We are constantly telling the banks that banking products design should be clear, simple and helpful in solving user issues. All of them agree, but they wonder why we have to constantly repeat what appears to be so obvious. Actually, this reaction puzzles me, because, in reality, I rarely see a user-centered design in modern banking services.

Digital banking design is not about visual revamp

I recently got a good example of why this understanding is not enough. And this is one of the key reasons why we create practical case studies of banking user interfaces that illustrate our approach to customer-centered design in banking. I am referring to a popular bank whose services I enjoy and use. This bank has billions in assets and eight-digit profits. Their online banking solution is actively used by approximately one million customers. In my opinion, they have the most extensive and advanced banking service with very professional staff. Moreover, the bank always declares its customer-centered approach.

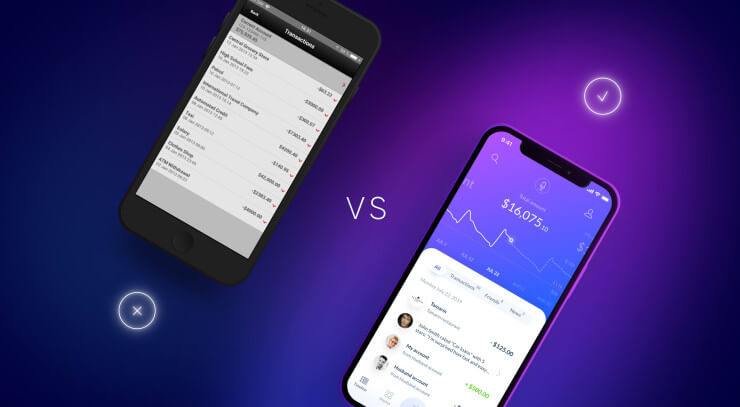

So, our bank officially announced and released an banking user interface (UI) update to its online solution. The prior update was made in the previous decade. Imagine how surprised I was to see only minor visual redesign of buttons and UI style. Of course, new icons and a flat design modernized the look, but the online service remained the same as it was 10 years ago. There is no enjoyment in using such outdated banking online services nowadays. Interviews with friends and acquaintances confirmed our suspicions — that all previously detected UX service problems were not fixed. A lot of people didn’t even notice any changes.

Unfortunately, there have been no fundamental improvements in the user experience. Banking information architecture is still difficult to understand and navigation consists of 90 sections. So, why doesn’t the bank take this opportunity to radically improve its user experience? Even the most superficial analysis of popular solutions and advanced capabilities in the financial industry should show the bank’s management the clear digital strategy and help to set the right purpose of UI project in banking. Unfortunately, the architecture and functionality of new banking interface design no longer meets the technical and resource level of large, innovative and customer-centered banks.

It's time to stop self-deception in the banking industry

Sure, we can justify this by bank management’s conscious reluctance to take risks and invest in a radical architecture update. And there is also a fear that their customers will not accept the significant banking interface changes.

Another explanation is that the internal bank team can’t think outside of the box to provide customer-centered digitization in banking. They are not ready to take responsibility for required innovative banking solutions. Or even worse, they underestimate the importance of online channels in the digital age. Indeed, I don’t believe that bank management is not able to adequately assess how such a formal approach to banking product design will affect the performance of the bank, particularly considering the number of tech-savvy customers and their growing demand for online and mobile banking.

I am sure they are well aware of the possible dire consequences: market share loss in the near future; reduction in the bank’s long-term benefits to competitors and neobanks; customers’ dissatisfaction with the digital banking user experience and decrease in loyalty; and, finally, resulting loss of profits. However, we see a formal approach that doesn’t improve the service usability for millions of users. And it seems there is no rational explanation for this. Apparently the bank’s management is sure that everything is done 100% correctly and according to customer centered approach in banking.

This means that the worst happens — a business engaged in self-deception. They have lost connection with their customers, and do not hear them. Roughly speaking, bankers don rose-colored glasses and convince themselves that everything is fine.

The problem is that this case is not the only one. We see numerous banks trying to maintain their standing in the banking sector and complete digitization in banking using formal declarations and minor redesigns, ones that don’t change the fundamentals of the service and don’t improve the banking user experience. It is important to understand how to help those financial institutions remove the rose-colored glasses and stop ignoring the need for a customer-centered approach.

Perhaps the reason for self-deception is a strong market position and inert in-house bureaucracy. Such conditions do not allow them to see the difference between the traditional banking approach and user-centered design that drastically improves the user experience. For example, neo banking companies not burdened with such “comfort” and deliver fantastic services providing an example to follow for the entire banking industry.

This story raises two very difficult issues: Do traditional financial institutions fully realize the gap between their usual banking product design and user-centered FinTech services? And, most importantly, will banks be able to overcome it? I really hope that we will not witness this self-deception turning into a catastrophic fall — a fall similar to that of Nokia, whose CEO said, with tears in his eyes, “we didn’t do anything wrong, but, somehow, we lost.”

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin