Traditional banks are undergoing a transformative period to stay competitive in the evolving financial landscape. In response, Banorte, a leading Mexican banking group, took a bold step to launch the first 100% digital bank in the country ─ Bineo. This groundbreaking move aimed to revolutionize the market and address the needs of tech-savvy customers, challenging common obstacles that traditional banks may face due to legal and technological constraints. Dive into this case study to learn how UXDA's collaboration with the team at Banorte initiated a new dedicated digital banking journey for Mexicans.

Client: Mexico's Leading Banking Group Shakes up the Digital Landscape

Grupo Financiero Banorte, one of Mexico's largest financial companies, came to UXDA to design Bineo, a digital bank that offers savings accounts and personal loans with the aim to compete against all-online banks, such as Brazil's Nubank and Argentina's Uala. Banco Banorte already has 12 million clients, making it the second largest banking group in the country when measured by credit portfolio. "There's a segment of our clients today that demands a 100% digital service," the group's president, Carlos Hank, said in an interview with Reuters.

The first domestic digital bank, Bineo, has quickly gained attention and sparked discussions in the Mexican digital banking market after their launch at the end of January 2024. Within just three months of its launch, Bineo has seen a remarkable 669% increase in its customer base, now serving 10,000 clients. With ambitious goals, the bank aims to reach 2.5 to 3 million clients within the next five years. Bineo's chairman, Carlos Hank, in the app's presentation, emphasized the historical significance of the country's banking history, stating that Bineo represents a fusion of over 120 years of Banorte's financial experience empowered with the best digital technologies.

Bineo distinguishes itself as Mexico's first and only 100% digital bank, with a comprehensive banking license issued by the National Banking and Securities Commission (CNBV). Supported by Banorte, a leading Mexican bank, Bineo operates as a separate digital-only bank, capitalizing on Banorte's security, trusted reputation and business development expertise. While investing in a next-generation digital bank like Bineo, Banorte demonstrates its dedication to reshaping Mexicans' digital banking experiences and changing the overall perception of banks.

The Bineo team prioritizes customers in their business strategy, aiming to surpass other digital banking services. They intend to achieve this by delivering personalized experiences, fostering simplicity and trust in banking products and providing comprehensive support to address customer needs.

As a local bank, Bineo understands the challenges faced by Mexicans, including concerns about security, the desire for self-service and control in managing personal finances, transparency in banking services and the need to feel cared for. The bank was ready to revolutionize digital banking experiences with trustworthy and reliable banking services tailored to users' preferences. Addressing customer pain points also required the bank to ensure alignment with legal requirements and prioritize the security of its services.

To design the first 100% digital bank in Mexico, the Bineo team found UXDA to be a skilled partner experienced in creating next-gen digital banking experiences empowered by emotions. Their goal was to pioneer a fully digital bank in Mexico, corresponding to the needs of digital-savvy Mexicans. Both Bineo and UXDA prioritize human-centered design and share a commitment to providing next-gen humanized banking services. Being a purpose-driven disruptor, the Bineo team aligns its brand values of transparency, customer-centricity and innovations with its mission and vision to make a positive contribution to society.

Challenge: Transform Mexicans' Perception of Banks

Our primary challenge was to transform the way users perceive banks in Mexico through our mobile app design and the digital experience it offers. Insights gained from stakeholder interviews uncovered a prevailing view that banks are perceived as untrustworthy rather than supportive partners in ensuring financial stability.

Address Challenges and Insecurities of Mexican Banking Customers

UXDA team research on Mexican banking customers highlighted key areas where users face challenges and insecurity. Users need control over their entire financial lives, trust their bank to help them achieve goals, and ensure financial security. Data from the Annual Financial Wellness Report (2022) by Invested reveals that Mexicans spend nearly 15 hours per month stressed about financial concerns, with money being the most overwhelming issue. Therefore, we utilized the expertise of the UXDA team to create solutions addressing Mexicans' needs and making users' lives more enjoyable.

Our strategy centered on humanizing the digital banking experience by employing straightforward language and prioritizing customer-centered information design. We aimed to create an app layout that helped Bineo customers reach their financial goals easily and feel valued. By conducting thorough user and market research and leveraging our expertise in digital product design, we aimed to discover innovative ways to deliver an unparalleled banking experience, ultimately driving success in the digital banking landscape.

Navigate the Landscape From Failed Digital App Launches

In today's financial landscape, traditional banks confront intense competition from digital service newcomers. To compete, they can optimize existing operations, acquire Fintech companies or venture into creating their own digital banks. However, each option involves risks like reputation damage and integration challenges. Banorte bank has evaluated these risks and opted to build the first domestic digital-only bank under its support to promptly address the evolving digital needs of Mexicans.

There are plenty of examples around the world of banks that have launched their own independent digital banks. However, some of these developments weren't as successful as they were initially supposed to be. One example is the Finn app by JPMorgan Chase Bank, launched in 2017 and closed one year later. The app was created to target millennials with its mobile-first approach. Still, it lacked differentiators both from Chase and other existing digital banking solutions on the market and couldn't attract customers. In Finn's case, there was a lack of understanding of user needs and a proper strategy for delivering an innovative digital customer experience.

This case shows that instead of being satisfied with digital access to banking services, customers seek solutions for their needs. While crafting 100% digital solutions, banks have to ensure they understand and align the digital product with the specific requirements of their customers, delivering appropriate services to fulfill needs of modern customers. To address those needs, banks should research external factors influencing emotions and perceptions of why and how people make decisions.

Another example is the Marcus app by Goldman Sachs, one of the oldest financial institutions in the world, which decided to create a separate digital-only product. Despite the leading financial institution's business expertise, it failed to leverage available innovations and revolutionize the market with its product. While the app showed great potential upon launch, its story reveals that appropriate strategic business and design decisions were not made.

To disrupt the market with an exceptional customer-driven solution, the bank should prioritize placing customers at the center of the product design process. Instead of adopting a sprinting design strategy focused solely on business profitability, it should approach it as a marathon, emphasizing continuous development.

Solution: A Vibrant and Enjoyable Digital Banking Experience

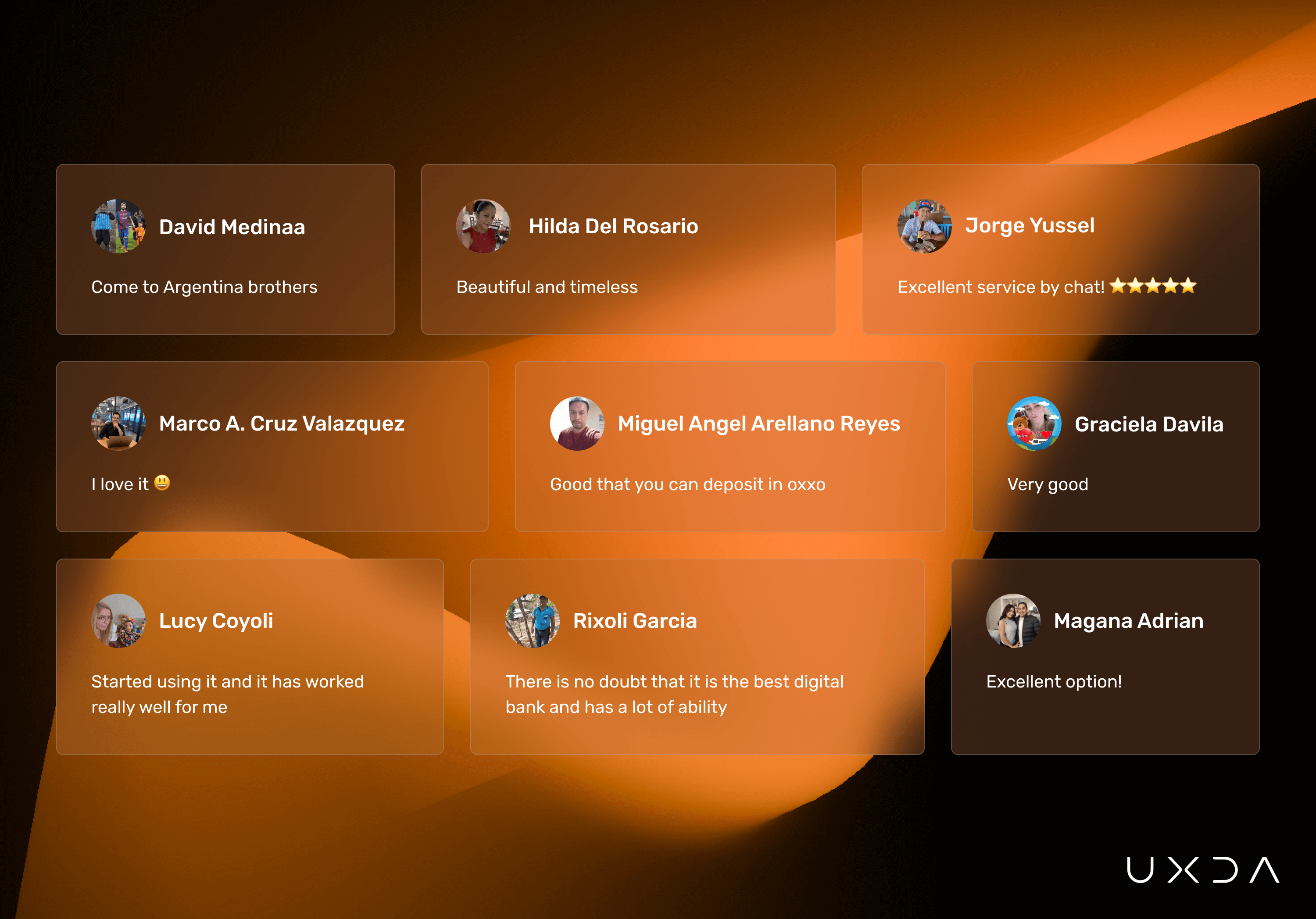

In just a month since its launch, the Bineo app has received praise on social media with customers commending its performance and security features. There's also interest from other regions like Argentina, requesting Bineo to extend its services.

User comments on social media after the launch of the Bineo mobile app

User comments on social media after the launch of the Bineo mobile app

Banking Transformation with a User-Centric Digital Journey

To achieve this remarkable outcome, we collaborated with the Bineo team to devise an emotion-driven strategy for a digital user journey. Applying UXDA's experience pyramid and expertise in designing next-gen digital financial products, we have helped to identify and evaluate emotions we aim to evoke in customers and features that primarily meet their needs. We've also facilitated the integration of human banking language, creating a feeling of care from the bank in the app.

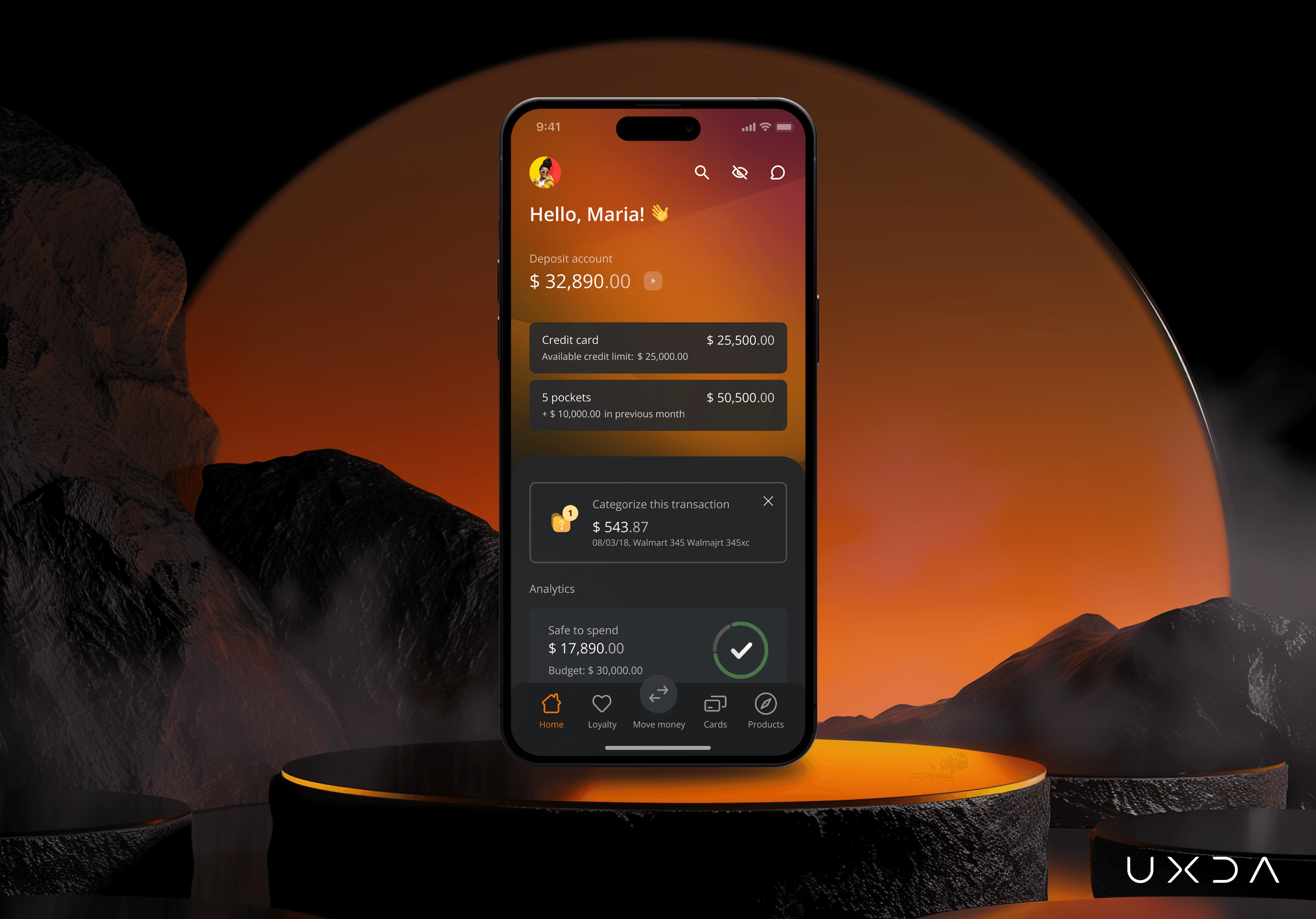

Bineo banking app Dashboard screen design by UXDA

Bineo banking app Dashboard screen design by UXDA

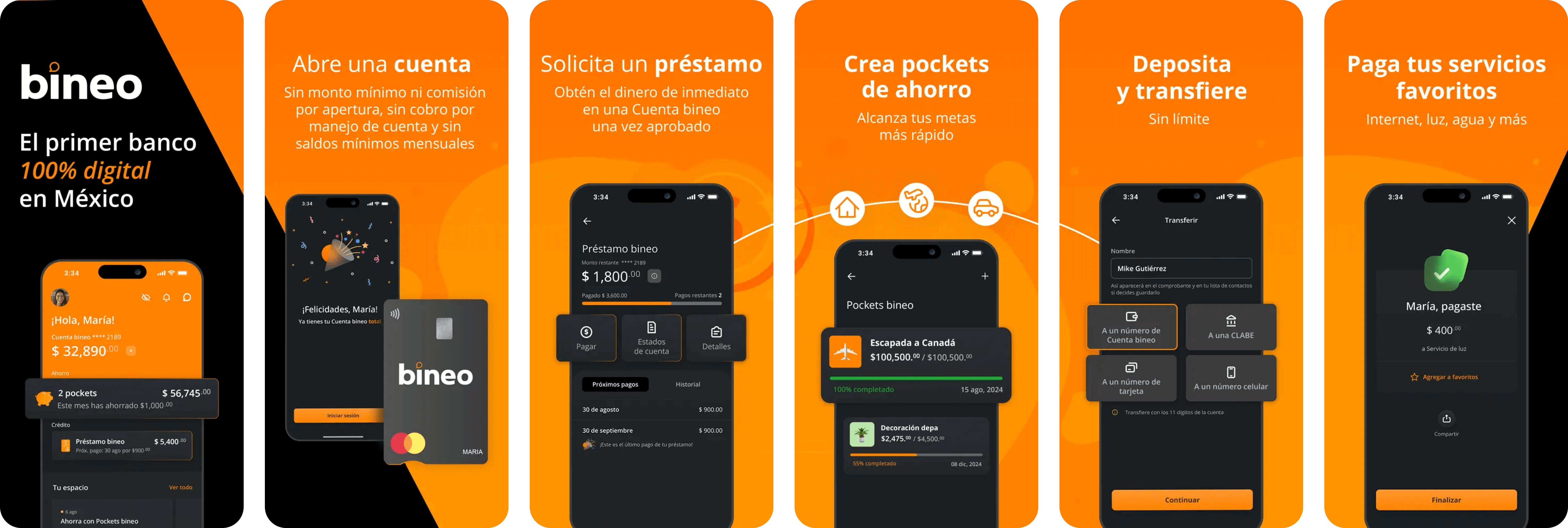

Addressing customers' demands on transparency and care, the dashboard displays not only all essential information on the customer's financial situation but also insights into the app’s product opportunities and how customers can improve their financial well-being through them.

For example, the widely-used option to hide balances in European financial apps offers Mexican customers an innovative way to maintain privacy and peace of mind when accessing accounts and checking transaction details in public places. The designed information architecture fosters the perception that Bineo is committed to enhancing customers' financial well-being and prioritizes their care. Moreover, the users got a new experience on a 100% digital app that allows them to onboard, order a new card or apply for a loan securely from the stress-free environment of their home.

The launch of the Bineo app signifies the bank's initial step in bringing its vision and mission to life, providing Mexicans with access to the financial stability and trust central to Bineo's mission. Given the dedication of the Bineo team to the global banking vision, the current version is just the starting point.

Align Digital Banking UX Design with Brand Values

The Bineo app reflects the bank's customer-centric and friendly culture, prioritizing user needs by delivering essential account information promptly. Upon accessing the app, users are greeted with a festive atmosphere characterized by personalized greetings and vibrant orange brand color.

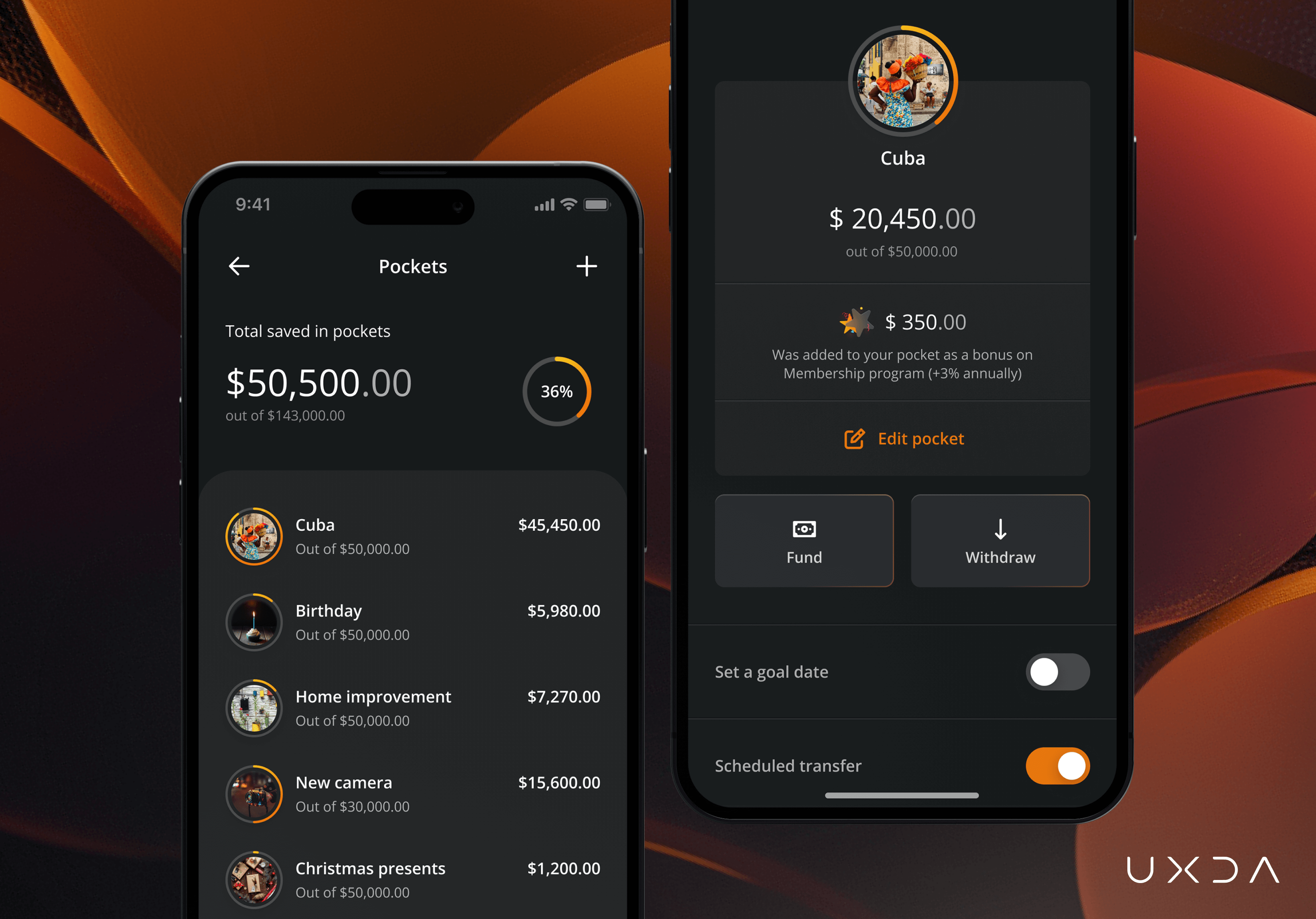

Bineo banking app Pockets / Savings screen design by UXDA

Bineo banking app Pockets / Savings screen design by UXDA

By responding to users' identified challenges, the UXDA team has integrated personalized insights on money management in the app's design, ensuring users remain engaged and focused on activities they enjoy rather than becoming overwhelmed or lost. Considering Mexicans' frequent habit of saving money in physical pockets, Bineo named the digital savings account accordingly. Through a well-designed savings wallet and clear information architecture, users better understand their financial situation and savings progress. The app's design is tailored to support dreamers prepared to turn their aspirations into reality and become better versions of themselves.

Local Advantage and Commitment

In Mexico's open market for foreign banks, Bineo's status as a local bank gives it a significant advantage over competitors by better understanding customers' genuine needs. Bineo can swiftly respond to customers' digital banking needs and expectations, setting it apart from other big international banks in the market. A crucial differentiation from other digital bank competitors lies in technical and reputational support by Grupo Financiero Banorte, empowering Bineo to gain customers' trust and compete effectively in the market.

Our flexible process enables the rapid development of new and customized features in response to changing needs and customer feedback. - Victor Moya Aguilar, CEO, Bineo

Approach: Transform Challenges Into Opportunities for Product Enhancement

Our approach to focus on transforming challenges into opportunities during the design process was fully supported by the openness of both the Bineo and vendor teams. The Bineo team was ready to take certain risks, such as changing the in-app navigation approach, which required altering existing customer behavior patterns. We strayed from the norm by offering a bottom menu instead of the hamburger menu found in the most popular apps in Mexico at the time. Before making this decision, we conducted a card sorting test to determine the optimal grouping of navigation options within the app's five menu choices. This approach proved to be simpler and more effective, and it imposed less cognitive load on users while navigating the app. As a result, the team recognized the potential impact and remained committed to delivering the best digital experience to their customers.

We were also pleased to observe how remote collaboration, initially seen as a constraint, resulted in outstanding project outcomes. The Bineo team's swift adaptation to remote work during the COVID-19 pandemic restrictions, along with our expertise in leading remote collaboration, provided clear evidence of how a shared goal resulted in a remarkable digital banking application.

Identify Market Gaps and User Needs

During our Mexican market research of 16 banks, the UXDA team uncovered several shortcomings that a new digital banking solution like Bineo could address. We found that many banks impose hidden charges without adequately explaining them to customers, leading to confusion and frustration. Moreover, banks often conceal product descriptions and details, making users unable to utilize all available opportunities or find assistance for their financial needs. Additionally, we have identified customers who frequently need to visit branches to resolve everyday banking issues. They are presented with features they cannot currently utilize, such as payment types unavailable to them.

The findings from the market research were further supported by user interviews, which uncovered similar challenges and struggles experienced by Mexicans. Most respondents supported the necessity of a digital-only bank to enhance their independence and acquire supportive financial partners to take care of them and their finances. The Bineo team had a clear focus and a passion for creating a digital bank they would enjoy using. Drawing from their own experiences with existing banks in Mexico, the team members provided valuable insights into market specifics and customer pain points.

Optimize Information Architecture in Digital Banking UX

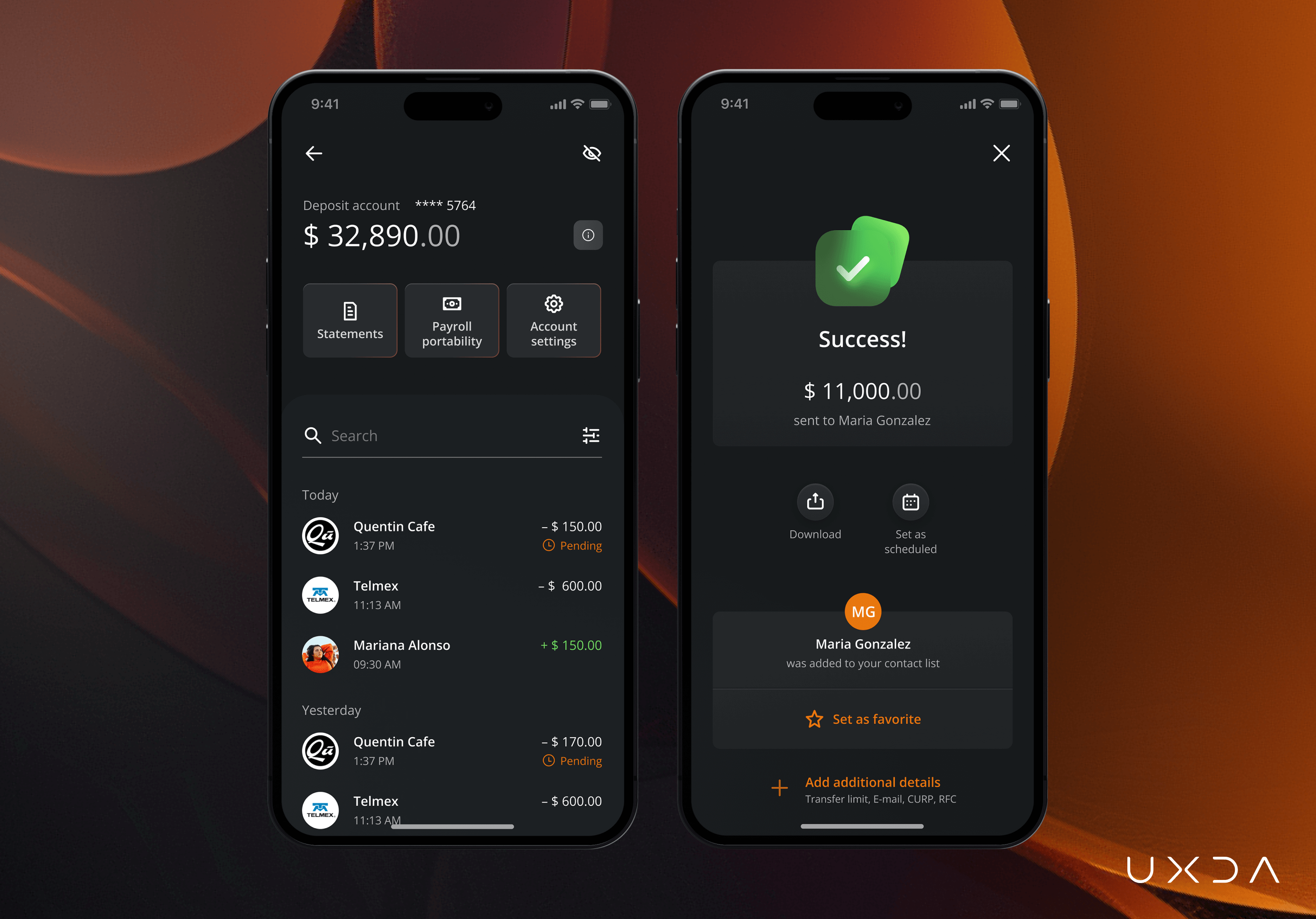

The thoughtfully designed architecture ensures users can seamlessly and intuitively navigate the app, facilitating tasks such as viewing account balances, applying for loans or ordering new cards, thereby instilling a sense of security in app usage. The digital bank's self-service features streamline banking tasks, reducing the need for branch visits. With enhanced communication tools, issues can now be resolved swiftly within the mobile app, saving time for users.

The concept of personalized digital customer content isn't new, but it's still not widely implemented in digital banking apps. Addressing customers' needs for advice on finance management, we've developed the idea of providing personalized suggestions. By analyzing customers' activities, such as cash withdrawals, the Bineo app offers tailored advice on bank card usage to enhance customers' financial management experience.

The Bineo app's UX design aligns with Mexicans' values regarding the importance of savings and their belief in financial control. By enabling users to allocate funds among different savings accounts, set goals and track their progress, the app empowers them to witness their dreams turning into reality and take charge of their finances. According to a McKinsey report, 71% of customers now expect personalization as the default standard for engagement from the businesses they use. In response to this, our team has assessed ways to introduce personalization options for Bineo app users. For instance, by incorporating unique visualizations for each savings account, Bineo customers can personalize their savings journeys and enhance their motivation to save.

Apply UI Design Principles to Enhance Emotions

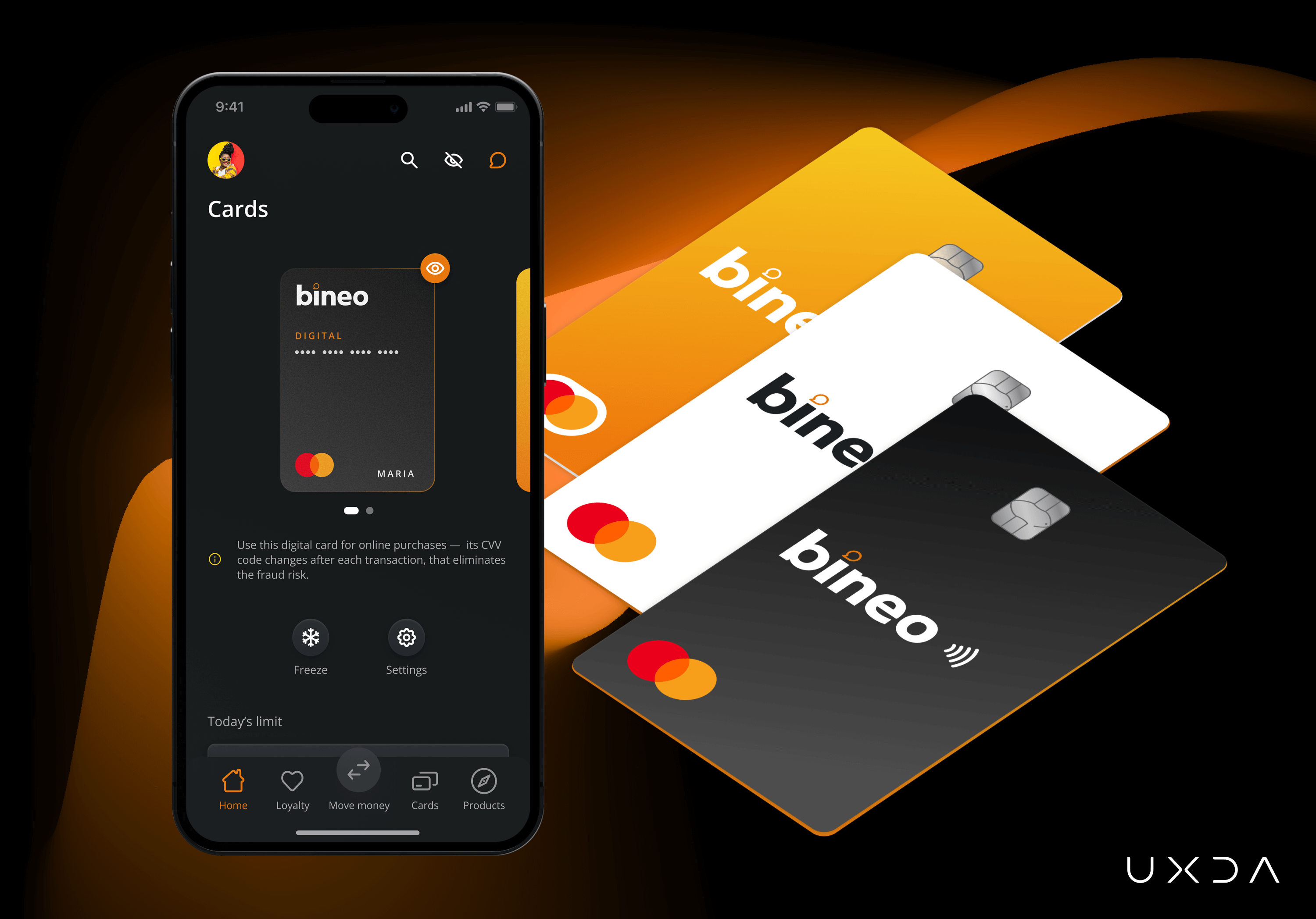

Bineo banking app Cards screen design by UXDA

Bineo banking app Cards screen design by UXDA

Before developing the Bineo app, the digital bank had already established its brand design. We aimed to create an app that aligns with the bank's brand. Our designers aimed to highlight aesthetics and minimalism and support the bank's vision of simplification. This approach is evident in the card design crafted by our UI designers. We created a sleek, black card with orange accents to create a "wow" effect for users. This design visually emphasizes how the Bineo brand seeks to simplify things while maintaining creativity, innovation and style.

We have incorporated solutions to the main users' concerns through stunning icons and festive visualizations for successful transactions, enabling a unique and humanized banking experience. We've ensured user confidence in the reliability of Bineo services through consistent design, smooth navigation and clear digital banking language. The vibrant orange accents visually align with the Bineo brand and convey non-verbal cues of optimism, happiness and enthusiasm.

Bineo banking app Account and Transfer success screen design by UXDA

Bineo banking app Account and Transfer success screen design by UXDA

To design the application, our team went beyond traditional methods to deliver a world-class digital experience and uphold the bank's mission of fostering trust and financial empowerment for users. We have also explored non-banking industries to identify areas that could enrich personalized experiences and instill a sense of calm and security in the bank. Our goal was to assure users through our design solutions that the Bineo app is more than just a typical digital bank – it's a trustworthy life partner capable of making their dreams a reality.

Spark Unique Ideas for Humanized Digital Banking

The success achieved is the direct outcome of the collaborative efforts among the UXDA, Bineo and their vendor teams. The Bineo team actively contributed insights into local culture, prepared materials for user interviews and participated in collaborative workshops to enhance the user experience and help Bineo customers achieve their goals.

We were able to think out of the box and create a unique list of "lovable things" – ideas for personal touches that could be implemented in the app's further development stages. This list provided the bank with a clear roadmap for improvements, pinpointing areas where these enhancements would benefit users. An example is adding emojis to the app design to evoke a sense of care and human interaction. Together with the Bineo team, we have discussed each potential product feature for integration into the app, carefully considering the optimal placement. The Bineo team's commitment to delivering a world-class digital banking experience kept them open-minded to new ideas for continuous app development.

With the Bineo app launch, we're excited to witness its continued development. During the app's development phase, the team successfully streamlined its background interface, making it more simple. We're thrilled to continue following the further updates and successes of the Bineo app in the market!

Bineo mobile app in the App Store

Bineo mobile app in the App Store

UXDA Deliverables

- Stakeholders’ interviews

- Product strategy

- Contextual market analysis

- User interviews

- User personas through a JTBD framework

- Empathy map

- User journey map

- Scenario prioritization in red route map

- Information architecture

- Value storyboard

- User flow maps

- Wireframes

- Key design concept

- Product experience movie

- UI design prototype

- Product motion design

- Design system

- Usability testing

Takeaway: Start with a Clean Slate

Traditional banks with a long history, strong reputation and extensive experience have proven their abilities to sustain and align with the changing financial landscape. Today, many banks seek opportunities to incorporate new technologies and features into their digital products to enhance their customers' everyday lives and transition from being perceived as "just a bank" to a trusted "partner" in their financial journey.

To launch the Bineo digital bank, Banorte group created a separate and independent team that worked from the first principle. They were not burdened by traditional banking culture, work standards or bureaucracy. They were flexible, open-minded and hungry for innovation.

And while incumbent banks struggle to adapt their service procedures to meet customer needs and digital age requirements, purpose-driven digital banks such as Bineo can unlock their potential through a human-centered approach and UX design strategy.

By prioritizing user needs and offering tailored solutions, including transparency, security, clear information architecture and user-friendly language, next-gen digital banks empower users to confidently engage with banking products, fostering a positive and accessible financial experience. To achieve these improvements, challenger banks utilize UX/UI design techniques to design innovative product interfaces and elevate satisfaction levels.

Digital product launches are usually divided into various development steps, and the Bineo app is only at the beginning of the development process. The initial reaction in the market has been very encouraging, but there is a lot of work ahead to process feedback and improve the user experience. As bank CEO Victor Moya Aguilar said in the interview, “the product will expand with new services and features designed to accompany the client in their life journey.”

Management excellence and high-quality outcomes were the best part. I am most impressed by the research process/outcomes, the team's knowledge, talent and professionalism, and the high UX design quality. - Jesus Perez Gutierrez, Bineo team

Explore our client's next-gen financial digital products and UX transformations:

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin