Article by Ieva Treija | First published on eu-startups.com

Earlier this year, it was announced that UXDA, a small startup from Latvia, has been nominated for European’s Best FinTech Award. The Riga-based startup has been operational for four years, but for the last two years has been focused exclusively on financial services. The next big news, also a bit surprising, was that UXDA has been named one of the Top 15 user experience agencies worldwide by Clutch. So, we decided to take a closer look and speak with the Founder and CEO, Alex Kreger.

I think user experience (UX) has become more important in the recent years. At what stage should companies start to think about it?

Every company should start to think about UX from the very beginning, from its inception. It is actually not a new trend. It is a way of thinking. When you have evaluated your business idea and identified the solution to the problem, you have to make this solution materialize in the service interface. It is going to be the core of your service so you should ensure that users have an intuitive and user-friendly experience.

What do you offer your clients regarding UX? What is your agency about?

This agency is about making user interfaces for financial services – banks, FinTech startups, insurance and charity services, trading platforms and payment services. We have noticed that finances are really complicated and difficult to understand since most people are not financially minded. Finance is an artificial concept that is linked to our new brain, the neocortex. The brain consists of three parts. The first one is paleomammalian, or ancient part, which is responsible for fear, safety and tracking movement. The reptilian (middle) part is about emotions, feelings and social interactions.

And the new part–neomammalian or neocortex–is about thinking and cognitive processes. Finances are connected with the latter one. 80% of our behavior is controlled by the paleomammalian and reptilian brain. Only around 20% of scientists say that only 10% is controlled by the neocortex. That is the reason why it is so hard for us to manage and control finances. It is not in our nature to understand finances.

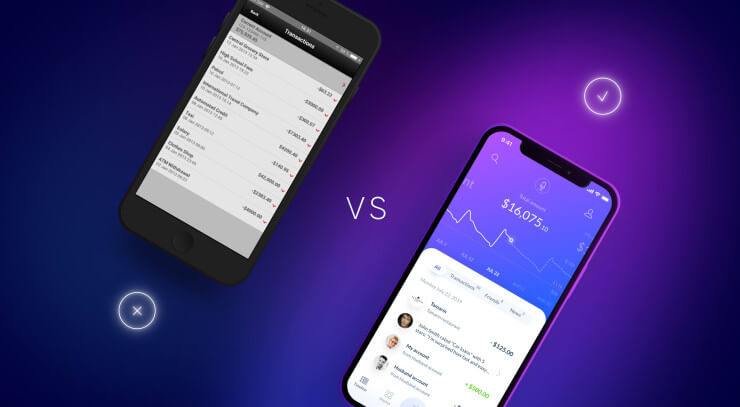

This is the reason why we can’t allow an Excel spreadsheet to figure out how everything works. We have to transform this interface we offer to be suitable for customer psychology and their type of thinking. It is all about psychology. And we conduct research in psychology about how people react and interact with interfaces. Our aim is to make them extremely easy to use. Basically, we just create a simple financial experience.

Why did you choose FinTech?

It is because of this complexity explained earlier. We see that current financial services, especially bank services, are really complex. They frustrate users and do not engage them. We want to reinvent the finance industry and make financial services as simple as using a mobile phone.

What is the attitude of banks towards this proposition?

On the one hand, banks understand that something is definitely going on. FinTech is on the rise – the industry had 12 billion euros in funding last year alone! And they are here to compete with banks. They provide really specific and easy-to-use solutions, and users choose those solutions because they solve their problems and fulfill their needs.

Banks definitely think of the future. Some banks create daughter companies – experimental challenger banks that provide fully digital offers to their customer. They try to capitalize on the newest trends, but often they do not understand that the most important thing is to change thinking from product-centered to user-centered. Product-centered thinking is about push marketing and advertising with the aim to make someone love your product. User-centered thinking is about making a product that everyone loves. These are two different approaches.

One more problem with banks is that they are too big and old-fashioned. Banks were created many years ago, and the system still works as it was originally created. It is very difficult for them to change, particularly in a short period of time. It is easier for FinTech companies to observe the market and quickly offer new and valuable products.

What are your current projects you are most proud of?

We are proud of every project. Unfortunately, I can’t tell you about all the projects we have completed due to confidentiality agreements. However, I can definitely discuss one project that we have sold to one of the banks in the U.S. We have created a user-designed project that reflects our vision of the bank of the future. Our client that bought it will try to implement this solution.

Does this future bank differ a lot from the traditional banks that we have now?

Yes. The main difference is more simple navigation; users no longer have to navigate 30 or 40 sections indicative of the average bank. There are only seven main sections in our vision with a clear definition for every section. Basically, all services are in one marketplace that looks like a store filled with financial applications. This is really engaging for users as they can easily navigate through this store and find all the products they need.

One more thing that I would like to emphasize is personal finance management. Users can monitor their spending and determine what amount of money is safe to spend based on their daily and monthly expenditures. Typical scenarios are provided on the first page.

This offer is based on data we have about the most popular services offered by banks. Users want to see their balances, view their transaction history and make transfers and payments. You can do it all in one or two clicks with our solution! This is a big advantage over traditional banking solutions, which typically require over eight clicks.

What does this European’s Best FinTech Award nomination mean to you?

It was a surprise for us since we are the only company among the nominees to provide design solutions. It can be explained by the fact that FinTech professionals are looking at UX as a powerful feature.

Where are we moving with UX design?

Every designer now claims in his/her curriculum vitae that he/she is a UX designer. UX is currently a very broad concept that includes everything that is understood by the word “design”. But every designer can’t be a UX designer; they can’t understand customers behind the solution. UX involves human psychology as well as business analysis. UX designers should be entrepreneurs since they have to understand the business model behind the solution and even be able to consult the customer on particular issues. They also have to understand marketing and how to create content for the solution.

UX designers need expertise in technical solutions; they have to understand what architected solutions will work and if it is possible to create such solutions with existing technologies. Today, the main problem that UX tries to solve is moving all the complexity into the background. Users don’t want to have to switch or tap dozens of buttons. They just want to push one button and be provided with what they need. This is what awaits us in the future.

A perfect interface is no interface at all; users just get what they want. We call it a “magic button experience.”

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin