation introduces new risks and vulnerabilities, including cyber threats and data breaches. Banks need to invest in robust cybersecurity and risk management frameworks that protect customer data and prevent unauthorized access especially across open banking APIs. This requires regular security assessments, training for employees, and investments in technologies such as AI and machine learning to detect and respond to cyber threats in real-time. By prioritizing cybersecurity and risk management, banks can build trust with customers and protect their reputation in the market.

Value-driven reverse engineering approach reduces the uncertainty of whether there will be a demand for the product even before it’s launched.

Find out how purpose-driven FIs create exceptional products

Fuel Bank Digital Transformation With Great Product Design

As the banking industry continues to evolve and embrace digital technologies, product design has become a crucial element in driving successful digital transformation. By designing digital products that meet the evolving needs and preferences of customers, banks can drive innovation, improve efficiency, and enhance the overall customer experience.

Effective product design in the digital age requires a deep understanding of customer needs and behaviors, as well as a keen sense of what differentiates your product in the market. It also requires a focus on usability and user experience, as well as a clear understanding of how your product fits into the larger ecosystem of your business.

As a fully digital company, we maintain the highest quality of services for all of our clients, totally remotely, regardless of the external circumstances. We use this 7 steps process to design digital products to implement desired digital strategy and ensure successful bank digital transformation.

The seven stages of the Financial UX Design Methodology by UXDA

The seven stages of the Financial UX Design Methodology by UXDA

1. Step: Make Sure Your Team Has a United Vision

Together with the team, explore your business model and discover the unique value of your financial product. Make sure that you are all on the same page about why you are creating this product and what its future perspective entails.

If this step is ignored, the possibility of such risks grows critically:

- Disagreements among stakeholders and team members

- Unclear goals and expectations that lead to conflicts and slow down the overall process

- Chaotic, ineffective action plan

Action plan:

- Conduct a stakeholders’ interview prepared and led by an experienced UX architect

- Create a product audit and research

- Conduct thorough research on your competitors

Source: User story mapping, Jeff Patton

Source: User story mapping, Jeff Patton

2. Step: Define the Expectations of Your Product's Users

Study the psychology, expectations, needs and pain points of your end users and define a clear context for your product, ensuring it will be loved and demanded.

If this step is ignored, the possibility of such risks grows critically:

- Customers being disappointed with your product

- Negative reviews on social media

- Low product ratings in the App Store and Google Play

- Losing customers to competitors

Action plan:

- Define the key user personas

- Create empathy maps for each of the user personas

- Define the Jobs-To-Be-Done (JTBD)

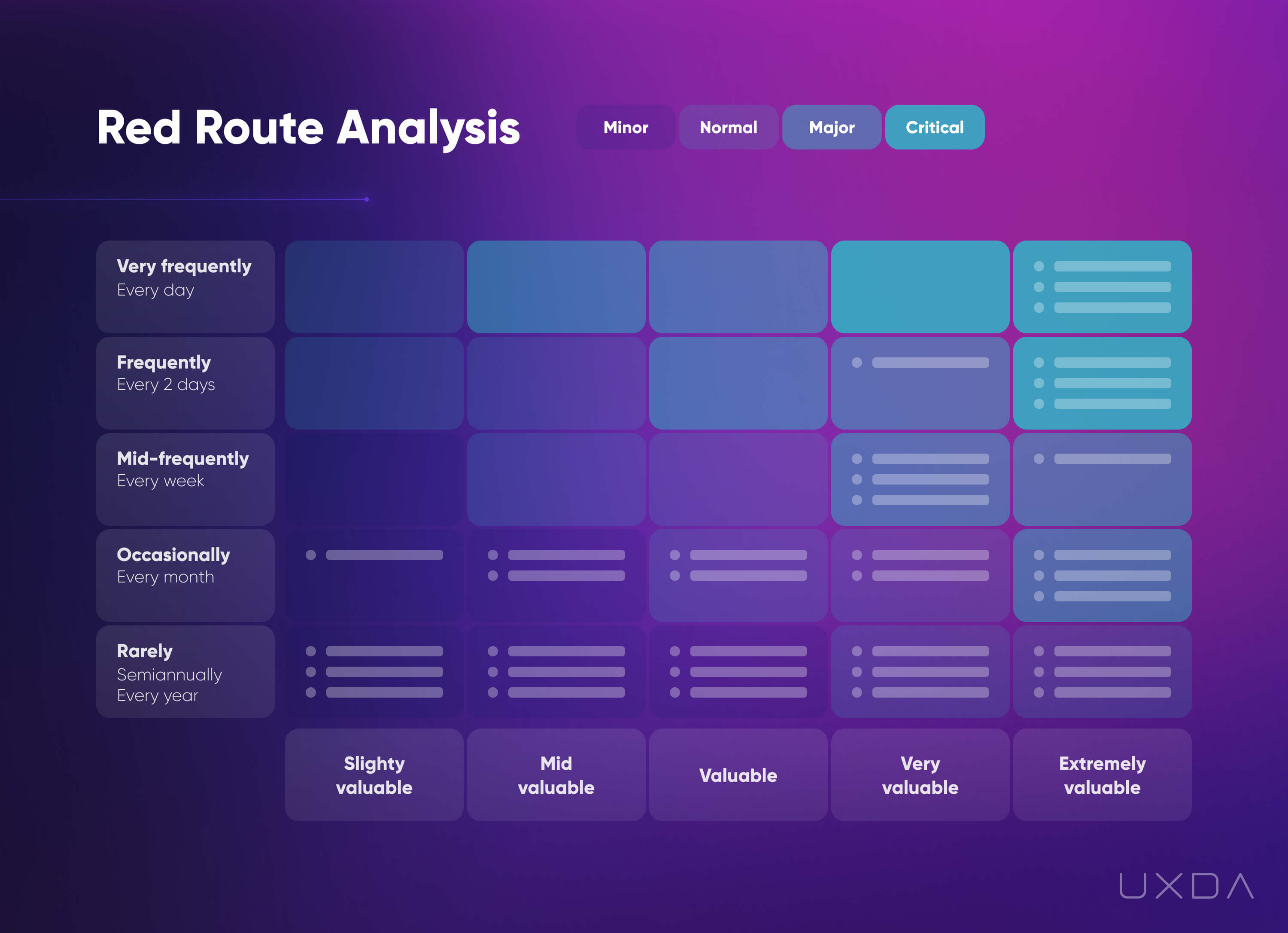

- Conduct a Red Route analysis (see graphic below)

3. Step: Create a Match Between Your Financial Product and the Users

Engineer the ultimate experience of your financial product by focusing 100% on the users. Make their goals as effortless and easy to achieve as possible.

If this step is ignored, the possibility of such risks grows critically:

- Struggle due to the complexity of the product

- Difficulties that take extra time and effort

- Ignored or sabotaged business goals

Action plan:

- Map a user journey with a BUP holistic frame

- Engineer information architecture

- Create user flows

- Make banking wireframes

- Conduct user testing

4. Step: Create a Visual Identity of Your Financial Product That WOWs

Form a visual identity of your digital product based on the unique goals of your business, the essence of the brand and the character of its users. In this way, you form an emotional bond between your product and the customers.

If this step is ignored, the possibility of such risks grows critically:

- Being outdated and boring

- Not differentiating yourself from your competitors

- A product that doesn’t match brand values

Action plan:

- Conduct design research

- Generate a Design Mood Board

- Create the Key Concept

Read more about the process of creating an award-winning visual identity in the Bank of Jordan Mobile Banking UX Case study.

Read more about the process of creating an award-winning visual identity in the Bank of Jordan Mobile Banking UX Case study.

5. Step: Craft a Full Visual Prototype

Demonstrate the experience of your product before it's even launched. Envision interactions in motion and prepare omnichannel clickable screens, so your product is fully ready for testing in the hands of real users.

If this step is ignored, the possibility of such risks grows critically:

- Developmental struggles

- Faulty estimations

- Bad usability and lack of demand

Action plan:

- Craft an omnichannel UI design

- Provide a click-through UI prototype

- Deliver a cutting-edge motion design

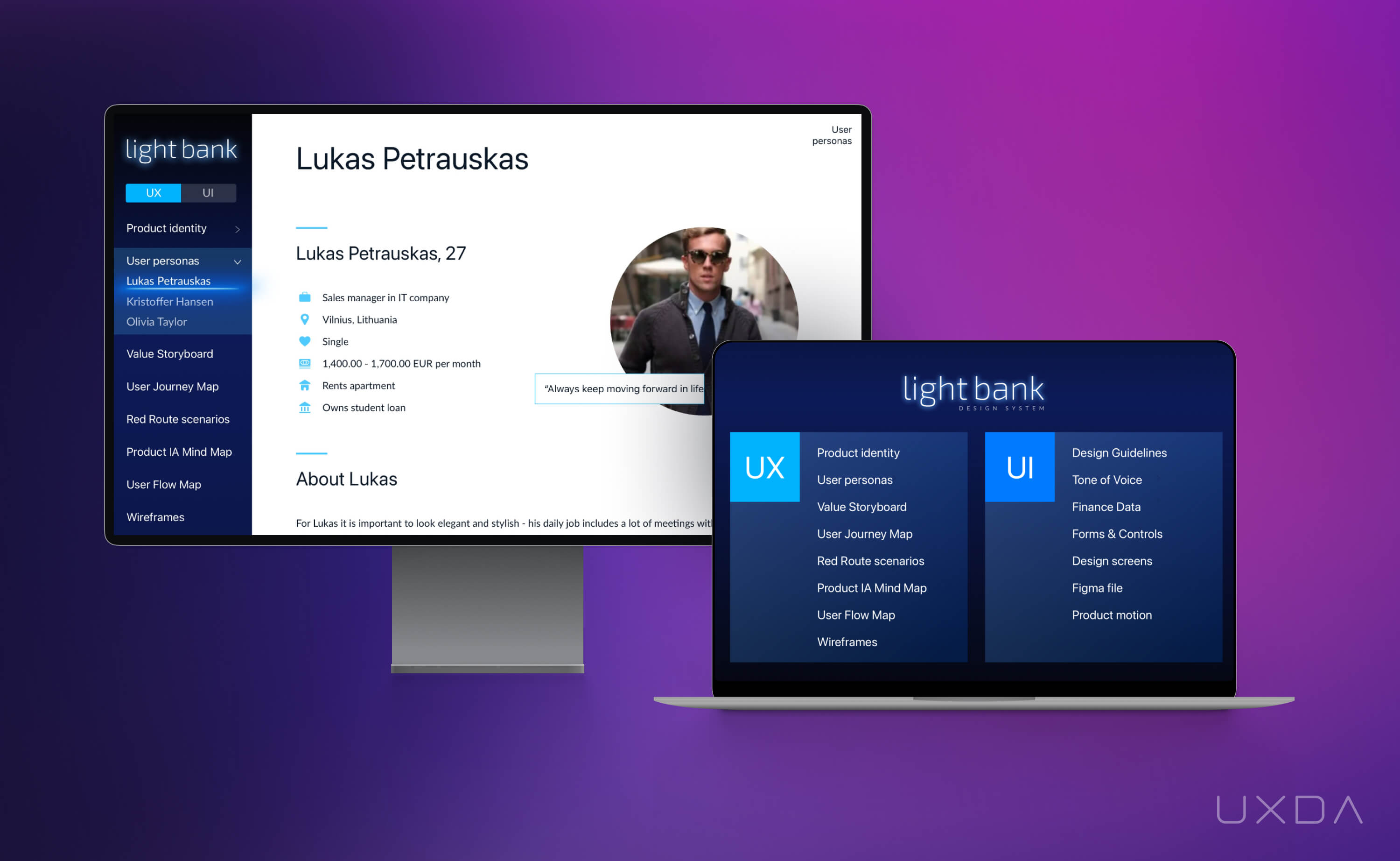

6. Step: Make Sure to Have a Systematic UX Implementation

Create a UX design guide for your product that ensures a quick and effective handover of the UX and UI deliverables to your developers so that they can start working on it immediately. All deliverables and elements compiled in a design system book allow everyone to be on the same page and develop the product further with ease.

If this step is ignored, the possibility of such risks grows critically:

- Slowed developmental process

- Inconsistency of flows, modules and channels

- Miscommunication among the team

Action plan:

- Create the UX/UI design system

- Form a motion design system

- Prepare design documentation

Read more about the possibilities and the importance of a Design System in the Light Bank UX Case Study.

Read more about the possibilities and the importance of a Design System in the Light Bank UX Case Study.

7. Step: Ensure a UX Guidance Throughout the Development Process

UX design support and development supervision allows your team to go full speed in delivering a top-notch product to your customers and avoids any mistakes in UX implementation.

If this step is ignored, the possibility of such risks grows critically:

- Design implementation errors

- User frustration caused by the end product

- Lack of user-centricity on the development team

Action plan:

- Organize UX consulting and support for the development

- Supervise the development work

- Implement UX design improvements based on user feedback

There are several principles that banks can follow to ensure the best customer experience through digital products. These principles can help banks to deliver a high-quality customer experience through digital products and enhance customer satisfaction and loyalty:

- Convenience: Digital products should be easy for customers to use and access, with a user-friendly interface and intuitive navigation.

- Personalization: Digital products should be tailored to the individual needs and preferences of customers, with the ability to provide personalized recommendations and advice.

- Security: Digital products should prioritize the security and privacy of customer data, with robust protection against fraud and data breaches.

- Transparency: Digital products should be transparent about fees and charges, as well as any limitations or restrictions that may apply.

- Responsiveness: Digital products should be responsive to customer inquiries and needs, with timely and helpful support and assistance.

- Integration: Digital products should be integrated with other systems and technologies, such as mobile apps and online banking portals, to provide a seamless experience for customers.

- Accessibility: Digital products and environments should be usable and friendly for people with a wide range of abilities and disabilities.

Products Ecosystem Is Your Leverage for Bank Digital Transformation

Bank digital transformation is driven by the need to improve the customer experience and remain competitive in an increasingly digital market. Effective execution of all of these seven stages will allow you to create customer-centered products that build digital products ecosystem to ensure the best possible customer experience across all customer journey.

I believe experience is the key in the digital age, and the future of the banking industry depends on it. Customers in the digital age expect nothing less from their banks than to be ethical, responsible, honest and caring toward their clients, striving to satisfy their needs.

Ensuring such an attitude not just on the surface level, with marketing campaigns or posters on the walls, but doing so at the core, which is the only way for banks to ensure their survival. This is especially true in times when the finance industry is disrupted by open banking data transparency, sharing economy, increasing global competition, blockchain impact on intermediaries, reducing market barriers and transforming consumer values.

At the end of the day, the “jury” to evaluate the results of your digital transformation efforts will be the customers, not the shareholders, business owners, board or other executives. The customers will “vote” by how regularly they use your digital solution and the number of transactions made. So, don’t try to fool them with a nicely packaged digital technology. Instead, cultivate empathy throughout your financial organization to become truly valuable to the customers, and you will witness a rapid growth in loyalty and retention rates.

And one more important thing. Unfortunately, some banks are on the verge of failing because they focus on digitizing their products separately. Each digitization project within a single financial institution might have its own team of project managers and designers working on it, executing different visions and setting different goals. This causes fragmentation within the organization that might not harm the financial institution from the inside but will definitely have a negative impact on the customers. This is because customers see the experience as a connected, holistic flow, not separate fragments, and fragmentation breaks the customer experience by causing a lot of struggle and confusion.

Perceiving all banking products as part of a single digital banking ecosystem rather than separate elements is crucial for successful bank digital transformation for several reasons:

Improved customer experience

By viewing all products as part of a unified digital ecosystem, banks can create a more seamless, integrated customer experience. Customers can easily access and use multiple products and services without having to navigate multiple interfaces or log in and out of different systems.

Enhanced functionality

Viewing all products as part of a single digital ecosystem allows for greater integration and functionality between products. For example, a customer's account information and transaction history can be seamlessly accessed and shared across multiple products, such as mobile banking and online banking.

Increased efficiency

A single digital banking ecosystem allows for greater efficiency and cost-saving opportunities, as it reduces the need for separate systems and processes for each product. It also enables banks to leverage data and insights from across the ecosystem to make informed business decisions and optimize operations.

Enhanced security

By viewing all products as part of a single ecosystem, banks can more easily implement and enforce security measures across the entire product range. This helps to protect both the bank and its customers from potential security breaches and fraud.

Transforming all banking products as part of a single digital banking ecosystem enables banks to improve functionality, increase efficiency, enhance security, and ensure a smooth, connected flow of a delightful experience that the customers expect.

Explore how to implement design ops in banking

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin