In a world where the digital revolution is reshaping every corner of our lives, the banking sector stands at a crucial crossroads. The pandemic has not just accelerated the digital transformation in banking; it has made it a do-or-die scenario. As traditional banking models scramble to adapt, a new frontier emerges, one where being digital-first is not just an advantage, it's a lifeline. But amidst this seismic shift, a deeper, more profound change is taking root. It's not just about going digital; it's about why we're doing it in the first place.

What is Digital Transformation in Banking

Digital transformation in banking refers to the comprehensive integration of digital technology into all areas of banking, fundamentally changing how banks operate and deliver value to customers. It involves the use of innovative technologies such as artificial intelligence (AI), machine learning, blockchain, data analytics, and cloud computing to enhance banking services.

Digital transformation in banking is driven by the need to meet changing customer expectations, improve operational efficiency, and address the competitive pressures from both traditional financial institutions and fintech startups. Based on data from U.S. regional and community financial institutions with $4.4 billion in assets on average, the Alkami report finds that mid-size banks and credit unions more than doubled their investments in digital transformation in fiscal year 2022, to nearly $425,000 per $1 billion in assets.

Key aspects of digital transformation in banking include:

Customer Experience Enhancement

Banks leverage digital channels (e.g., mobile apps, websites) to offer personalized, convenient, and efficient services. This includes 24/7 access to banking services, personalized financial advice, and seamless transaction experiences.

Customer-Centricity

Placing the customer at the center of digital transformation efforts by leveraging technology to deliver personalized, seamless, and convenient banking experiences. This includes empowering customers with self-service options, intuitive interfaces, and proactive financial guidance by embracing agile methodologies to swiftly adapt to changing market dynamics, customer preferences, and emerging technologies.

Operational Efficiency

Automation and digitization of manual processes reduce operational costs and improve efficiency. Technologies like AI and machine learning are used for tasks ranging from customer service (via chatbots) to risk management and fraud detection.

Data-Driven Decision Making

Banks use big data analytics to gain insights into customer behavior, preferences, and trends. This helps in designing targeted products, optimizing pricing strategies, and improving risk management.

Innovation and Product Development

Digital transformation encourages the creation of new digital products and services, such as digital wallets, peer-to-peer payments, and blockchain-based solutions. This innovation helps banks stay competitive and meet the evolving needs of their customers.

Enhanced Security and Compliance

Digital transformation also involves the implementation of advanced cybersecurity measures to protect sensitive data and transactions. Compliance with regulatory requirements is streamlined through digital solutions.

Collaboration with Fintech

Banks increasingly collaborate with fintech companies to leverage their technologies and innovations, providing customers with enhanced services and products.

Sustainability and Ethical Practices

Integrating environmental, social, and governance (ESG) considerations into the digital transformation strategy. This encompasses adopting sustainable and ethical practices in product development, operations, and investments, with a focus on promoting financial inclusion, reducing carbon footprint, and promoting responsible data usage.

Empowering Employees

Equipping employees with the necessary digital skills and providing them with a supportive work environment to effectively navigate the digital transformation journey. This involves investing in training and upskilling programs, fostering a culture of continuous learning, and encouraging cross-functional collaboration.

Digital transformation in banking is not just about adopting new technologies but also involves a cultural shift within the organization, requiring banks to be more agile, innovative, and customer-centric. It's a strategic approach aimed at securing a competitive advantage in the rapidly evolving digital economy.

Key Strategy for Digital Transformation in Banking

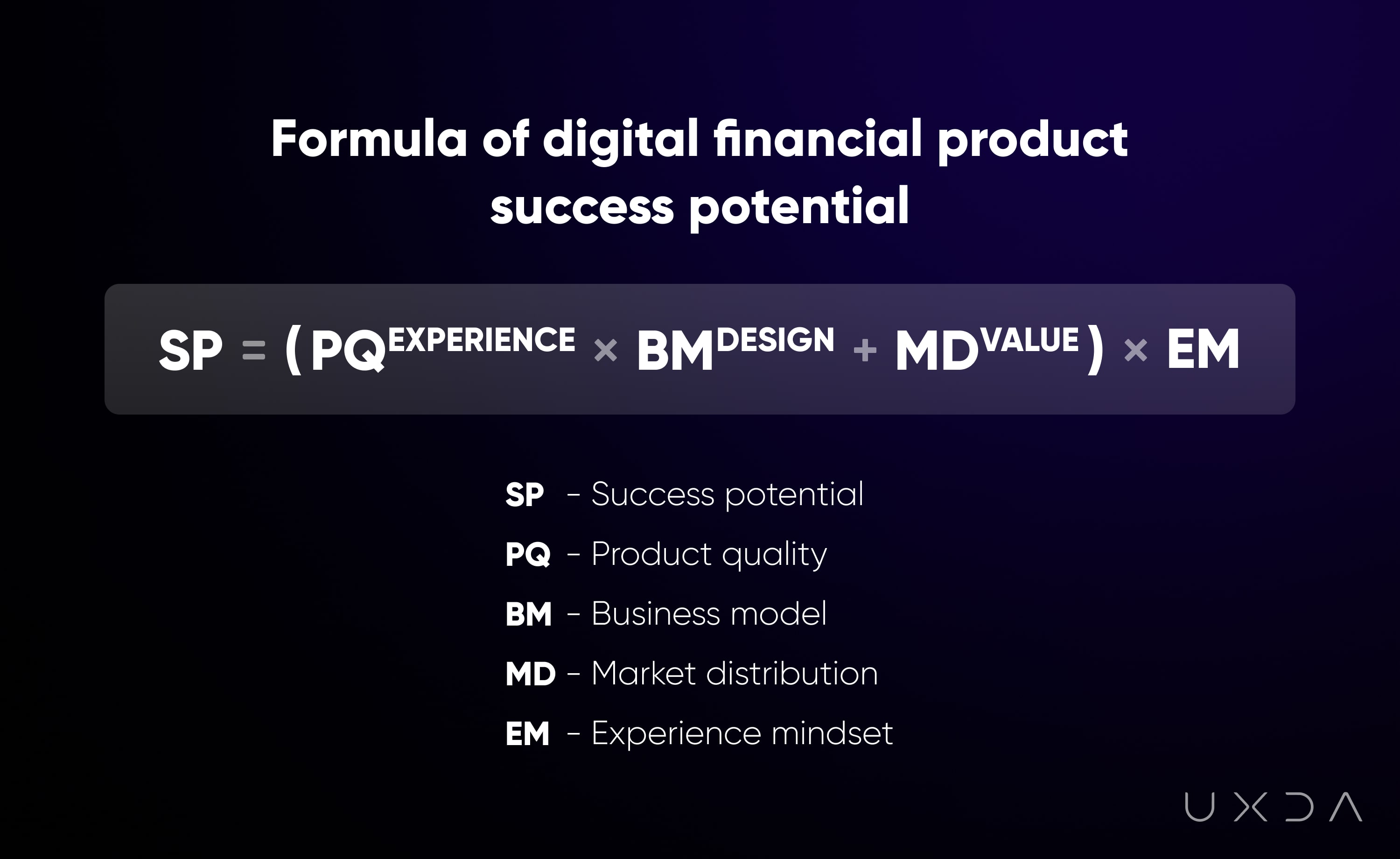

Effective strategy for the digital transformation in banking is the crucial factor determining whether a financial company will lose it all or strengthen its position in the market. A product that doesn't carry any value or benefit to facilitate people's daily lives will not be viewed as a necessity. Global digitization and the post-pandemic have completely changed the rules of the game in the financial industry. When the primary goal was to make a profit, it was enough with a product, business model and market distribution to ensure the company's success. Now it doesn't work that way anymore, we need empathy and purpose-driven strategy.

In the digital age, purpose becomes the main advantage and successful digital products are differentiated by the experience, benefit, and value they provide. That's why in the UXDA we define the digital success formula by adding some very important elements to the traditional operational model. The scale in which a financial business integrates these key factors defines the success potential of its digital financial products.

By embracing a purpose-driven strategy as the foundation for digital transformation in banking, banks go beyond simply adopting technology for the sake of efficiency gains or cost savings. Instead, they embrace a holistic approach that integrates technology with their core purpose and values, focusing on generating positive societal impact, sustainable growth, and responsible practices.

With a purpose-driven strategy in their digital transformation journey, banks can create long-term value for all stakeholders while positively contributing to the broader society. It enables them to build a sustainable competitive advantage, attract and retain customers, foster innovation, and navigate the ever-evolving landscape of the financial services industry.

The quality of purpose-driven strategy implementation in the business DNA of a financial company is determined by five factors:

1. How well the customers context is taken into account;

2. How does your organization’s culture meet the strategy requirement;

3. How effective is your digital strategy in terms of digital age;

4. Is design implemented at all levels of your organization;

5. How does the value of your product match the market requirements.

In this article I will consider all three factors and show you how to purposefully create an advantage in this difficult time to turn the crisis into growth.

However, there can be several challenges to implementing a purpose-driven strategy in business. One challenge is that it can be difficult to identify and articulate a clear purpose or mission that aligns with the company's goals and resonates with its target customers. This can require extensive research, consultation, and collaboration with different stakeholders.

Another challenge is that a purpose-driven strategy can require significant changes to the way a company operates, which can be difficult to implement and require the support and buy-in of employees at all levels of the organization. Additionally, a purpose-driven approach can require a company to prioritize long-term goals and social impact over short-term financial gains, which can be difficult for some organizations to balance.

1. Meet User Expectations Based on Customers Context

Digital financial service success is directly dependent on its ability to ease users’ daily lives and solve their problems. If the product does not live up to user expectations and specific needs, they will seek another alternative that eases their lives in these difficult conditions.

There's a common faulty belief among many entrepreneurs. They are certain that it's enough to understand the user's problem in order to create a product that will solve it. But, truth to be told, this seemingly clear problem could not be solved without taking into account the specific context of it.

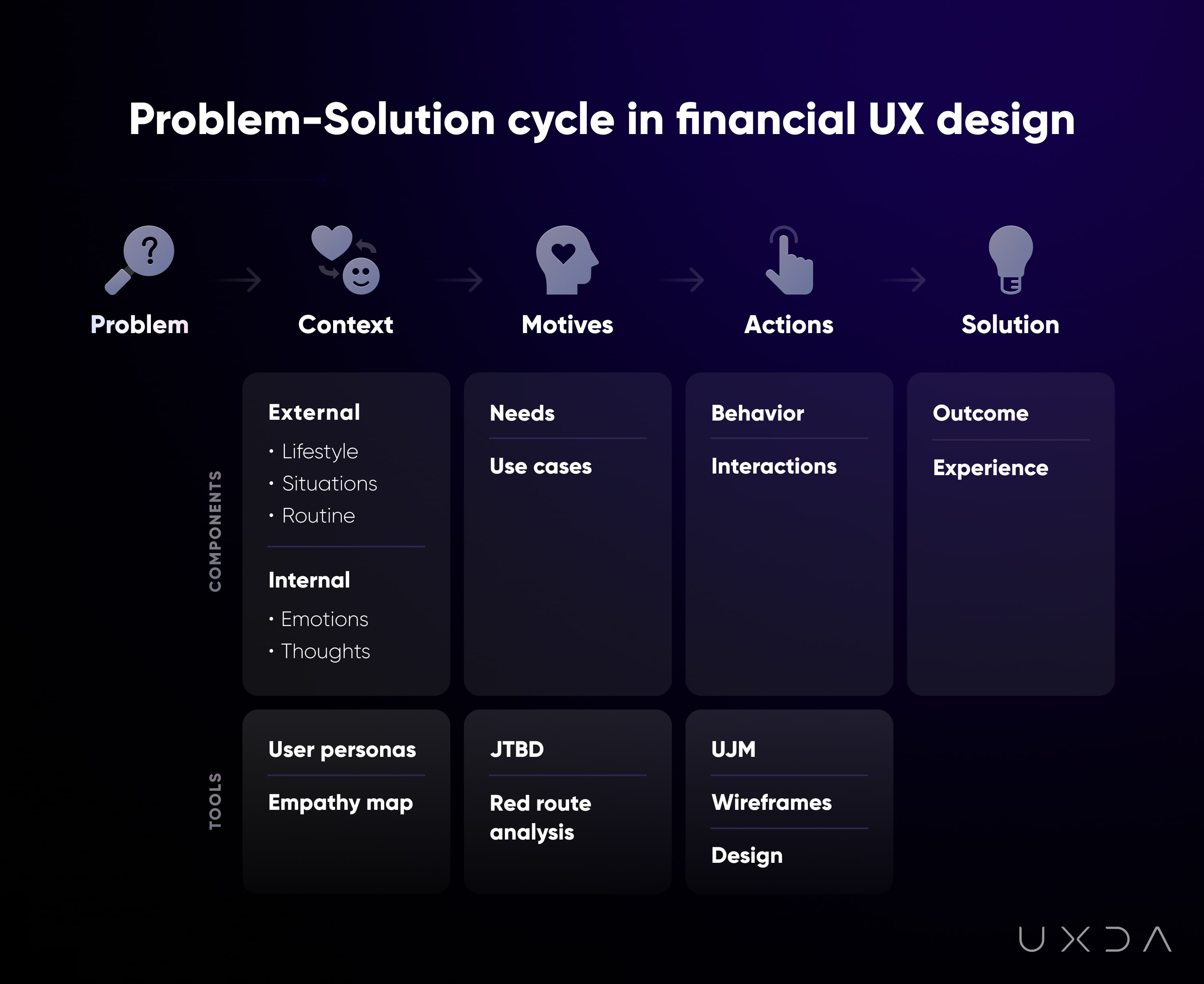

Financial companies are trying to find ways to cope with post-pandemic and provide the best digital service to their customers. Unfortunately, these efforts can become meaningless if they haven't dived deep into exploring the user context, motives and actions - three elements that are crucial for truly satisfying the users and solving the problems they are facing.

To better understand these three conditions, we need to explore the problem-solution cycle from the human perspective. It's an approach to defining a problem and finding a solution through three conditions. It starts with the context that defines the motives that then lead to actions. At each point, you can use specific tools that reveal the process and give you an idea of exactly how the financial service should work in order to solve the specific problem of the customer.

Let's take a closer look at each of these elements.

Explore Context

To identify the external context, you have to collect information about the potential users of your digital financial service. Create a user profile that describes the lifestyle and habits of the user persona.

Then, you should create an Empathy map to uncover the deepest understanding of the internal context. This uncovers the limitations and/or opportunities associated with the product use context.

There is no way to research user expectations without investigating both the internal and external user contexts. Truth be told, if you do not get to know your user's habits, lifestyle, environment, emotions and cognitions, you cannot understand how your product can help solve their daily tasks and problems.

Define Motive

The identified context determines the person's expectations in searching for a solution to the problem. How customers perceive the problem, where they will look for the solution, and how they will evaluate the effectiveness and quality of it. This defines the motive for using your banking product or financial service. In fact, this is the job for which users hire the product.

You can specify this job using the Jobs To Be Done framework (JTBD), and set the key priorities through the Red Route Analysis. You need to look deep enough to find the true motives that affect the actions of the users and their mental models.

Guide Actions

Next, the user takes action to achieve the needed solution. Customers use the product and interact with it. Your task is to ensure that the product provides the user with a clear, enjoyable and effective solution to their initial problem.

This is where the User Journey Map (UJM), user flow map, wireframes, UI design and testing come in as user experience design (UX) tools.

When you have found out and defined why people will choose your digital financial service in these circumstances, you have to be aware of the proper approach that allows materializing all of this knowledge. This leads us to the second important step of implementing a purpose-driven strategy in digital banking - the Organization's Culture.

Read more about the Problem-Solution Cycle

2. Become Purpose-Driven Disruptor Through Organization’s Culture

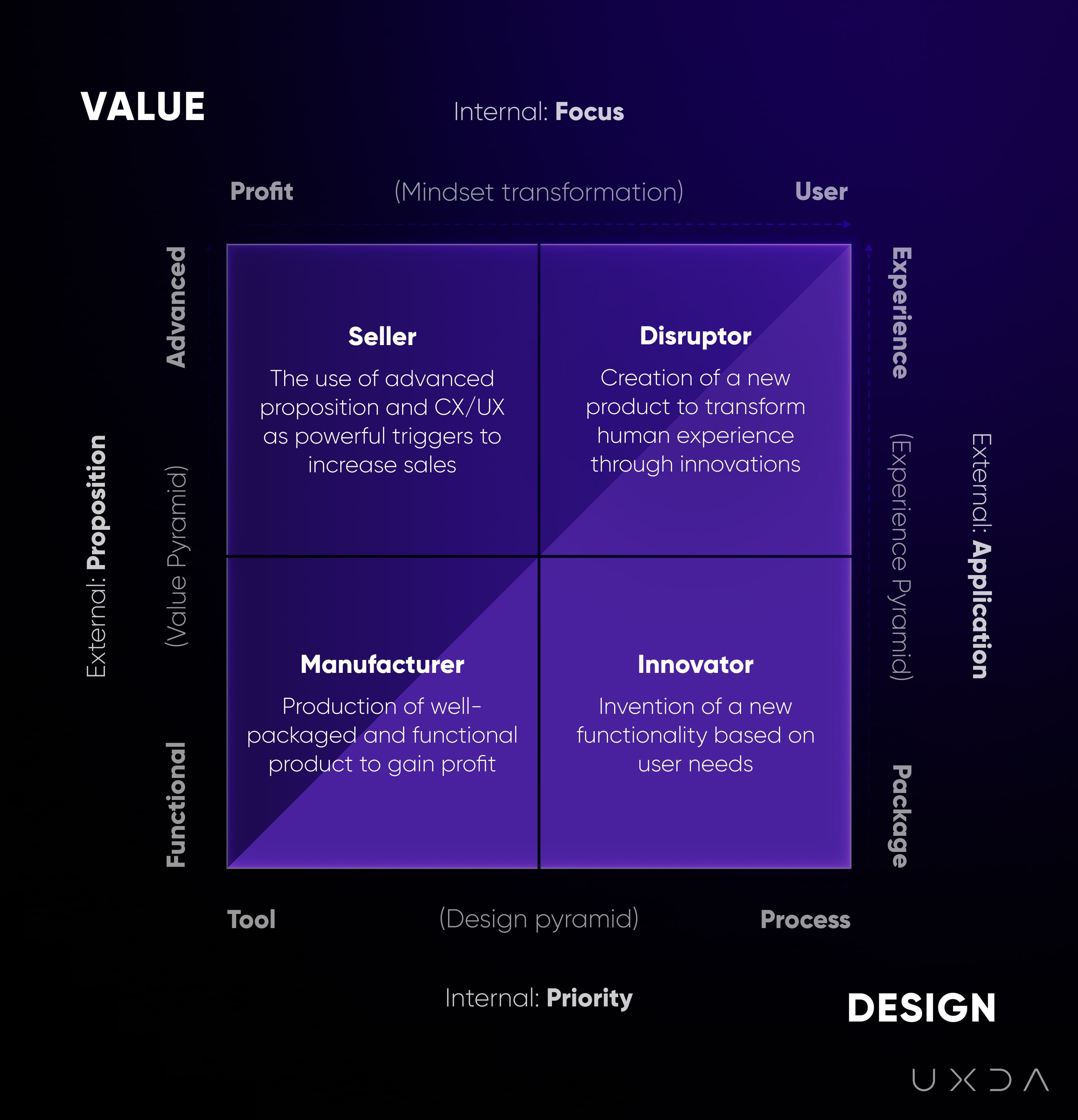

To identify what kind of company culture your business executes and how it's possible to change it in order to become a Digital Disruptor, I'm introducing you to the Financial UX Design Matrix.

In the digital world, companies that are disruptors have the greatest potential. The secret of their success is the design-matured culture that develops two basic components: Value and Design.

Both of these elements significantly affect the formation of customer experience within any business. Let's take a look at how the use or the lack of the use of Design and Value distinguishes four different company types.

Manufacturer

This is a company that cares more about its production process than its customers. Against the backdrop of the efforts invested in product creation and standardization of production, the interests of consumers do not seem so important.

Therefore, the management of this company is convinced that basic functionality is enough for users. Design,in this case, is a tool that is needed to create packaging, to bring the product to the market in an attractive way. The manufacturing company is an outdated type of organization that excelled in the industrial age.

Seller

Unlike the Manufacturer, Seller company is more focused on promotion than on product functionality. The Seller collects data about customers, finding out their preferences and needs. Then this information is further used by a marketing department that develops advanced communication strategies to address them on an emotional level.

Sellers are well aware that, in conditions of high competition, it is necessary to use something more attractive to users than boring and standardized functionality. Therefore, they use an advanced value proposition and design as powerful promotional triggers.

Despite all the client-centered slogans of such company, their customers don't feel that the company is concerned about their interests, face formal attitude and poor service. This kind of company would have actively advertised their high level of customer experience, as well as digitization efforts but they are not able to ensure the promised quality of their service.

Innovator

Innovators in our frame are user-oriented entrepreneurs who make technological improvements. These are usually engineering companies looking for technical solutions that will better meet the needs of consumers to provide them with extra functionality.

They use Design thinking as a creative process aimed at finding new solutions. Innovators are sure that the functionality of a new level provides high value for consumers. Therefore, they are much more interested in researching and developing a new technology than caring about the customer's actual needs and experience.

The difficulties of Innovators are related to the fact that the development of new functionality is a key process for them, and they are not ready to delve into psychology and consumer behavior. As a result, the products of the Innovator’s companies are often inconvenient and interesting only to a narrow circle of specialists and technology geeks.

Disruptor

Disruptors are companies that leverage the maximum potential of all four vectors and are extremely customer-oriented. Very often, they are perceived as companies changing markets or even creating new markets through disruptive innovations. These are design-matured companies that reinvent experience, offering new service that is much more convenient, efficient and enjoyable than the boring alternatives already available on the market.

Disruptors see profit as the result of maximum user satisfaction, and as a result of realizing the meaning of the company purpose that is focused on customers’ benefits. This provides them with long-term competitive advantages, customer loyalty and community support, all of which results in above-average profits.

Disruptors often use the functionality that Innovators have created but develop it at the higher levels of the Value Proposition. Being obsessed with execution, they bring every element of the user experience to perfection. Their task is not so much to create innovative technologies, but rather to rethink the habitual way of life. And, that is what makes them true Disruptors.

They realize the maximum potential of their business model, product and market offer through the integration of a purpose-driven approach into the company's DNA through Design. Thanks to this, Disruptors are able to build the most trusting relationships with their customers, and, in case of any business difficulties, they receive support and assistance from their fans.

Read more about the Financial UX Design Matrix

3. Make the Strategy Effective in Terms of Digital Age

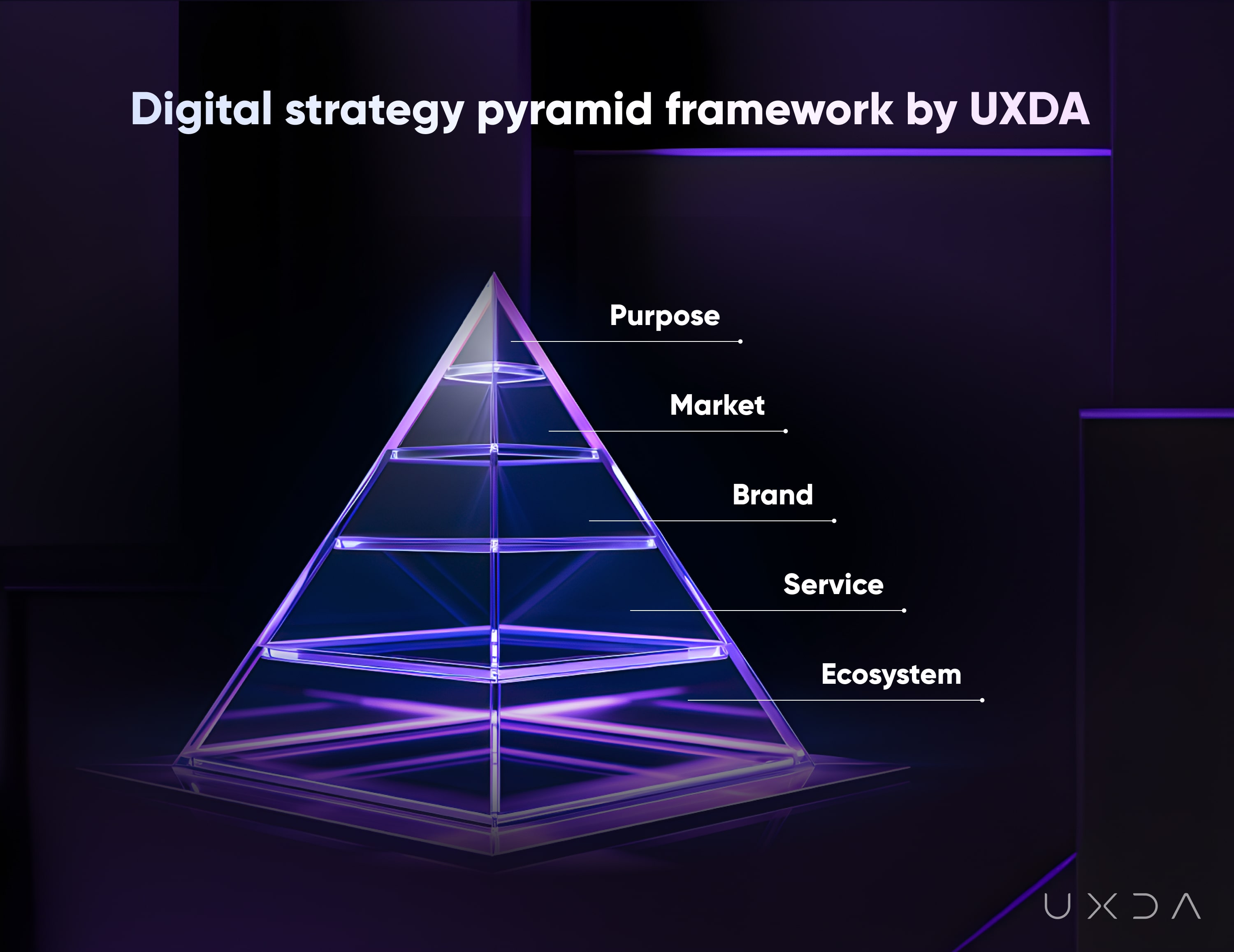

In order to remain competitive in the digital age, modern businesses must adopt a strategic approach to financial product design. In order to facilitate this integration, the Digital Strategy Pyramid framework provides a clear, step-by-step process that guarantees design choices are in line with the goals of the business, market research, brand identity, service details, and ecosystem coherence.

Purpose

The foundational level, where a company defines its core "why" - its vision, mission, values, and goals. It's about creating meaningful impact beyond mere financial gains, focusing on serving a significant cause that benefits customers and society. For banks, this could mean enhancing financial well-being, providing education, and offering more transparent and value-driven services.

Market

Understanding the target audience, including their needs, expectations, and pain points, is crucial. Banks need to develop digital strategies that resonate with their customers, tailored to address specific requirements and enhance their financial journey.

Brand

This involves shaping the company's brand identity and how it communicates authentically with customers. The goal is to reflect the company's purpose and values in a way that resonates with the target market, ensuring consistency across all brand experiences to foster loyalty and trust.

Service

Decisions regarding the service offerings are made to fulfill the company's purpose for its target market, aligned with the brand identity. Positive customer service experiences are key to retention and loyalty, highlighting the importance of offering a comprehensive range of relevant financial services and products.

Ecosystem

The final level encompasses the digital products and infrastructure that enable customer interaction and service delivery. A cohesive, user-centric digital ecosystem is essential for providing a seamless and frictionless experience across all touchpoints, which is critical for customer retention and competitive advantage.

Read more about the Digital Strategy Pyramid

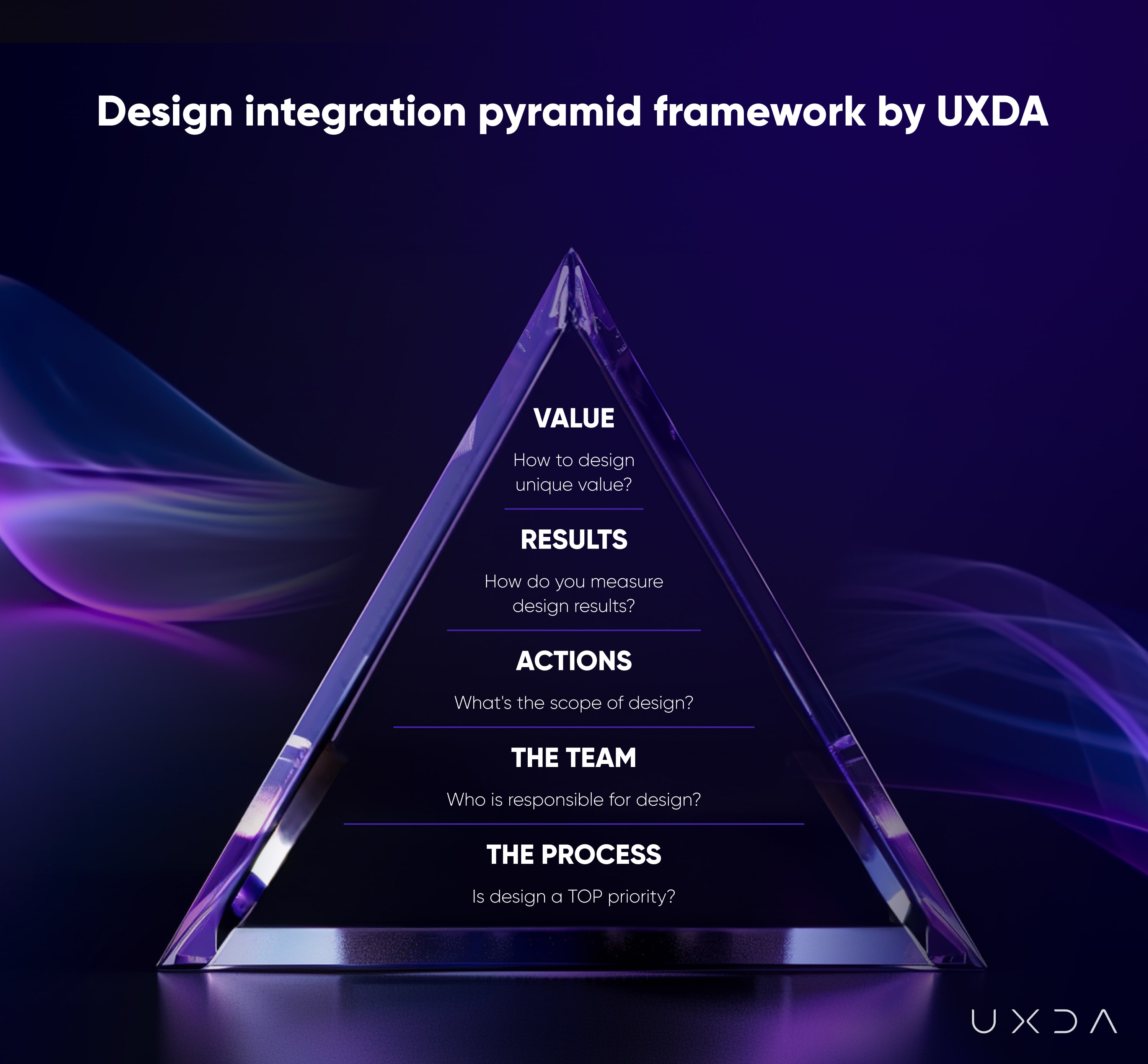

4. Implement Design at all Level of your Organization

As banking digitally transforms, it is critical to navigate the complexities of creating user-centered financial services. Ignoring potential pitfalls can lead to product rejection and lost market advantage, often due to overlooked obstacles and blind spots by product owners.

Let's take five business levels: Process, Team, Action, Results, and Value, each crucial for enhancing design impact within financial organizations. Missteps at any level can jeopardize digital product success.

First Level: Process

Assess the role of design in company processes. It's not just about having designers; it's about integrating design thinking throughout the organization to ensure projects are user-centered, leading to more successful products.

Second Level: Team

The right team is essential. This includes roles from Chief Experience Officers to UI Designers, each bringing necessary skills to the table. Failure to select competent team members can lead to project failures, as seen in startups that overlook the importance of financial service design expertise.

Third Level: Action

Design skills must influence beyond superficial elements. Design should act as a unifying force across all departments, emphasizing collaboration over competition to avoid disjointed digital solutions.

Fourth Level: Results

Success metrics should focus on the value provided to users, not just on deliverables like the number of screens. A user-centered approach requires fewer screens and increases satisfaction, requiring expertise in analysis, research, and UX architecture.

Fifth Level: Value

The most crucial question is "Why?" Understanding the unique value your product offers ensures innovation and distinguishes it from competitors. Encourage a disruptive mindset within the team to explore outside-the-box solutions that enhance product value and user benefits.

Learn more about the UXDA's Design Pyramid

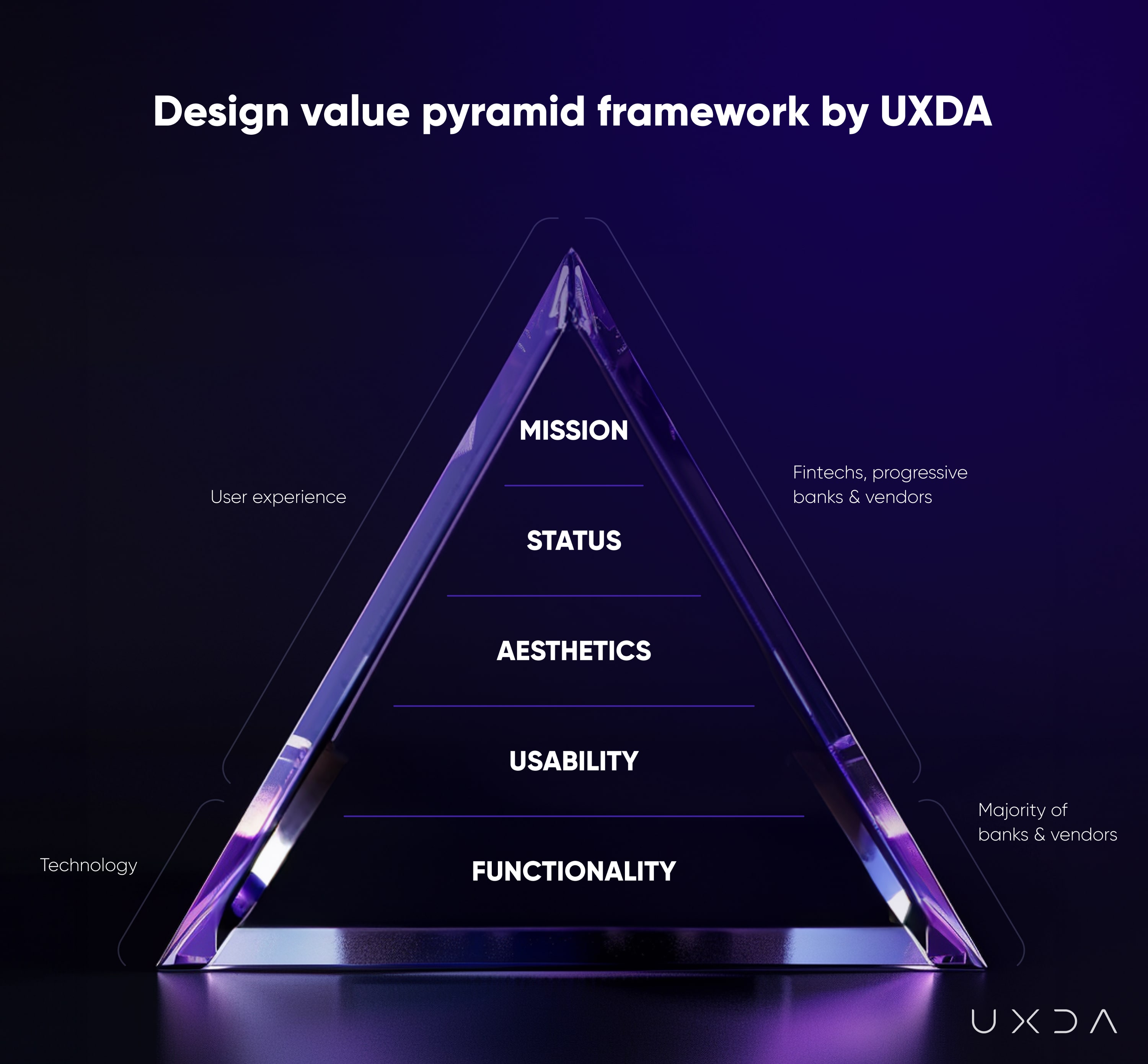

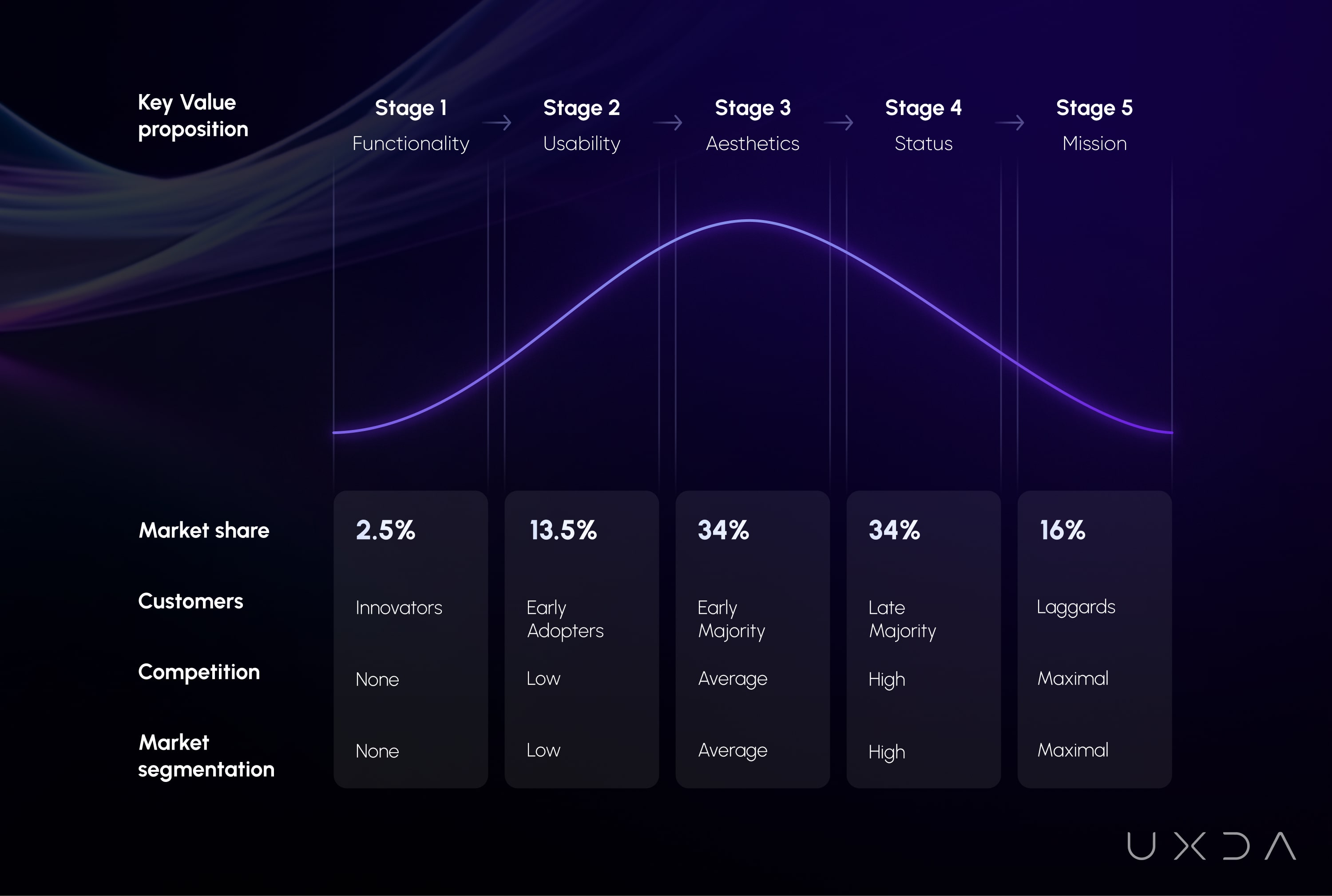

5. Provide Product Value that has Maximum Market Fit

The Financial UX Design Value Pyramid draws inspiration from Maslow's hierarchy, suggesting products evolve to meet higher human needs as competition increases. This evolution makes products more humane, resonating with human nature and desires, especially in the banking sector where fintech innovation caters to specific user needs more effectively.

Functional Value

Mirrors physiological needs, focusing on delivering the desired result through product features. This is the basic level where products aim to fulfill the primary function or service they were designed for.

Usability Value

Aligns with the need for security, emphasizing ease of use to provide users with control and confidence, making the product not just functional but also comfortable to interact with.

Aesthetics Value

Corresponds to the need for love and belonging, where a product's design and appearance play a role in attracting users by appealing to their emotions and sense of beauty.

Status Value

Tied to the need for respect, where the product's prestige or alignment with a certain lifestyle confers a particular status on its users, making it a symbol of their identity or aspirations.

Mission Value

Reflects the need for self-actualization, where products or services inspire users to realize their potential or contribute to a larger cause, offering a sense of participation in something significant.

Innovation drives the progression from functionality to mission, with competition pushing products through these stages. Each level of the pyramid not only meets a more sophisticated set of user needs but also competes more effectively in a crowded market. This progression is evident in industries beyond banking, such as automotive, where products evolve from basic functionality such as T Model by Ford to embodying a mission or ideology that resonates deeply with consumers, such as sustainable Tesla.

As products advance up the pyramid, they must maintain the foundational values of functionality and usability while also embracing aesthetics, status, and ultimately, a mission that aligns with the changing needs and values of society. This holistic approach to product value development ensures that financial services can remain relevant and impactful in an ever-evolving market landscape.

Benefits of Purpose-Driven Digital Transformation in Banking

In the digital age, it is increasingly important for financial companies to become purpose-driven in order to stay competitive and relevant. This is because customers in the digital age have access to a wide range of financial products and services, and are often looking for companies that align with their values and beliefs.

A purpose-driven approach to digital transformation in banking ensures that technology adoption and innovation are aligned with broader goals that benefit all stakeholders, including customers, employees, society, and the environment. It positions banks to be more resilient, responsible, and relevant in the digital era.

A purpose-driven strategy can help financial companies differentiate themselves and stand out in a crowded marketplace. It can also help them attract and retain top talent, and motivate employees to work towards a common goal. Additionally, a strong sense of purpose can help financial companies build trust and credibility with their customers, partners, and stakeholders, which can be essential for building long-term relationships and driving business growth.

A purpose-driven strategy in banking is a business strategy that is focused on using the bank's resources and expertise to address specific social needs, rather than simply maximizing profits. The overall goal of a purpose-driven strategy is to align the bank's business objectives with its values and mission, and to use its position as a financial institution to make a positive contribution to society.

A purpose-driven approach ensures that digital transformation efforts are not just about adopting the latest technologies but are also about creating meaningful value for customers, employees, stakeholders, and society at large. Here are key reasons why a purpose-driven approach is crucial:

- Satisfaction. A purpose-driven digital transformation focuses on deeply understanding and meeting customer needs, expectations, and preferences. By prioritizing customer-centric solutions, banks can create more meaningful and personalized experiences, thereby increasing customer loyalty and satisfaction.

- Trust. In the digital age, customers are increasingly concerned about privacy, data security, and ethical use of their information. A purpose-driven approach emphasizes ethical standards, data protection, and transparent communication, helping to build trust with customers and stakeholders.

- Responsibility. Purpose-driven transformation encourages banks to look beyond short-term gains and invest in sustainable growth strategies. This includes developing products and services that are not only profitable but also socially responsible and environmentally sustainable.

- Motivation. By aligning digital transformation with a clear purpose, banks can create a more engaging and motivating work environment for their employees. This helps in attracting and retaining talent, implementing innovation, and ensuring that employees are aligned with the bank's mission and values.

- Reputation. The banking sector is heavily regulated, and a purpose-driven approach can help ensure that digital transformation efforts comply with legal and regulatory requirements. By focusing on sustainable and ethical practices, banks can mitigate risks associated with cybersecurity, operational disruptions, and reputational damage.

- Value. Banks play a crucial role in the economy and society. A purpose-driven approach to digital transformation allows banks to leverage technology not just for financial gains but also to address social challenges, such as financial inclusion, economic empowerment, and community development.

- Adaptation. A purpose-driven digital strategy ensures that digital transformation efforts are resilient and adaptable to changes in the market, technology, and customer behavior. It helps banks to remain relevant and competitive in a rapidly evolving digital landscape.

Conclusion: Build Relationships With Your Clients That Will Last

Digital transformation in banking has evolved from a strategic advantage to a survival necessity, and it is critical to understand that at its core, the transition to next-generation banking and fintech requires more than just finance and technology. The journey towards digitalization is not merely about adopting cutting-edge technologies or optimizing operational efficiencies; it is about fostering a deep sense of empathy and focusing on design thinking that places the customer at the heart of every innovation. This evolution is fundamentally about people—about understanding their needs, preferences, and behaviors in a rapidly changing digital landscape.

As banks and other financial institutions navigate through this digital transformation, they must embrace a purpose-driven strategy that goes beyond the goal of making a profit at any cost. This strategy should aim to create a positive social impact, promote financial inclusion, and build a banking experience that is accessible, intuitive, and tailored to meet the diverse needs of the customer base. By doing so, banks can cultivate long-lasting relationships with their customers, grounded in trust, loyalty, and mutual respect.

Moreover, the focus on empathy and design highlights the importance of understanding the emotional and practical aspects of customer interactions with financial services. It is about creating products and services that are not only technologically advanced but also deeply resonant with the users' lives and aspirations. This approach acknowledges that technology should serve as a means to enrich human experiences rather than being an end in itself.

Banks must recognize that their greatest assets are not just their financial products or technological innovations, but the people they serve. By prioritizing empathy and design in their digital transformation strategy, banks can ensure that they are not just surviving in the digital age but thriving, by creating meaningful, user-centric experiences that align with their customers' needs and values. In doing so, they will not only secure their place in the future of banking but also contribute to a more inclusive, accessible, and human-centered financial ecosystem.

In the past nine years, the UXDA team has completed over 150 digital financial app design transformations for Fintechs and banks in 36 countries. Explore examples of financial app design transformation that exceeds expectations and creates an emotional connection through a stunning UX design by UXDA:

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin