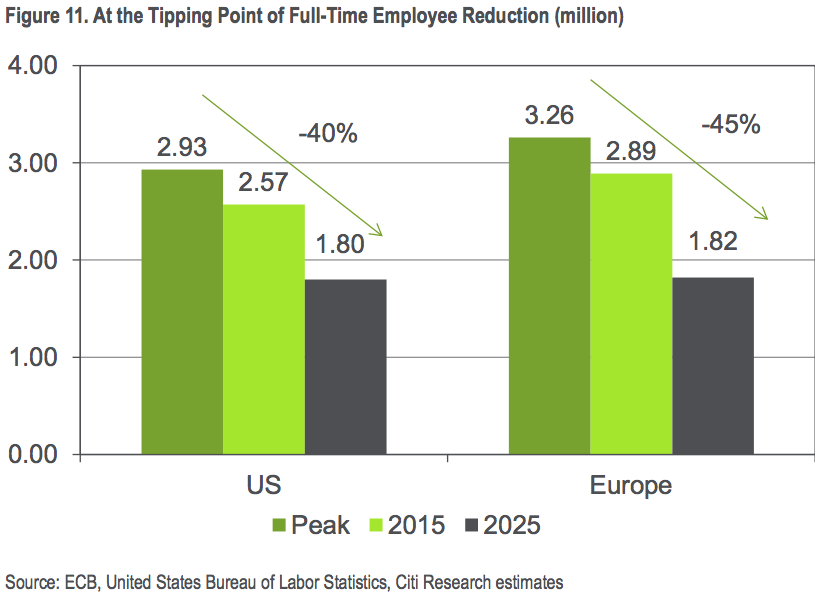

Many job titles have disappeared throughout history, and the reason for that is technology. The idea behind technology is to make human life much easier and more convenient. All the technological progress we see is done just to raise our comfort level. The banking industry is no exception: digitalization has already closed thousands of branches, and millions of banking jobs will be eliminated due to AI.

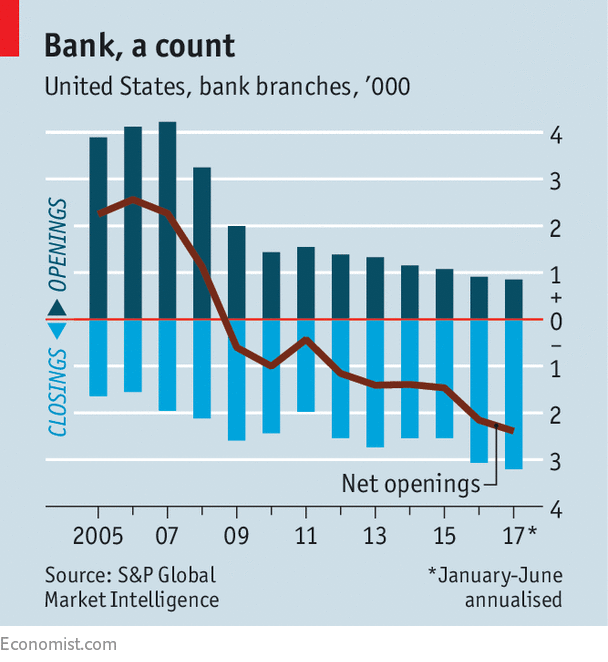

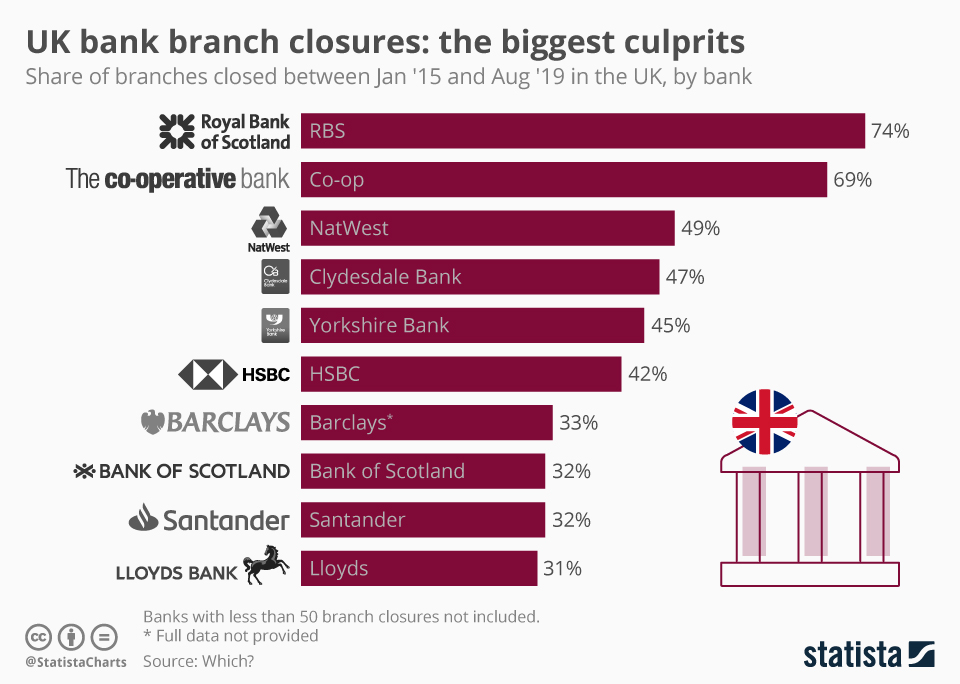

Digitalization in Banking Industry Leads to the Closing of Thousands of Branches

In recent time, we see that news with frightening headlines appear more often:

- Banks shed 60,000 jobs in one of worst years for cuts since financial crisis | Financial Times, 2023

- Bank of America is closing more than 100 branches this year | Yahoo Finance, 2023

- Lloyds Banking Group to close 123 branches in 2024 | Which, 2023

- TD Bank to cut about 3,000 jobs; profit misses estimate | Reuters, 2023

- Metro Bank to cut about 800 jobs and review opening hours | The Guardian, 2023

- HSBC accelerates 35,000 job cuts amid Covid-19 profit plunge | The Guardian, 2020

- Robots to Cut 200,000 U.S. Bank Jobs in next decade | Bloomberg, 2019

- Global banks cutting nearly 80,000 jobs this year, most since 2015 | American Banker, 2019

- Europe's banks slash 60,000 jobs as outlook turns negative | Financial Times, 2019

- UniCredit could cut around 10,000 jobs under new plan | Reuters, 2019

- Deutsche Bank confirms plan to cut 18,000 jobs | BBC News, 2019

- U.S. Bank to cut thousands of branch workers in digital push | American Banker, 2019

Why some people hate any communication with banks? Maybe because service is too slow, and the outcome of the conversations depends on the bank consultant’s mood and depth of knowledge. Banks branches are filled with people with similar needs, who need to sign, accept or receive something. This could result standing in line for hours just to sign one paper or receive acceptance on credit card. These are only some of pitfalls in the banking world.

There are 400,000 jobs available in banks for digital professionals, designers, programmers, banking customer experience experts, and others related digital banking jobs that define future of banking jobs. A total of 1,5 million vacancies are posted in LinkedIn Job Search for the banking industry and financial services at the beginning of 2021. At the same time, thousands of bank tellers and other branch clerks are losing their jobs, especially at major banks due to COVID-19 lockdown and rapid digitization. There are only 16,000 full-time bank teller vacancies at LinkedIn.

How can you lead the digital breakthrough in banking

Aim of technology is to improve banking service, and in fact, it is already happening. Many Fintech startups and neobanks are working hard to bring features that will enhance the banking customer experience. This means that technological possibilities cause digital disruption in banking. And artificial intelligence in banking could replace millions of bank employees with smart lines of code that can fully automate their jobs in near future.

So let’s name key factors that will have a huge impact on the financial industry and banking customer experience in the next decade:

1. AI in Banking Instead of Support Centres

Never again will you have to wait in a call line to receive consultation on any matter. Soon, banking AI assistants will start to become a must for every practice in a customer-centered bank service. This actually means that banks will need less customer support, and even no support center, to resolve their customers’ issues. This decreased dependency will result in fewer banking branches.

2. Digitalization Instead of Branch Lines

No more waiting in branch lines to provide necessary documents and sign needed ones. Online digital document signatures with high security IDs are solving this issue. You just receive your documents on your digital banking app or email, open them, sign them and that's it. This is literally a bank branch killer feature. After this is applied to every single bank, I see no other need for a bank branch, do you?

3. Robo Advisors Instead of Expensive Consultants

You don't need to rely on so-called “investment experts.” Robo investment advisors can do it for free while eliminating human error. There are too many people who get paid to play with your money and take zero responsibility if something goes wrong. That is the reason why teams of smart people have created robo advisors. These platforms assess your income and risk level and suggest the best possible result to invest for your future.

4. Automatic Scoring and Fast Mortgage

Some banks are really challenging financial industry by partnering with companies that develop housing. Since banks are the owners of your home until you pay off the full amount of your mortgage, why not complete all the legal documents with seller on their own and just deliver you keys to your new home, and all of this can actually be done automatically. Banks can use big data, open APIs and predictive analytics to ensure automatic credit scoring. There will only be a need for one person, who will deliver the keys; however, even the need for the delivery person could be eliminated in the future with drone delivery and further automatisation being developed.

5. Blockchain Instead of Middlemen

Nowadays, thanks to digital technology, we have seen a huge impact from instant services. Customer expectations are increased by online shopping, instant messaging, fast delivery, etc. How can multiple days waiting for payment execution by banks still exist with this technology? Blockchain is going change the landscape forever through real-time payment processing based on transparent and instant transaction infrastructure. No need for middlemen with their high fees and low response time.

Technology is meant to change everything around us; for years, it has changed manufacturing, logistics and medicine, and now it’s banking’s turn. Thousands of bank branches have already closed in the U.S. and Europe in the last couple of years. More and more consumers prefer online and mobile banking and expect a satisfying digital customer experience in banking. And implementation of AI in banking will have dramatic effect. All of this will cause millions of bank clerks to lose their job all around the world in the next decade, but they had to see it coming; progress is invading traditional banking.

Digital solutions have become the main service channel, and banks are turning into technology companies. Their success depends on what kind of customer experience in banking they can deliver and how customer-centered their digital products are.

YOUR ROAD TO REMARKABLE BANKING SERVICE

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin